How to Tap Into Goldman’s Top 50 Stocks

Hedge funds are meant to be the best of the best when it comes to hedging – taking both long and short positions to protect their investments and maximize returns regardless of market conditions. It’s no wonder, then, that Goldman Sachs recently did a deep dive into hedge fund activity. To give you a brief look at what the investment bank found out, here’s a summary – so let’s get started!

Goldman’s Better (finally) Than SP500 This Year

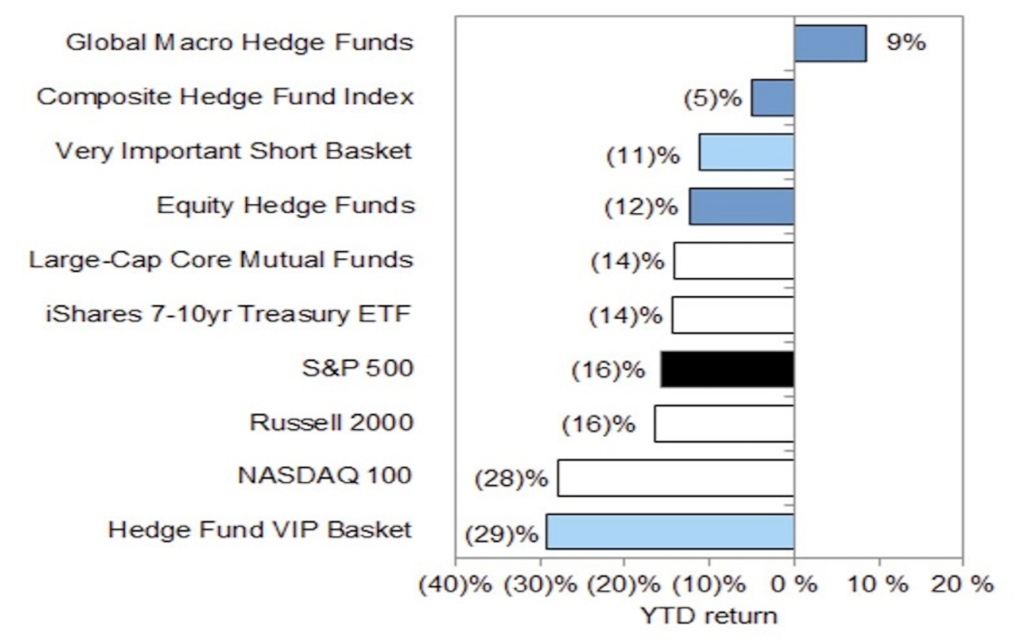

Goldman’s hedge fund report delved into the specifics of 786 hedge funds with a combined $2.3 trillion of stock investments – an astonishing $1.5 trillion of which was long, and $730 billion short. On average, hedge funds have earned a 1% return since the middle of the year, in spite of a 5% drop so far this year. While that might not seem incredible, it still marks a remarkable 11 percentage point advantage over the S&P 500’s 16% decline.

Hedge funds that use global macro trends for their trading strategies have been incredibly successful this year, bringing in an impressive 9% return. With so many factors influencing the market, from geopolitical unrest to rate hikes and inflation worries, the opportunities seem almost limitless – and this is only the beginning!

