How to Bet on 🤖 AI Sector with Nvidia

You don’t need to be an AI expert to recognize the potential of this revolutionary technology. Many companies, like Nvidia, are playing a big part in the AI world and could be the perfect investment opportunity.

So, let’s dive in and discover the remarkable possibilities and potential dangers of this chip giant and decide whether it deserves a spot in your portfolio.

| Instrument | Entry | TP/SL | Long/Short | Duration |

|---|---|---|---|---|

| Nvidia (NVDA) | $175-$200* | $280/$350 | Long | Up to 120 days |

Why Nvidia Then?

Nvidia is the unquestioned king when it comes to the semiconductors driving AI technology today. But their GPUs are the driving force behind so much more, from powering self-driving cars, to creating aerospace simulations and even aiding in drug discovery. Crack open the computers that make it all possible, and you’ll find the ubiquitous Nvidia GPU.

Prior to the emergence of Nvidia, personal computing needs were attended to by Central Processing Units (CPUs), acting as the “brains” of computers and performing all tasks.

But, the founder of Nvidia, Jensen Huang (or Jen-Hsun Huang in his native Taiwanese) had a vision; a future where computing functions such as graphics, audio and network speed could be enhanced with specialized plug-in cards.

The ’90s saw a monumental shift in the graphics industry, as blockbuster films like Jurassic Park and early versions of 3D game Doom catalyzed its rise to the top. Huang had faith that graphics would propel the gaming industry into a period of rapid expansion. Who amongst us that grew up in the ’80s and ’90s can forget the thrilling obsession with computer graphics?

Nvidia, a combination of “invidia” (Latin for envy) and NV (the first product name) sporting a green logo, was not yet the envy of the chip world. In fact, its overly ambitious plan nearly caused the company’s downfall. Enter Microsoft, who offered a cheaper and simpler way for developers to create 3D graphics games, and with their reputation, drew away many developers, leaving Nvidia in its solitary pursuit.

Huang and Nvidia certainly weren’t ready to give up, and after some close calls and some much-needed strategic adjustments – ditching their own standards and switching over to Microsoft’s – they managed to stay one step ahead of their competitors, ultimately building an unbeatable foothold in the 3D gaming graphics industry.

In 1999, Nvidia sent a subtle yet powerful message to Intel when they introduced the third iteration of their graphics card, GeForce 256, and proclaimed it a Graphics Processing Unit (GPU). This marked the beginning of their mission to build a chip capable of competing with the CPU, the dominant force in the processor industry.

What’s Next for Nvidia?

Gaming still makes up a hefty portion of Nvidia’s income and is likely to grow in the future due to the innovative work being done in virtual and augmented reality. But the industry has been around for a while now and is unlikely to provide the growth required to justify Nvidia’s current share price.

This is also the case for its professional visualization business, which accounts for 8% of the company’s revenue and is largely dependant on the spending habits of more established firms.

Nvidia’s automobile industry is rapidly rising, and it’s no wonder why: electric vehicles and self-driving cars need double the amount of semiconductors compared to normal cars, thus Nvidia’s car chip business, although relatively small (making up only 2% of their total income), is flourishing.

Nvidia makes an impressive 40% of its profits from selling components to datacenter giants such as Microsoft and Amazon, powering the future of AI and machine learning within these data warehouses.

We can only speculate as to how AI will impact our lives on a daily basis, but the demand for semiconductors will only continue to grow as this technology develops. The future of AI is unknown, but it’s clear that the need for semiconductors will be vast.

Investors are enticed by themes whose potential is hard to assess since it causes stock valuations to skyrocket! In other words, if Artificial Intelligence turns out to be as revolutionary as anticipated, the rules of estimating Nvidia stocks’ worth can be disregarded; they could soar beyond our wildest dreams!

Possible Risks

Although Nvidia appears to be in the lead at the moment, AMD and other companies are not far behind and can easily take the lead if Nvidia’s technology falls short. It is also worth noting that AI could potentially be nothing more than a passing trend – the hype around ChatGPT is substantial, but it is important to remember that similar technological enthusiasm has been wrong in the past – just ask any Meta shareholders about their thoughts on the metaverse today! Keeping a healthy balance between optimism and scepticism is therefore essential.

