Bridgewater versus Goldman Sachs on Recession

The biggest Hedge Fund ($140bln) and one of the biggest Investment banks don’t see eye to eye when it comes to recession predictions and while the latter is in the minority, let’s take a look at what sets these two visions apart.

Bridgwater’s Case

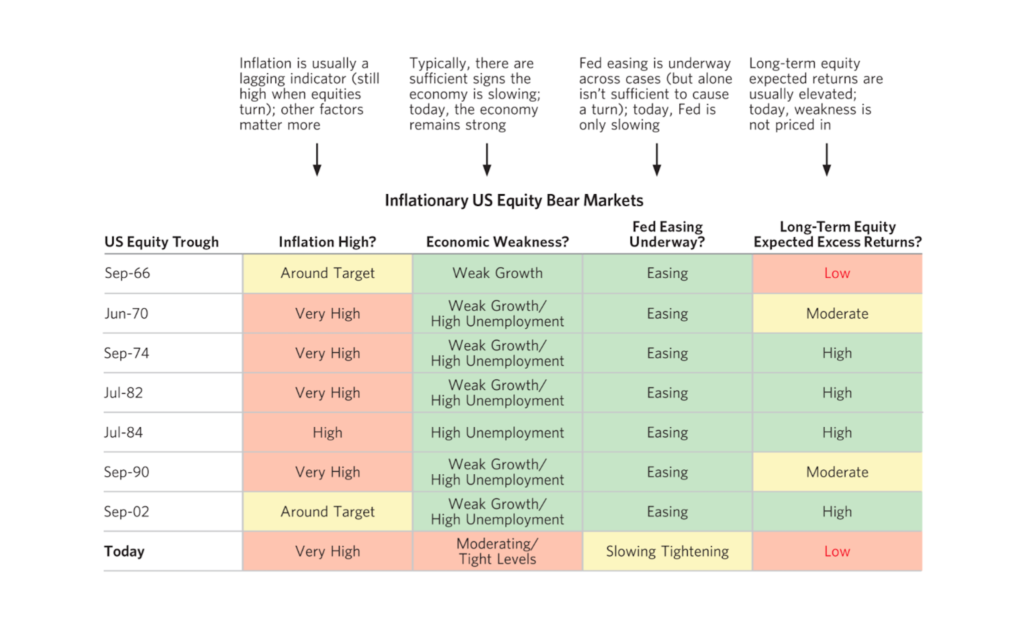

The world’s biggest hedge fund has compared today’s conditions to those of past inflation-driven bear markets, and it fears things have to get worse before they get better.

One of the reasons behind lower valuations this year is that rising interest rates reduce the present value of a firm’s future cash flows. This is because higher interest rates increase the rate that’s used to discount them back to today.

And since higher interest rates can cause problems for the economy, they also make investors less confident. This means that they are less likely to buy stocks unless the risk premium seems high enough. So for stocks to look more attractive than holding cash, company valuations need to go down.

Additionally, lower earnings. This phase is less about valuations and market sentiment, and more about the actual economy and companies’ earnings.

Additionally, lower earnings. This phase is less about valuations and market sentiment, and more about the actual economy and companies’ earnings.

Different sectors of the economy are impacted with different lags, so a slowdown in one sector won’t necessarily mean an immediate slowdown in earnings for companies. If a sector like housing starts to slow down, it could take a few months for earnings to follow suit.

And if earnings then slow more than the market expects, as they generally do, stock prices will usually dip again. We haven’t experienced that stage yet, but we might be getting closer to it.

Case for the Stocks Rebound

Bridgewater Associates says that for stocks to rebound during an inflation-driven recession, three conditions must be met:

- The economy must be slowing down significantly.

- Central banks must ease monetary conditions through rate cuts or slowing the pace of hikes.

- Expected long-term returns from stocks must be high enough to incentivize investors to choose them over safer assets like bonds.

None are true at the moment.

