How To Bet on Emerging Markets

Morgan Stanley Investment Management believes that emerging markets are set to be the shining stars of the stock market for the next decade – and they’re not just saying it, they’re doing it.

They’re taking their money out of expensive US equities and investing it in ones from developing economies, especially India. So, let’s explore why this wealth giant is so enamored with emerging market assets and if you should follow suit.

What’s The Take?

With a whopping $1.3 trillion in assets under management, Morgan Stanley IM believes that a new leader emerges in the market roughly every decade. Over the last ten years, US stocks and mega-cap tech have had the spotlight due to a period of ultra-low interest rates that has caused technology stocks – with the US at the forefront of the world – to reach incredibly high valuations.

Looking ahead to the next ten years, the fund manager asserts that the combination of strong growth prospects, more attractive valuations, and positive demographic trends signal a prolonged period of above-average returns in emerging and foreign markets.

Currently, Chinese equities account for a hefty 30% of the MSCI emerging markets index, however Morgan Stanley Investment Management predicts this will not be a major force of expansion in the near future. This is because China is confronting the issues of a decreasing population, a huge debt load in some areas – property being one of them – as well as a dwindling standing in international supply chains.

The fund manager is investing heavily in India, whose debt is low and population is still increasing, as well as Thailand, Vietnam, Mexico, and Indonesia, all of which have the potential to gain from altered supply chains.

Is There a Momentum Right Now?

Morgan Stanley IM has decided to stay the course, and they are already reaping the rewards. The US dollar was on the rise against most other currencies in 2020, but it has since experienced broad-based losses.

When the US dollar is weakening, US-based investors tend to find exposure to non-US assets more appealing, while emerging countries and companies benefit from a better overall outlook. Thanks to this, they can raise funds by issuing debt in US dollars, thereby being able to use the money to invest in growth while repaying the debt in the future with cheaper US dollars.

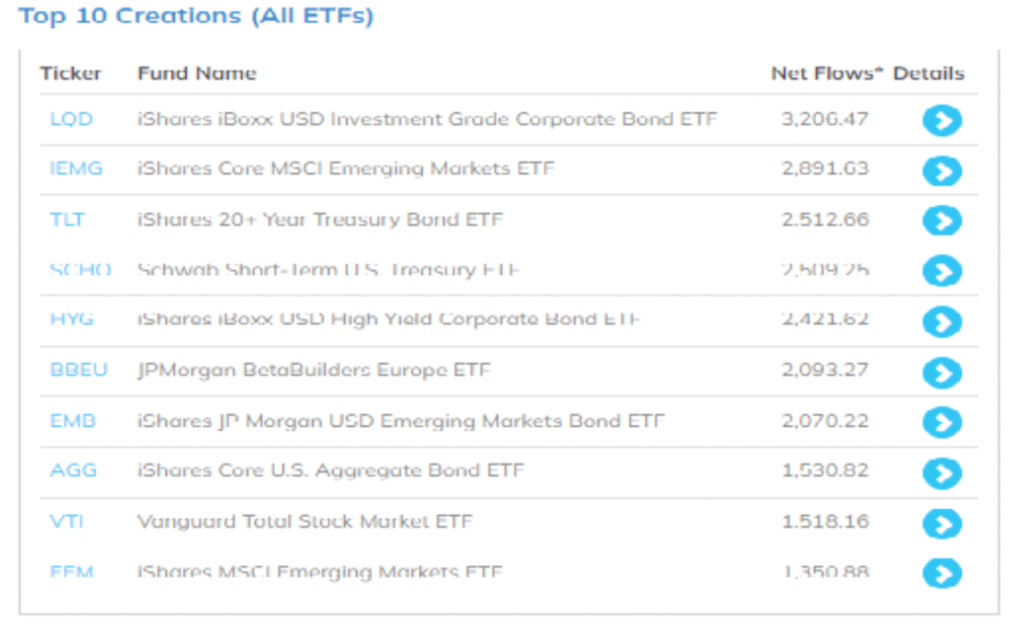

Morgan Stanley IM is not the only one looking towards emerging markets as a viable asset – global indexes and ETF flows in the past year have proven a similar pattern.

The latest ETF data reveals that the Invesco QQQ Trust Series 1 (ticker: QQQ; expense ratio: 0.2%), iShares Russell 2000 ETF (IWM; 0.19%) and iShares Russell 1000 Growth (IWF; 0.18%) have experienced the most significant outflows from U.S. stock ETFs.

As opposed to the JPMorgan Betabuilders Europe ETF (BBEU, 0.09%), the iShares Core MSCI Emerging Markets ETF (IEM; 0.09%) has garnered the greatest amount of investment, outdoing all other equity ETFs.

Thus far in 2021, European and emerging market indices have outpaced the rest, no doubt helped by the mild winter, which assuaged fears of energy and manufacturing constraints.

What are the Bets Here?

Want to get broad exposure to emerging markets? Check out the iShares Core MSCI Emerging Markets ETF: it features a diverse investment breakdown with 28% of the funds going to China, 14% to India, 14% to Taiwan, 12% to South Korea, and 5% to Brazil. Or, if you want to get even more specific, follow the lead of the fund manager and consider these additional investments!

Investing in India could be a great idea, considering its expanding population, younger median age (compared to China’s 38), and stocks with a 19x price-to-earnings multiple that point to strong potential in the long run. Last year was great for the Indian stock market, but this year it’s not off to the best start. Nonetheless, India still offers exciting growth opportunities for the future, so investing in an asset like the iShares MSCI India ETF (INDA; 0.68%) could be a wise and daring decision. If you’d like to learn more about India, Jon has written an article about it!

The return of China’s tourism market is an immense advantage for Thailand and Vietnam, according to Goldman Sachs. In 2019, it contributed 3% to Thailand’s economy and over 1% to Vietnam’s. Moreover, 6% of their economic outputs rely on Chinese domestic consumption. To invest in these countries’ potential success, you can buy the iShares Thailand ETF (THD; 0.58%) or the VanEck Vietnam ETF (VNM; 0.59%), if you want to venture into more volatile investments.

If you are curious to tap into developing markets but are not sure where to start, take a look into our Flagship and Algo money management solutions. Most of our trading ideas eventually go into that type of trading.

Safe Trading

Team of Elite CurrenSea 🇺🇦❤️

Leave a Reply