Banks Are Begging For Fed Money Now, What Does it Mean for The Markets?

Data out last week showed that banks have been jostling for loans from the Fed.

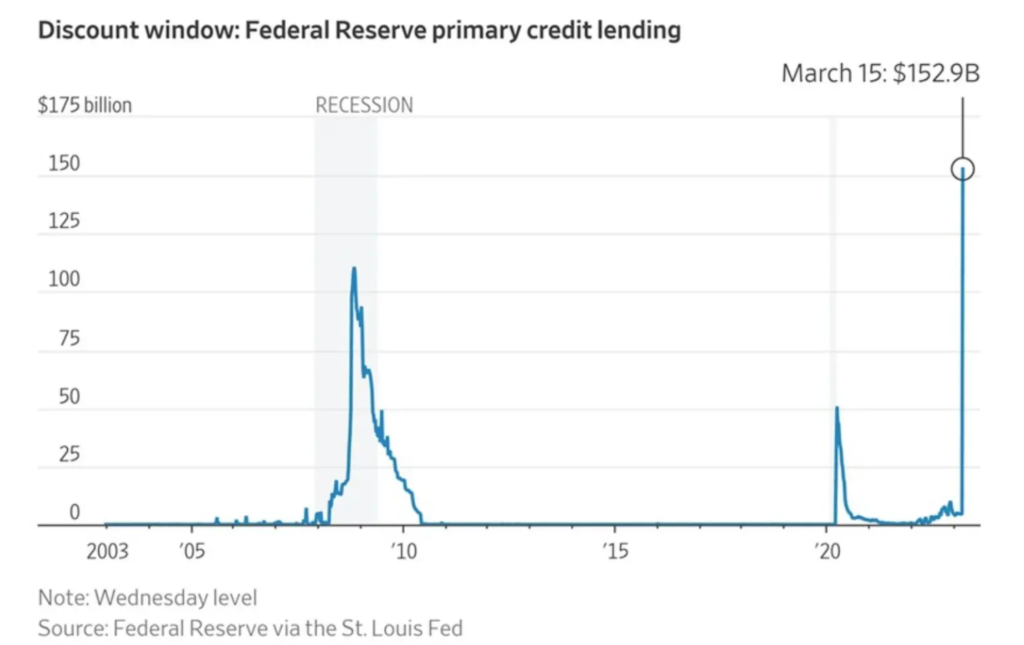

The US government would love it if everyone just forgot about Silicon Valley Bank’s collapse, but let’s be real: it’s going to be a hot minute before folk fully trust the banking system again. And the latest data won’t do much to help. The Federal Reserve (the Fed) made it easier for banks short on cash to borrow money in the wake of the crisis, and those loans swiftly hit a new record high in the week up to March 15th – blowing 2008’s out of the water. That shows a lot of players remained nervous about the amount of cash being withdrawn, suggesting the sector’s still in hot water. First Republic is probably biting its nails especially hard: even the tidy cash injection it’s getting from the nation’s biggest banks has done little to reassure investors it’s on firm ground.

