Can the UK Economy Recover to Become Appealing to the Outside World in 2023?

Each year, a few unexpected market developments catch investors by surprise. Morgan Stanley has thus looked ahead to 2023 and imagined ten potential situations that could disrupt our current expectations. One of them particularly fascinates me – the prospect of the UK economy emerging victorious and causing a surge in the British pound. Let us take a closer look at this intriguing possibility…

What’s going on with the UK at the moment?

The UK has been battling some of the highest inflation rates amongst the developed world in the last year, prompting the Bank of England to impose nine consecutive interest rate hikes in a bid to curb the effects – and it appears to have worked, with experts estimating that the nation has now entered a recession during the third quarter of 2022, awaiting further data to confirm the news.

The chances of the UK economy and its “stock price” (i.e. the British pound) bouncing back this year may be slim, as it’s not a widely held opinion in the market, nor Morgan Stanley’s predicted outcome. Yet, negativity often begets positive surprises; and thus the pound could be propelled higher when least expected.

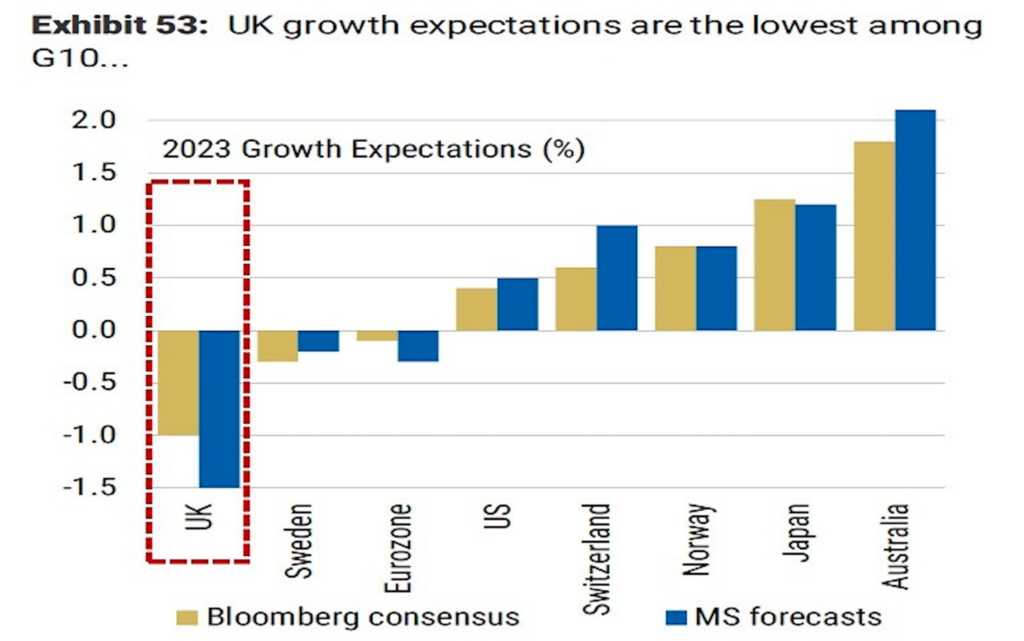

If nothing unexpected happens, Morgan Stanley’s economists anticipate that the UK’s economic growth will likely be lagging far behind its other developed-country counterparts, weighed down by high energy costs, the government’s restrictions on borrowing, and the Bank of England’s interest rate increases.

What would it take to turn things around?

In the UK, the fate of the pound lies in the expectations of people. Thinking outside the box could lead to a pleasant surprise. Morgan Stanley outlines the possible outcomes of this situation.

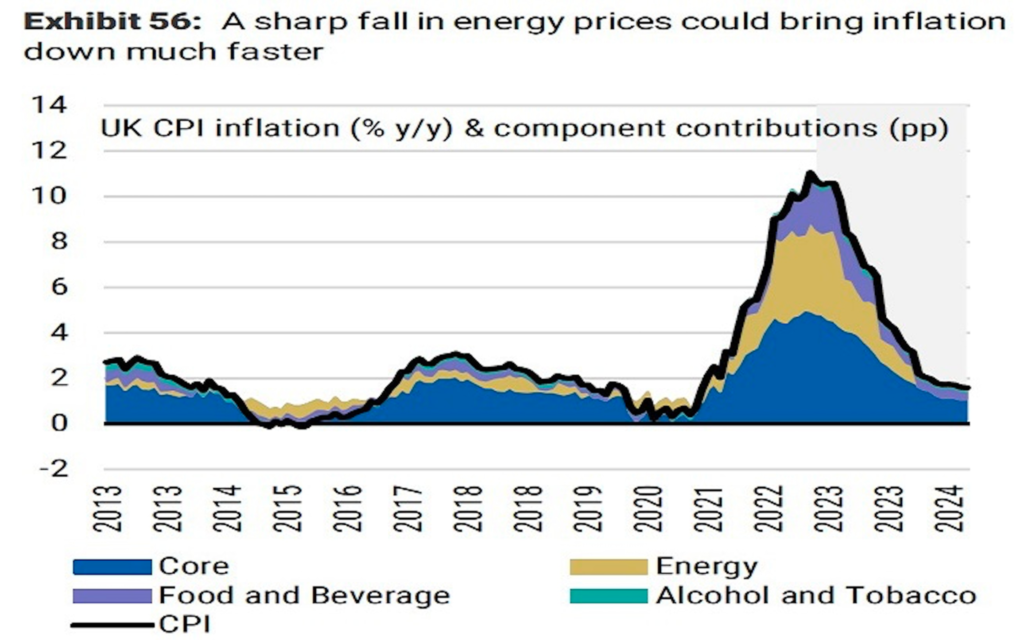

Energy Prices Further Decline

The UK’s persistently high inflation rate of 10.7% in November has had a detrimental impact on consumers and the entire economy. A decrease in energy costs, and their subsequent maintenance at a low level, would act as a catalyst for growth, aiding the country’s cost-of-living crisis and giving consumers more disposable income to spend on non-essential items and services. This, in turn, would stimulate growth in the economy.