Hedge Funds Taking Less Risk in 2022

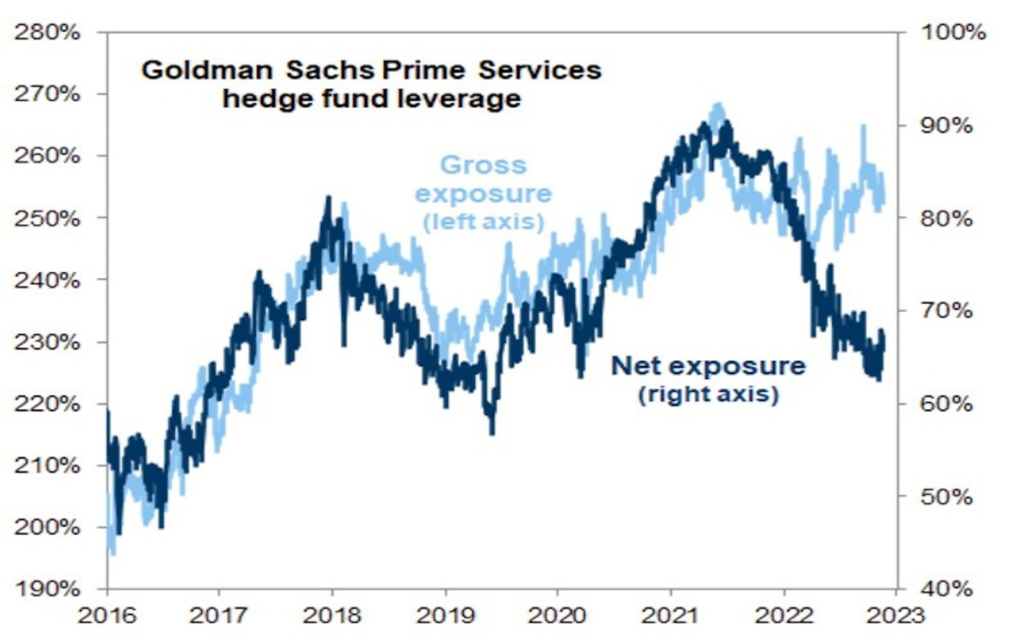

Allow me to introduce you to “net leverage” – the difference between how much hedge funds are investing in long and short positions. The lower the net leverage, the less risk involved. Presently, this metric is near the levels seen during the Covid crash in March 2020; Goldman’s data reveals that it is at the 18th percentile when looking back over the past five years, and the 14th percentile when comparing the last year.

If history repeats itself, hedge funds may take on more risk, which you can tell if their net leverage rises. Nevertheless, if the S&P 500 takes a downturn, they probably won’t be taking any risks in the immediate future.

What’s on the Hedge Funds Menu, Then?

Hedge funds have shied away from “momentum strategies” in the final quarter of 2022, opting not to trade alongside the markets’ sustained price trend. While momentum-based strategies usually produce better results during times of market distress – such as in 2009, 2012, 2016 and 2020 – the fact that hedge funds maintain low net leverage indicates they may have their doubts about market movements; thus, avoiding a market price trend could make sense.

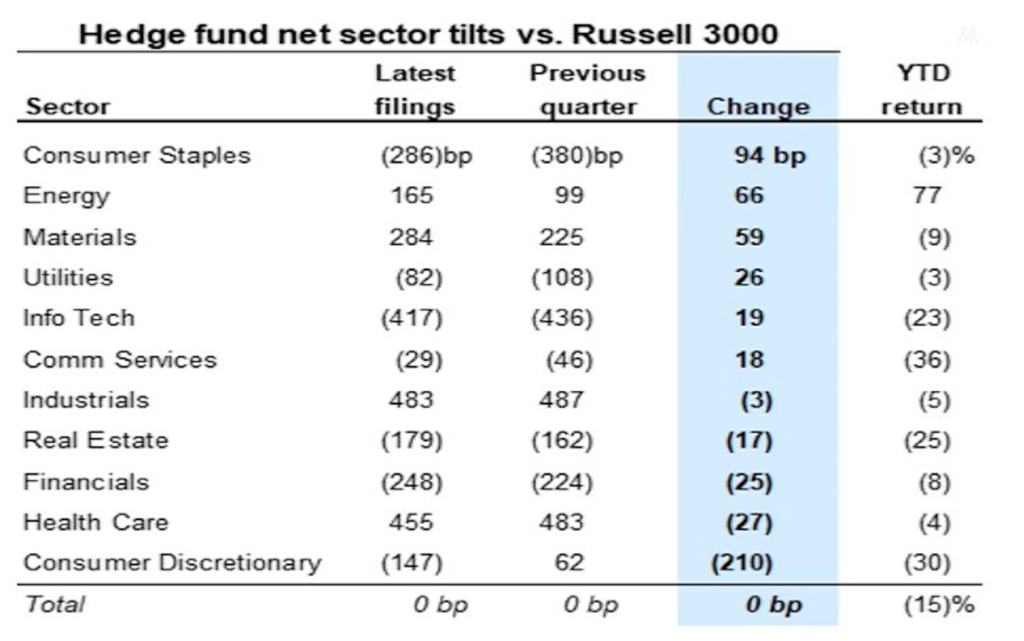

During the third quarter, hedge funds were relatively conservative with their sector allocation, but they did reduce their exposure to companies that make ‘nice-to-haves’ and increase their investment in companies that provide essential products.