Even though some key indicators like consumer spending and the labor market are still surprisingly strong, the economy is still too strong. Housing markets and consumer confidence have fallen off a cliff, and other metrics like the ISM Purchasing Managers Index (PMI) are slowing down too.

The Federal Reserve is far from cutting interest rates. The central bank might start slowing the pace of hikes down, or even pause the hikes in an extreme scenario. But inflation is still way above target, and the labor market is far too hot, for the Fed to actually pivot and start cutting.

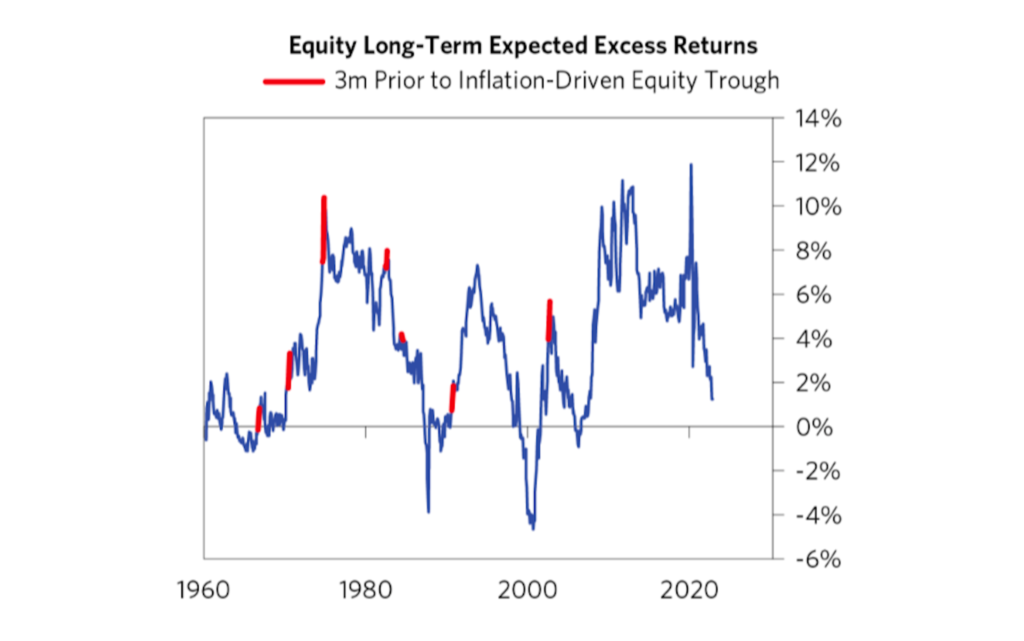

Although the S&P 500’s long-term expected returns look more attractive than at the beginning of the year, investors are still wary of stocks. This is because capitulation (when investors throw in the towel) has yet to occur, and valuations have only returned to their average, instead of overshooting on the downside as is typical in bear markets.

Given today’s yield levels, bonds are still more attractive than stocks, so prices might have to go lower for investors to start buying stocks again.