In November, the UK suffered from extremely high inflation (10.7%), largely due to an increase in energy costs that has left both consumers and the entire economy feeling the pinch. However, a drop in energy prices and the accompanying lower cost of living would have a positive ripple effect, giving businesses an uplift and freeing up consumers’ funds to spend on those ‘nice-to-have’ items and services – a real boost to economic growth.

Labor Increase

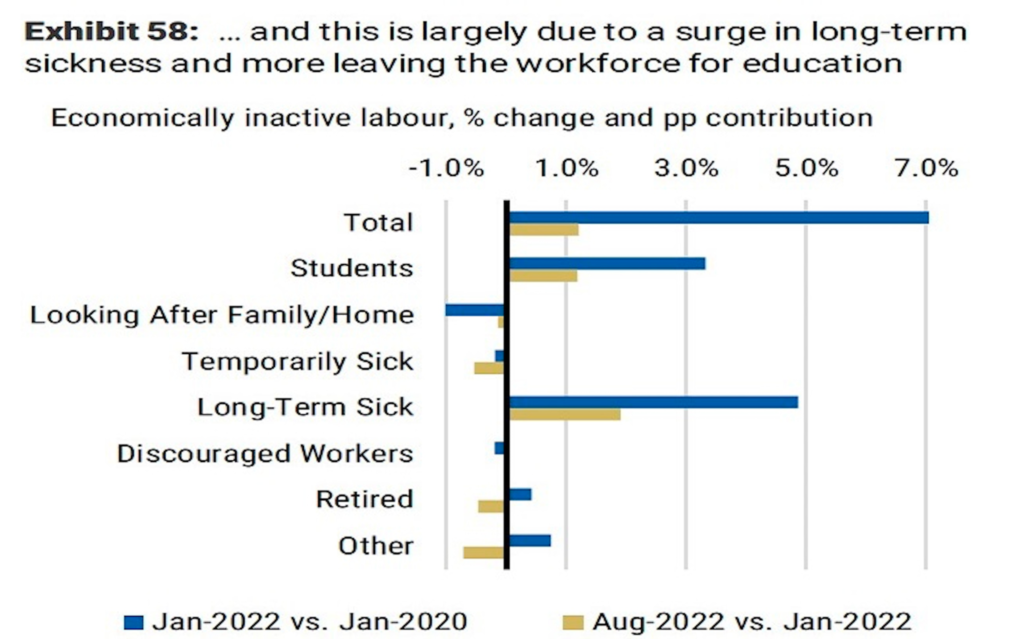

In the UK, a notable portion of inflation can be traced to a labor shortage – employers being obliged to entice employees with larger wages and therefore, consumers having to bear the brunt of these higher wages. The UK’s case is particularly grave compared to other developed nations (like the US) who are also facing labor shortages.

Morgan Stanley claims that the United Kingdom’s labor participation rate – the proportion of the working-age population actively engaged in or searching for employment – has been adversely affected by the lingering effects of Covid-19, as well as certain uniquely British issues: long waiting periods in the nation’s healthcare system and an exodus of foreign workers in the aftermath of Brexit.

More Discretionary Spending by Consumers

The UK population is currently hoarding an enormous sum of £200 billion ($243 billion) in savings and monthly deposit inflows remain above the pre-covid monthly average of £5 billion ($6 billion). With an increase in wages providing a much-needed feeling of security, people may become more willing to splash out of their nest egg, which could inject life into the economy. Whilst Morgan Stanley doubts that this will happen, they do see it as a potential upside – and it would provide a healthy amount of resilience to the economic climate this year.

Briefly on the UK Politics in 2023

This week, the pound saw a rise in strength as the EU and UK made a deal concerning the tracking of goods between Great Britain and Northern Ireland via the UK’s live database – resolving a Brexit-related dispute. This could lessen customs paperwork and potentially lead to further progress in other problem areas – paving the way for an even brighter future for the pound. Nevertheless, its status remains somewhat volatile.

A potential Scottish referendum later this year has the potential to shake the UK’s economy and currency. Scotland accounts for 7.5% of the country’s economy and should a second referendum, which Scotland’s leadership has called for in October, be granted approval by the Prime Minister, it could have a comparable effect to Brexit. Nonetheless, a Scottish exit is still considered unlikely.

As the 2014 vote loomed closer, the Pound tumbled roughly 5.5% against the Dollar – something to definitely keep an eye on, given the current government’s disposition. Seemingly unlikely, yet still a risk.

What are the Opportunities Here?

If you believe that this could be the year of the Great British Pound, why not take the plunge and invest in the Invesco Currency Shares British Pound Sterling Trust ETF (ticker: FXB; expense ratio: 0.4%)?

You can also consider opening a brokerage account and buying the pound against the dollar using a contract for difference or margin – perfect for those who like to think outside the box!

We are going to trade UK economy (currencies) and stocks in 2023, you can join by investing as little as $500 in Portfolio ECS – our flagship discretionary approach that has generated over 140% profit in 2022.

Safe Trading

Team of Elite CurrenSea 🇺🇦❤️

Leave a Reply