Five Market Insights to Take into the First Month of Autumn

But, first, kudos to Warren Buffet, turning 92 on August 30, only the best investor out there, who finally has something to agree on with Elon Musk.

- Borrow money when it’s cheap.

- Calling someone who trades actively in the market an investor is like calling someone who repeatedly engages in one-night stands a romantic. (we speculate, folks, don’t kid yourself)

- Forecasts may tell you a great deal about the forecaster; they tell you nothing about the future.

- Diversification is protection against ignorance. It makes little sense if you know what you are doing. Click To Tweet

- The most important thing to do if you find yourself in a hole is to stop digging

Now back to what we believe will be crucial in the upcoming weeks:

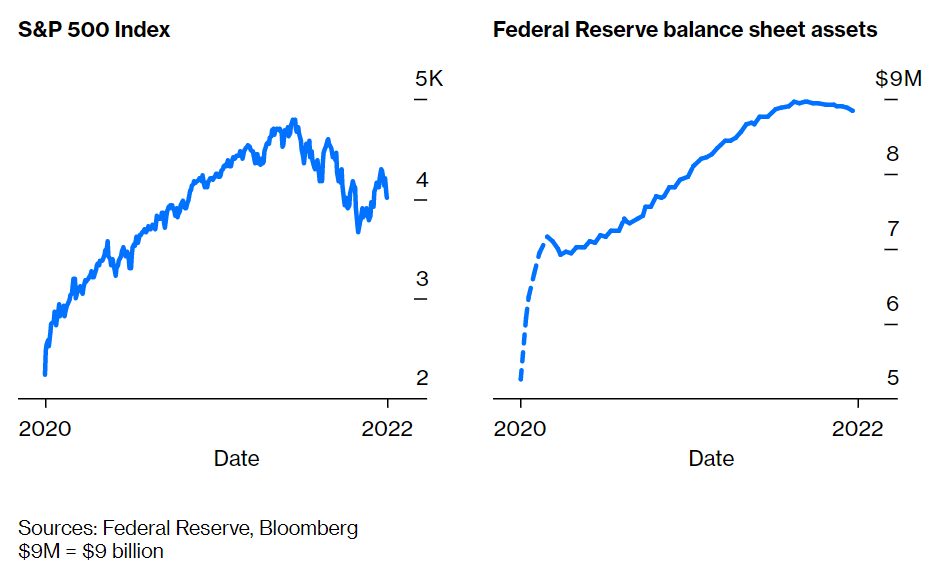

Quantitative Easing is Full Speed Ahead

The Fed’s $9 trillion balance sheet unwinding hit full stride this week, after almost doubling its asset holdings during the pandemic. This has made conditions even rockier.

The looming runoff is set to exacerbate the bill shortage that has been pushing investors into the Fed’s reverse repo program, which is now at an unprecedented $2.4 trillion.

Strategists at Bank of America are estimating that the unwinding of quantitative easing could ultimately knock 7% off the S&P 500 next year.

ECS Take:

As QA has driven the rates down, the reverse is expected with the government scaling the initiative down. At the moment, though, the best approach is to sit and wait. Click To TweetGrid trading, like Athena EA and Zeus EA, feel superb in this market; august results are in to attest (see institutional clients, retail account).

Electric Vehicles One Year Performance

Nikola and Lucid, along with a few other previously successful EV-makers, are running low on cash and may need to raise up to $9.5 billion to avoid a complete collapse.

Honorable mentions of the EV Things Turning Sour Over the last Year

$LCID

After successfully raising $4.4 billion in its SPAC deal last year, LCID Lucid has now notified investors that it plans to raise a further $8 billion by selling a mix of securities. This move will no doubt consolidate the company’s position as a major player in the market.

$NKLA

Nikola, one of the pioneers of the EV-SPAC craze in 2020, announced an at-the-market offering this week in hopes of bringing in as much as $400 million.

$ARVL

From a $1 billion 2022 revenue. to a zero in a year. The company has registered for securities sales of up to $300 million.

ECS Take:

Although EV Market is the future, picking your bets is as important as ever. While there are some companies on our list of “losers” that will probably see a better day, we wouldn’t be so quick to jump on the rush to buy into Electric Vehicles, just, certainly not the ones led by SPAC.

If you want to keep your exposure, say what you will, but Tesla has foreseen the past year much better than the rest of the crowd and is still the biggest maker out there. If anything worthy of your Longs, you can try investing in through dollar cost averaging (especially in September- which is considered the worst month for socks), while carefully trading CFDs in hopes of volatility swinging the stock both ways.

Alternatively, we are testing a high-frequency trading approach with KTM via Portfolio ECS; everyone is welcome to join (at your own risk 😀).

Stock Market

Powell quashed any hopes for a pivot in the near future when he said the Fed’s restrictive stance would likely remain “for some time”.

His comments exceeded already hawkish expectations and drove the yield on the US 2-year Treasury to its highest since 2007.

Since the central bank has shown its willingness to fight inflation, the US dollar has surged to its highest level in June 2002.

The Fed’s aggressive stance is clear. What’s less clear is how large the inevitable rate hikes will be. Many believe another 75 points in September.

ECS Take:

We’ll be keeping an eye on the data that comes in, especially today’s payroll report and the next CPI print in a couple of weeks, for clues about that.

The volatility in Autumn may strike unpredictably, therefore, those of you who trade any Grid trading system, be prepared to tune down your appetites and follow the markets closely, as movements in US Dollar & US Equities can offer ample opportunities.

For anything less fancy, consider checking our systems and indicators to gouge the markets with more certainty.

Oil

August’s oil prices marked the third consecutive monthly drop, the longest losing streak in over 2 years.

The outlook for oil is not looking any better as central banks around the world are aggressively raising rates to fight inflation in economies that are experiencing growth slowdowns.

Tighter monetary policy and reduced demand from China’s zero-Covid policy have prompted both OPEC and the US EIA (Energy Information Administration) to reduce demand forecasts for 2022 and 2023.

August’s oil prices marked the third consecutive monthly drop, the longest losing streak in over 2 years.

ECS Take:

Should OPEC not increase its production expectation on September 5th, it could be not among the worst ideas to hold onto your shorts.

KTM offers easy access to this bet, you can also tap into our discretionary trading actively managed fund via Portfolio ECS.

Crypto

All things considered, Ethereum is merging in the middle of September, and the space is still down for the year significantly, not offering much better results than struggling global equities (after all, most ETFs and Funds invest similarly lately).

The latest headline caught our attention recently, though,

Ticketmaster sells an average of 500 million tickets to concerts, games, and events every year, generating billions of dollars in revenue.

Ticketmaster and Dapper Labs have been working together for the past 6 months to mint 5 million tickets as NFTs.

Dapper Labs’ Flow will be the exclusive blockchain for minting future NFTs for select events. This move comes as the company looks to solidify its place in the digital memorabilia market.

ECS Take:

If you are not disgusted by all things crypto, at the current valuations, dollar cost averaging BTC & ETH could be a good thing after all.

For more aggressive moves, check out Black Widow (alternatively, a ATR indicator) & SWAT to time the entries while Bitcoin and Ethereum try to find their footing, before the bigger trend-based moves.

That’s it for this week. Hope you find our takes useful, if it’s too dull 😃, most of the trading on managed accounts is based on the above speculations, so you are welcome to tap in.

Safe Trading

Team of Elite CurrenSea

Leave a Reply