Goldman Sachs Case Against Recession

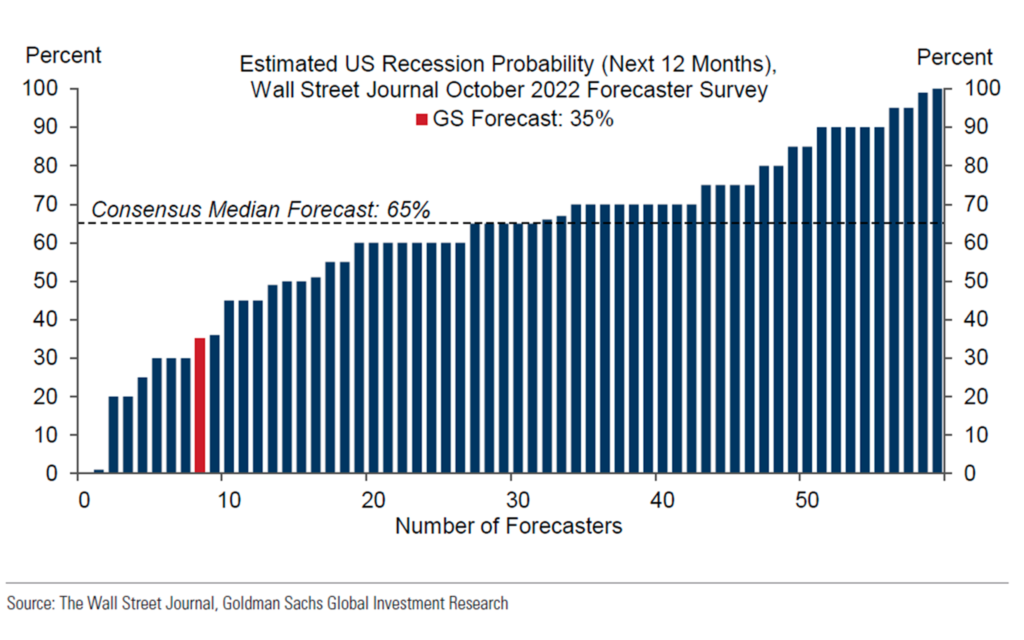

Now, let’s look at the case against the recession through the length of Goldman’s research team. It’s a minority view (30% below the general consensus) but still a worthy take in our view.

The investment bank expects the US economy to “barely escape” a recession in 2023, as core “Personal Consumption Expenditure” (PCE) inflation slips from today’s 5% a year to 3% in late 2023.

And while most economists believe a lot of Americans will have to lose their jobs – so they’re forced to spend less money – for inflation to come down, Goldman thinks this cycle is different: just a 0.5% rise in unemployment should do the trick.

After all, Goldman expects one major driver of inflation to start evening out: pandemic-induced supply chain issues. The bank says goods are becoming easier and faster to make and deliver to the end consumer, making the whole process cheaper.

And since suppliers are also stocking more inventory, stock is no longer impossibly scarce, driving prices back down. Goldman even says rent is starting to stabilize too, as the lockdown-accelerated demand for more home-working space returns to the status quo.

While the likes of Bridgewater and Fidelity expect the hard landing, Goldman’s 35% chance of recession is not exactly peachy, but it does show you the difference in certainty, which only signals that even the top research team doesn’t always see an eye to eye in what sees to be a moderately obvious economic climate.

Regardless, let’s see what are the opportunities here.

How to Trade the Likelihood of Recession While Staying Cautiously Optimistic

Let’s get it straight, our team also does not believe we have hit bottom in the equity market yet, hence a solid short on SP500 and individual tech stocks (there are plenty, just select the ones you follow more closely), should yield short-term profits – just don’t get greedy and stay well protected against volatility.

The last CPI report saw SP500 climbing above 4,000 in a matter of one trading session, indicating that the market is looking for a sign of relief.

In the meantime, if you are waiting for an entry point to have your portfolio extended with some of the juicy tech stocks or event dividend stocks, timing the market for these sorts of affairs is quite complicated. Therefore, dollar cost averaging now, may seem as a good option – if you are here for a long haul.

If Bridgewater is right, you might be doing well holding Longs on Gold and some treasury bonds, as well as some USD against EUR & Pound, although the last bet is vastly disfavoured by the big boys, who believe the greenback is extensively overpriced.

Finally, decreased economic activity may lead to Oil retracting its 2022 gains further.

However the recession plays out, there are ample opportunities in the market right now and we will be trading the news on the Portfolio ECS account (700%+ this year) while also speculating on ranging markets via one of our top five automated trading EAs, as well as sharing some of the trading signals via a free to join in November Signals channel on telegram.

Safe Trading

Team of Elite CurrenSea 🇺🇦❤️

Leave a Reply