Source: The Wall Street Journal

For markets: One step forward and…

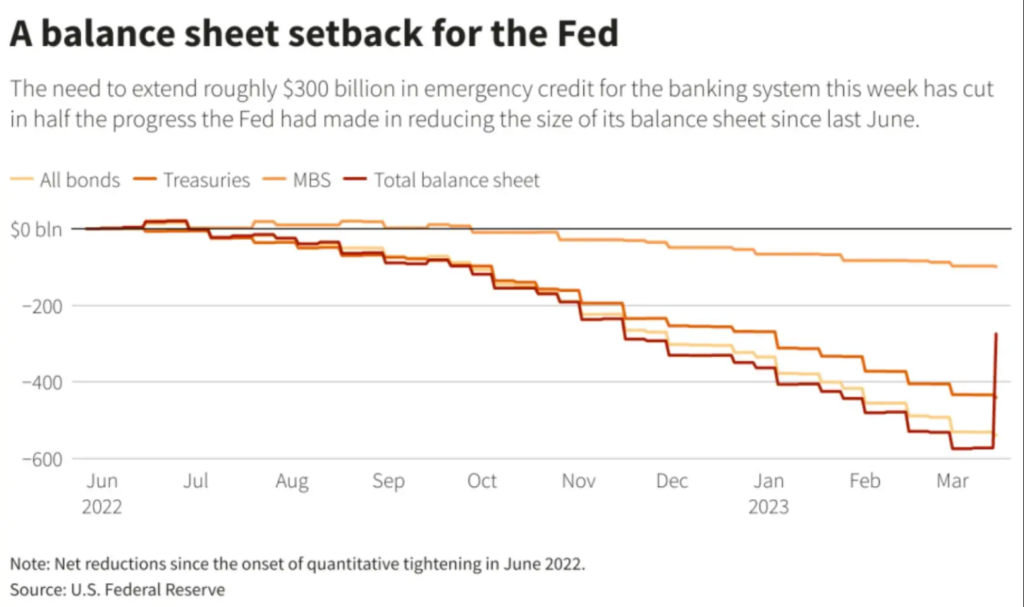

These numbers are a big deal when you consider how they affect the Fed’s policy moves. See, the central bank’s been doing two main things in its fight against inflation: hiking interest rates and reducing the value of bonds on its balance sheet. But these emergency loans are thought to have undone half the good of those bond-offloading efforts. So if the Fed does hike interest rates this week, it’ll be like fueling the blaze and taking a firehose to it at the same time.

The bigger picture: Follow the money.

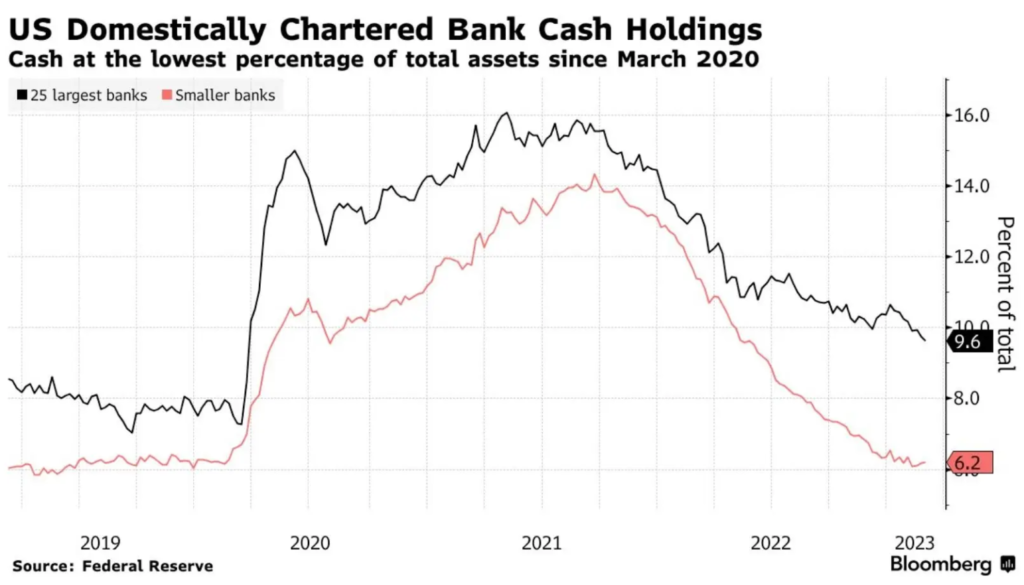

Folks aren’t sticking all that withdrawn cash under their mattresses. But the dollar trail does lead to seriously low-risk investments, like government bonds and money market funds (which essentially invest in cash and safe securities). That stands to reason: worried investors tend to make safer financial choices in times of crisis, in a so-called “flight to quality“.

Safe Trading

Team of Elite CurrenSea 🇺🇦❤️

Leave a Reply