Navigating the next year or so will be a tricky affair for Nvidia. It’ll have to brace for the economic decline that will undoubtedly hamper its more cyclical activities. After all, semiconductor cycles amplify economic cycles, meaning the highs are blissful and the lows are absolutely heartbreaking. The market is now attempting to determine the severity of the impending downturn.

Final Thoughts on Nvidia

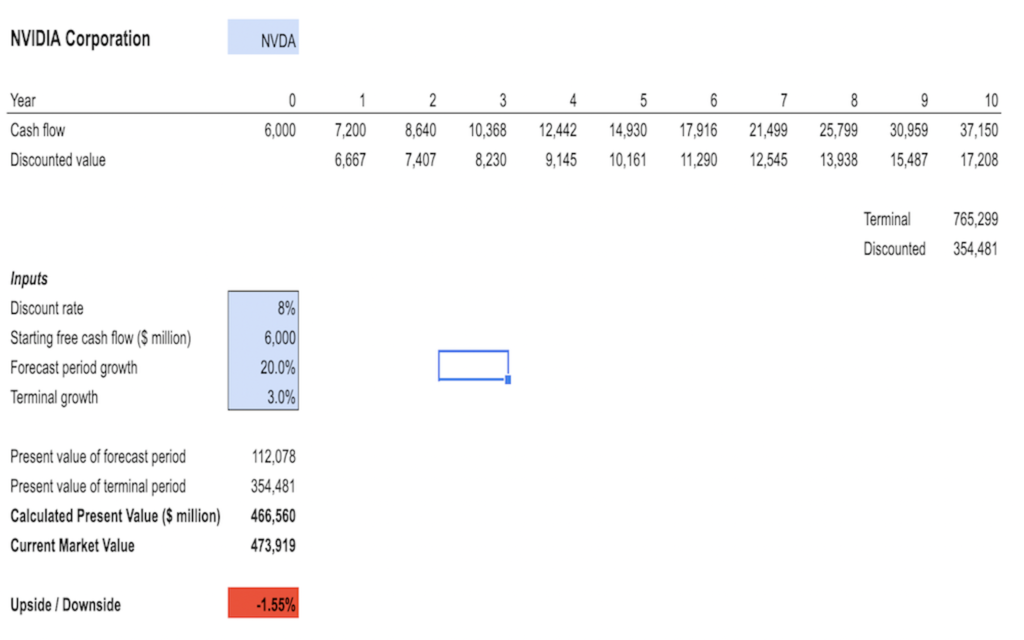

The market is expecting Nvidia to grow its cash flow by an impressive 20% each year for the next 10 years; and when you consider the firm’s impressive track record of 27% cash flow growth, 27% sales growth, and 30% profit growth each year over the past 10 years – it’s no wonder!

It can be tricky to accurately value companies that experience rapid growth like Nvidia, and traditional metrics such as Price to Earnings (P/E) are often meaningless.

However, despite its great success, the stock price reflects future cash flow. All Nvidia’s 45x P/E really tells you is that the market has high expectations – so the best thing to do is to try and understand what those hopes are.

To get a better idea of the company’s worth, I use a discounted cash flow (DCF) analysis, as I have written more about here.

Essentially, all you have to do is experiment with some growth numbers until the sheet gives an outcome for Nvidia that is equivalent to its current market value – that would be a growth rate of 20% for 10 years and 3% thereafter.

Utilizing DCFs may not provide exact results, yet when employed in this way they can be beneficial, providing a baseline to build your own deductions. Here, we must decide if Nvidia will outpace its 20% annual cash flow growth.

If you’re not confident that the firm’s cyclical industries will survive a long-term recession or that AI is soon ready to take over the globe (without any ‘evil’ implications, of course), then the 20% growth projection might seem overly hopeful to you.

But if you’re sure that AI is close to dominating the world, 20% growth could appear too conservative and it would be a good idea to invest in Nvidia (NVDA) or Wisdomtree Artificial Intelligence and Innovation Fund (WTAI; expense ratio: 0.45%).

Safe Trading

Team of Elite CurrenSea 🇺🇦❤️

Leave a Reply