Following Bill Ackman Trading Acumen About Hong Kong Dollar Peg Dissolution

The daring Bill Ackman, founder and CEO of Pershing Square Capital Management and formerly known as “Baby Buffett”, is taking a gamble in Asia by predicting the Hong Kong dollar’s inevitable break away from its long-term peg with the US dollar.

His bold prognosis could lead to some major rewards, and his view seems to be shared by many – let’s take a closer look…

What’s Up With Hong Kong Dollar Peg & Why It’s in Place?

A currency peg fixes one nation’s currency to the US dollar or a basket of currencies, and the Hong Kong dollar has been pegged to the value of the American dollar since 1983, with it allowed to trade between 7.75 and 7.85 Hong Kong dollars per US dollar.

When it gets close to either edge of that range, the Hong Kong Monetary Authority (HKMA), or the city’s central bank, steps in – drawing on its extensive foreign currency reserves to purchase or sell Hong Kong dollars, to bring its value back to the middle of the band.

When buying its currency, the available supply of Hong Kong dollars in the banking system diminishes, referred to as interbank liquidity, and thus domestic borrowing costs go up. Conversely, selling results in the opposite effect.

The Hong Kong dollar stands out among the currencies of other wealthy economies, with its pegged rate, in contrast to its peers who “freely float”, the value of which is mainly determined by demand and supply.

Nevertheless, Hong Kong maintains the old peg: due to its open economy and the abundance of export companies, the city benefits from a steady and easily exchanged currency, which is what enabled it to become a global financial hub in the first place. Additionally, Chinese companies benefit from the peg, able to take advantage of Hong Kong’s rich financial market.

Not only that, but thanks to the capital controls in China, Hong Kong has become an excellent gateway for the exchange of money in and out of the country.

Is There an Issue with Hong Kong Dollar Peg?

The HKMA are in a bit of a bind when it comes to monetary policy due to this system – when the US Federal Reserve hikes rates, they are compelled to do the same regardless of local economic conditions. Unfortunately, no system is flawless, and this one is no exception, requiring some concessions to be made.

At this very moment, just like during the 1997 Asian financial crisis, Hong Kong’s economy desperately needs lowered interest rates to jumpstart it, though it needs to maintain consistency with America’s high interest rates. On the contrary, prior to this, Hong Kong suffered a property bubble caused by the abnormally low rates from 2008 to 2016.

IS HKD Peg in Trouble?

The Hong Kong dollar recently experienced a dip in its value relative to the US dollar, pushing it close to its upper band of 7.85. This was due to the so-called ‘carry trade’, where HKD was borrowed at a low interest rate and swapped with the higher-yielding greenback. Nonetheless, the recent softening of the US dollar and the intervention of the HKMA has caused the HKD-USD currency pair to fall back near its lower band of 7.75.

How Does Bill Ackman See The Hong Kong Dollar Situation?

In a recent tweet, Richard Cookson, head of research at Rubicon Fund Management, expressed that the Hong Kong peg “no longer makes sense” due to increased debt, decreased asset prices, a weakening economy, and the influence of China – ultimately leading to a mass exodus of high earners and reducing the city’s tax income.

Ackman has employed an astute strategy for his hedge fund by taking a big short position against the Hong Kong currency. With put options giving him the right to sell at a fixed price at a designated date, his risk is constrained to the price of the option while his potential reward is far greater – cleverly safeguarding against the “tail risk scenario” of the peg snapping in Hong Kong.

Boaz Weinstein, Founder of Saba Capital, foresees an impending trouble for the peg and forecasts a potentially staggering 200-to-1 return if it does break – like a lucky lottery ticket, with a minimal wager for a massive pay-off!

How Likely is He To Be Correct?

