☝️ FedEx Completes Wave 4 Pullback at 38.2% Fibonacci ☝️

Dear traders,

the FedEx Corporation (FDX) has made a bullish bounce as expected in our previous analysis. But the rebound was even stronger than expected because price action broke above the top.

How far can the uptrend go? Let’s review the key Elliott Wave and Fibonacci patterns.

Price Charts and Technical Analysis

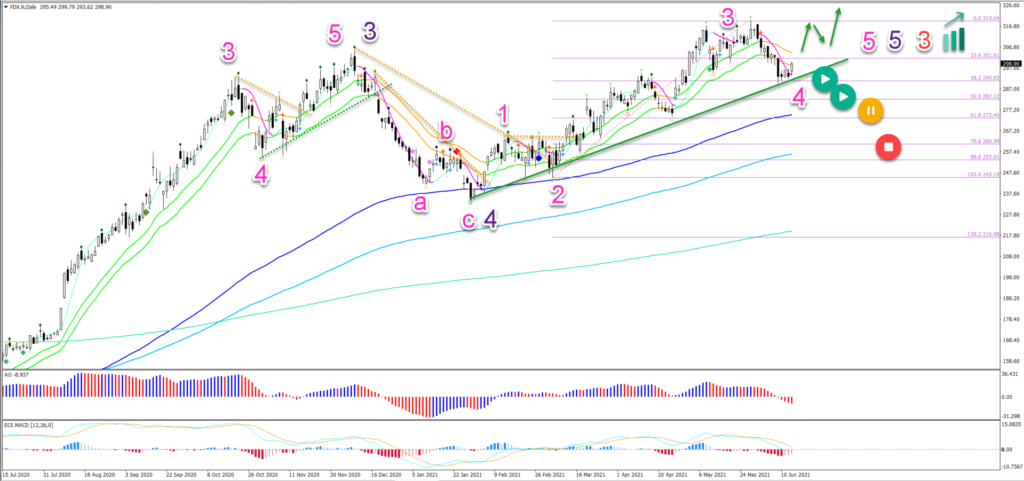

The FDX daily chart is showing a strong uptrend with all the moving averages bullishly aligned:

- The previous price swing is a wave 3 (purple) of wave 3 (red) due to its steep angle.

- The pullback was indeed a wave 4 (purple) which bounced at the 144 ema.

- The current higher high is expected to be part of a wave 5 (purple) of wave 3 (red).

- Within the wave 5 (purple), price action is building a 5 wave (pink) pattern. The current push up seems to be a wave 3 (pink).

- The current pullback could be a wave 4 (pink) as long as price action stays above the 50% Fibonacci level.

- A break below the 50% Fib places it on hold (orange circle) and a deeper break invalidates it (red circle).

- The main targets are located at the -27.2% Fibonacci level at $340 and the -61.8% Fibonacci level at $365.

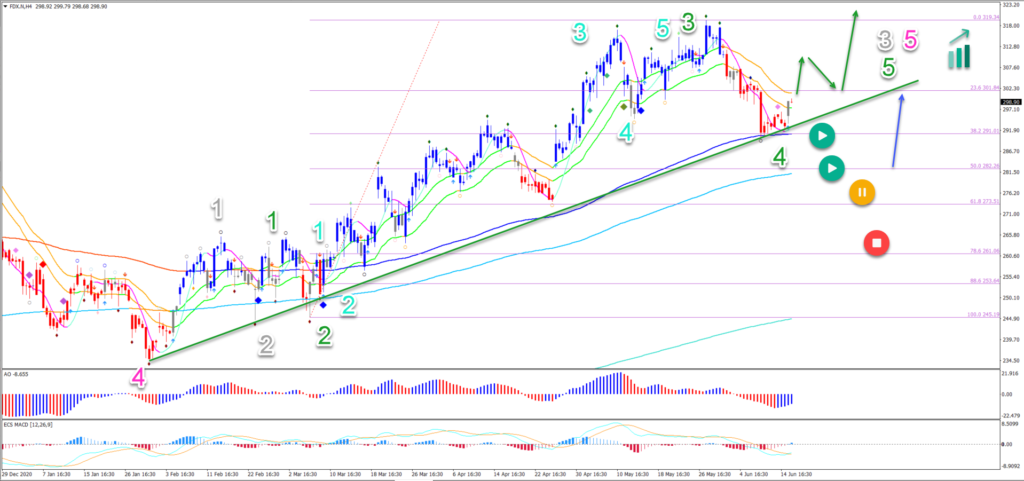

On the 4 hour chart, price action could be testing the support trend line (green):

- A bullish bounce took place at the 38.2% Fibonacci level, which makes a wave 4 (green) likely.

- A bullish breakout above the 21 ema high could confirm the uptrend continuation (green arrows).

- Price action should stay above the 50% Fibonacci level if this is indeed a wave 4 (green).

- A bullish bounce (blue arrow) could take place at the 50% Fib as well if price action gets there.

The analysis has been done with the indicators and template from the SWAT method (simple wave analysis and trading). For more daily technical and wave analysis and updates, sign-up to our newsletter.

Leave a Reply