Hedge funds are making a shift in focus and have increased their holdings in energy, materials and other defensive sectors, as seen by their portfolios: consumer staples, utilities, energy, materials and industrials. These sectors have all seen better returns than the Russell 3000 index, which is down 17% year-to-date.

Technology stocks still make up the largest portion at 21%, however that is lower than their weighting in the Russell 3000. All in all, this demonstrates that hedge funds are adding more capital to defensive stocks to protect against losses.

Most Popular Stock Picks

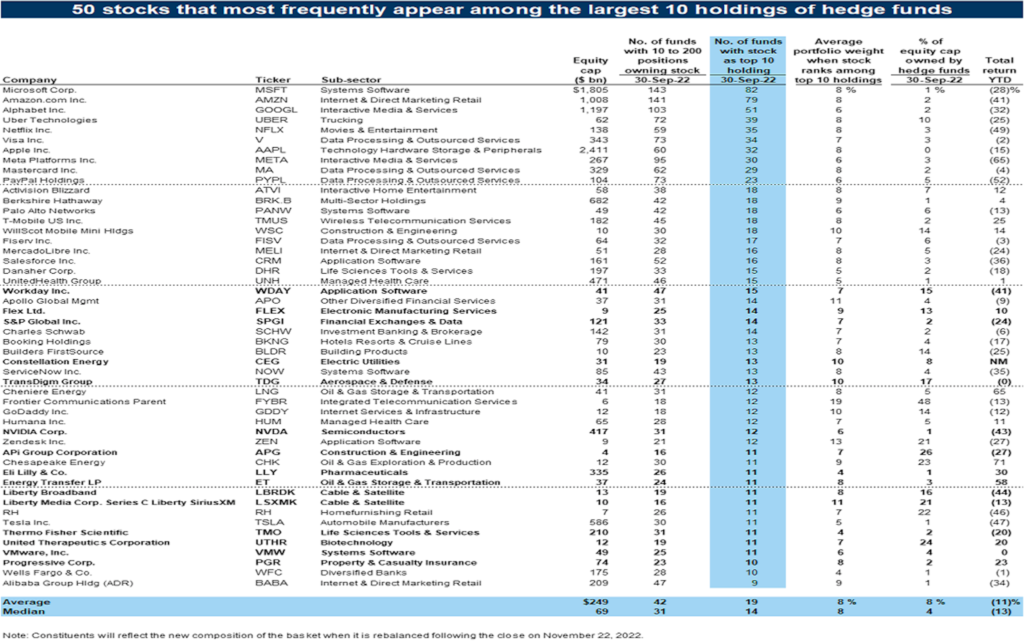

Let’s take a look at the stocks hedge funds are hot on! Microsoft takes the crown, dethroning Amazon from its longstanding position at the top. Netflix and Uber both climb into the top five, while Meta sees its rank slip out of the “Hedge Fund VIP List” for the first time since 2014.

Among the newcomers were these 15 firms: Pi Group Corporation, Constellation Energy, Energy Transfer LP, Flex Ltd, Liberty Broadband, Eli Lilly & Co, Liberty Media Corp Series C, Nvidia Corp, Progressive Corp, S&P Global Inc, Transdigm Group, Thermo Fisher Scientific, United Therapeutics Corporation, VMware Inc, and Workday Inc.

Since 2001, this VIP basket has beaten the S&P 500’s returns in 58% of the quarters, averaging a 0.34% increase over the index. However, since 2021, its performance has lagged the S&P 500 by a whopping 30 percentage points. While it isn’t a surefire solution, the VIP basket still provides interesting insight into where the “smart money” is stashing their cash. Moreover, a new market cycle could soon reverse this underperformance.

What Are We Doing With This Information (and you can too)?

Although, going were the herd is heading is not how fortunes are often made in “the business of speculations”, there are two ways to go about it.

One, you follow the hedge funds and shop on the abovementioned stocks (possibly even by using extra leverage tapping into the power of CFDs), alternatively just getting into a top 50 list directly via a Goldman Sachs Hedge Industry VIP ETF (GVIP ticker).

The alternative will be shorting the above. We are going to do both probably, and you can tap into it by joining Portfolio ECS.

Alternatively, consider trading daily moves on auto-pilot by getting our new MT4/5 Expert Advisor – Hades EA, get a test of trading by joining the telegram channel with signals generated by the aforementioned EA.

Safe Trading

Team of Elite CurrenSea 🇺🇦❤️

Leave a Reply