Goldman’s Forecast for the Next 50 Years Ahead

It’s been almost two decades since Jim O’Neil, the Goldman Sachs economist, created the term “BRIC” to identify Brazil, Russia, India, and China as emerging economic giants. Goldman Sachs recently unveiled its report that extends coverage to 104 countries and its predictions for world growth until 2075.

To save you the hassle of going through the hefty report, I have studied the banking giant’s expectations and can give you an insight into the world’s anticipated transformation over the next fifty years and the greatest potential investment opportunities.

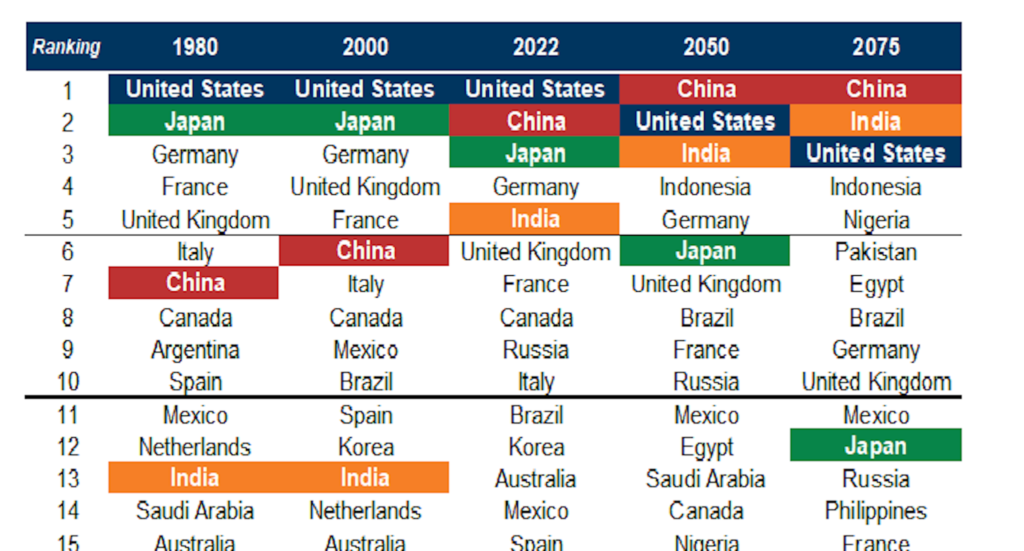

Let’s kick things off with some country-specific predictions. Goldman Sachs is certain that China, the US, India, and Germany will stay in the top five global economies by 2050. Indonesia is anticipated to be included in that group of five, with Japan dropping out. Fast-forward to 2075, and Goldman predicts that Germany and Japan will slip down the list, leaving room for Nigeria to make it into the top five.

Demographics could very likely be the cause of Japan’s dip – the current population of 125 million is anticipated to decrease to a mere 86 million by 2075. Although the worldwide population growth is projected to reach a high of 10 billion, a maturing population such as Japan’s comes with its own unique challenges and opportunities.