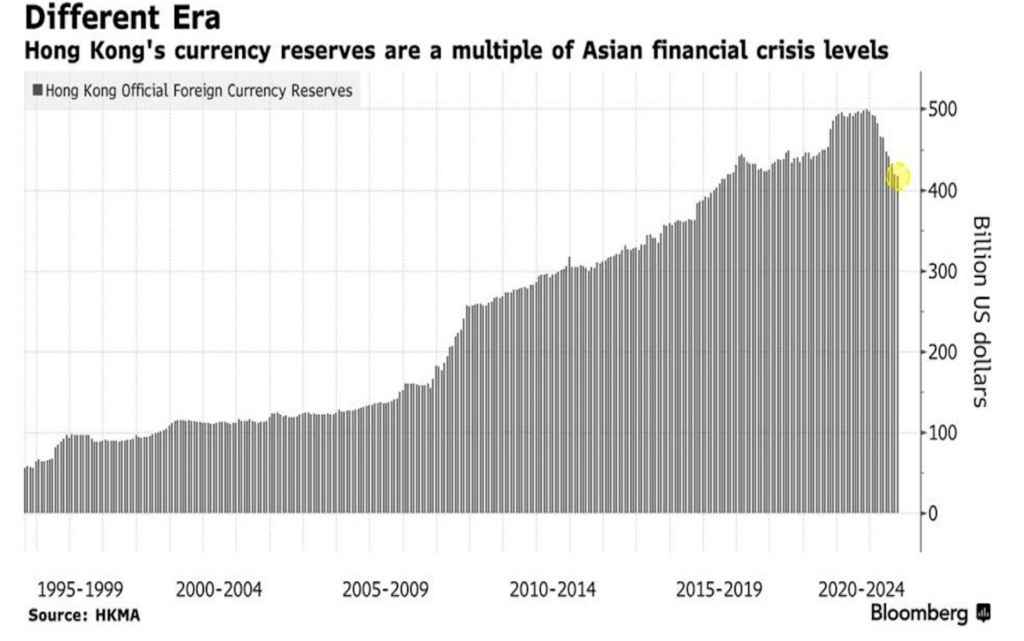

Although a seemingly far-fetched concept, the near-40-year-old peg of Hong Kong’s currency has not broken yet and that is a major advantage. Additionally, the Hong Kong Monetary Authority (HKMA) is well-prepared to protect the peg with its hefty foreign currency reserves of 417 billion. Plus, if it comes down to it, China’s Central Bank could come to the rescue with its gargantuan foreign-exchange reserves of over 3 trillion.

In light of such an impressive display of financial muscle, no hedge fund or speculative investor would dare to challenge such a war chest!

Paul Chan, Hong Kong’s financial secretary, recently issued a stern warning to speculators: don’t bet against the Hong Kong dollar! He has a point to prove; the architect of the city’s dollar peg, himself, has declared that speculating against the Hong Kong dollar is futile due to the presence of a currency board which has a single aim: maintaining the peg.

Ackman has previously attempted to challenge the Hong Kong dollar peg – in 2011, he thought the HKD was undervalued and due to break the peg’s lower boundary. But he was wrong, and even George Soros – renowned for his feat against the Bank of England – suffered a loss when betting against the peg after the Asian financial crisis.

Pegs don’t have to be permanent like Switzerland demonstrated when they removed their franc’s peg to the euro in 2015. It might be unlikely, but it’s not impossible that Hong Kong could follow suit and unpeg its dollar from the US greenback and instead peg it to the Chinese yuan as a way to oppose the dominance of the world’s reserve currency.

It’s a risky bet, but at least you know that Bill Ackman is with you on that one (at least publicly). If you’d like to know more about Bill (and into “finance porn” genre), we can’t advise more the book on Bill’s trepidation – “When The Wolfs Bite”. Otherwise, good luck making your own conclusion. We will be following the situation with HKD closely, if you are looking to bet on similar contrarian moves, male sure to check Portfolio ECS and our signals channel on telegram.

Safe Trading

Team of Elite CurrenSea 🇺🇦❤️

Leave a Reply