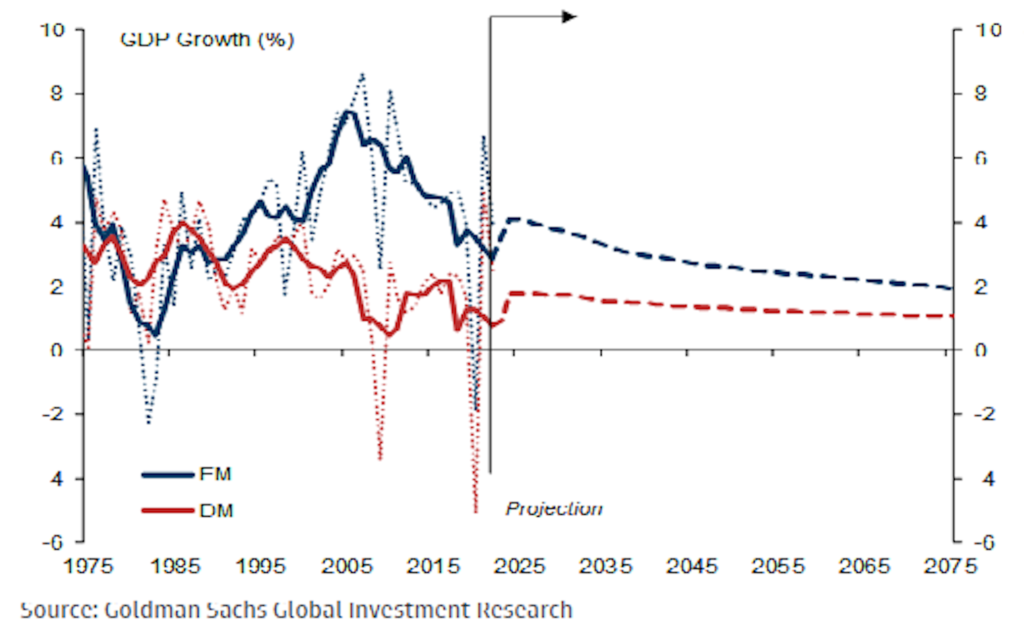

For the past two decades, global economies have been flourishing with an average growth rate of over 3%. But now, Goldman Sachs asserts that the peak potential of global expansion has passed. Their prediction? By 2024 to 2029, economic growth will slow to an average of 2.8%, eventually dropping to below 2% by 2075. Surprisingly, the report suggests that emerging markets, largely driven by Asia, will still expand at a faster rate than developed markets. (The two dotted lines in the graph illustrate this.)

The bank has its doubts that the US economy and dollar will repeat the extraordinary success seen in the past ten years, and actually predicts the US dollar will experience a drop in value in the next decade.

It’s no secret that economists and strategists often struggle to accurately predict what the year ahead holds – just think of how few predicted this year’s financial turmoil. Nonetheless, the professionals have some clever tricks in store and if you draw on these when you formulate your own long-term global economic outlook, you might be able to make some shrewd investment choices.

How to Trade Goldman’s Predictions Today?

Good news for investors in U.S. assets: The projection that the United States will maintain its dominance is an assurance that investing in the world’s most dynamic economy is still a sensible decision. But if you’re looking to explore some new investment opportunities, I have three potential areas to share with you: India’s anticipated growth, the global aging population, and diminishing labor forces.

India

Start your investment journey with India! According to Goldman Sachs, the country’s corporate profits are estimated to skyrocket by 15% next year and in 2024 – however, you’ll need to pay a premium price to gain access to such an impressive growth. Interestingly, India’s stock market is trading at a forward price-to-earnings ratio of 22, which is 30% higher than its long-term average. Despite that, Indian stocks have had a great run over the past two years. So if you agree with Goldman that there is more to come, consider investing in the iShares MSCI India ETF (ticker: INDA US; expense ratio: 0.65%).

If you’re looking to make some gains, the Indian stock market has seen stellar returns in the past two years, according to Goldman Sachs. And if you agree with them that the good times will continue, why not get started with the iShares MSCI India ETF (ticker: INDA US; expense ratio: 0.65%)? But if you’re looking to take advantage of growth opportunities in the emerging markets, you should take a look at the iShares MSCI Emerging Market ETF (EMM US; expense ratio 0.68%) – it could be your ticket to a rewarding experience!

Automation & Robots

Given the ever-shrinking labor forces around the world, companies are driven to seek solutions for labor shortages, even as they strive to better their operations and profitability. The Robo Global Robotics and Automation Index ETF (ROBO US, expense 0.95%) is an excellent option for investing in this growing field. Although the fund’s fees may be slightly higher than other ETFs, it can give you a great opportunity to become involved in the robotics and automation industry.

Behold, the L&G Robo Global Robotics and Automation UCITS ETF (ticker ROBO LN; expense ratio 0.8%) – an investment choice with a virtually identical portfolio!

Healthcare and Aging Population

As the population ages, there is expected to be lasting strong demand for healthcare, pharmaceuticals and medical devices. The Health Care Select Sector SPDR Fund (ticker XLV US; expense ratio 0.1%) invests in companies that are involved in healthcare, biotechnology and pharmaceuticals, making it a great choice for reliable returns over the coming years. Good news indeed!

Safe Trading

Team of Elite CurrenSea 🇺🇦❤️

Leave a Reply