Trading Results Overview – June 2021

Dear Traders,

the month of May ended up at a small profit of +2.52%. The winning systems included Zeus EA, ecsLIVE, the SWAT EA total, and the options signals. On the losing end were the Ultima EA and Rush EA from Mislav Nikolic.

Let’s review all of the trading systems in total and then one by one.

Summary of All Systems in June 2021

Here is a summary of all the trading systems and their performance in June 2021:

| System | Performance June 2021 |

Draw-down June 2021 |

Total running performance (30.06.2021) |

| Zeus EA 1 (PAMM) | +3.96% | 10.83% | +55.13% |

| ZEA Retail Rental (€2.5k per account) |

+3.01% | 15.03% | +82.91% |

| SWAT EA EUR/USD 1H | +5.74% | 7.30% | +11.2% |

| SWAT EA DAX 1H | -8.53% | 8.83% | +23.6% |

| ecsLIVE | -9.36% | 19.38% | +22.51% |

| Ultima EA (Bull Capital) | -13.06% | 16.15% | -28.61% (from 4.2020) +388.61% (from 8.2019) |

| Rush EA (Bull Capital) | +28.11% | 15.86% | -29.24% |

| Options | +8.1% | – | +17.32% |

| Total Last 5 Months | +104.4% | – | – |

| Total June 2021 | +17.97% | ||

| Total May 2021 | +9.97% | – | – |

| Total April 2021 | -49.69% | – | – |

| Total March 2021 | +20.5% | – | – |

| Total Feb 2021 | +108.6% |

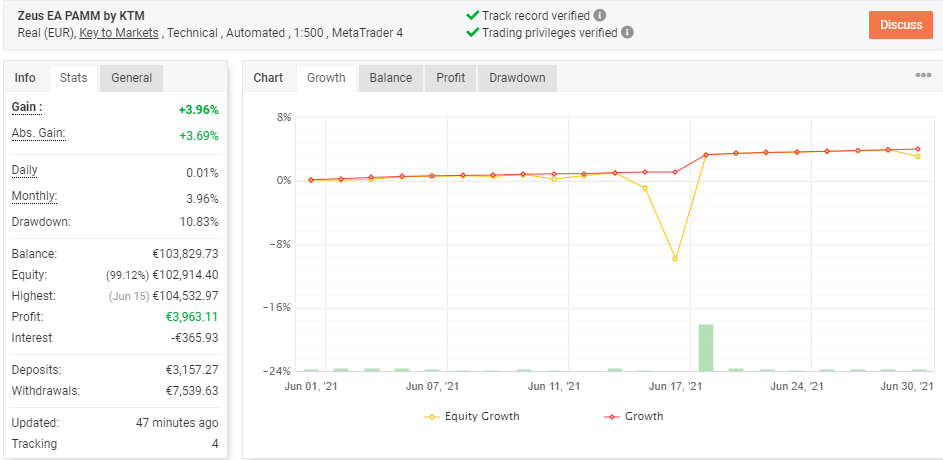

Zeus EA

The Zeus EA showed decent gains even in the slower month of June 2021. The profit share and retail accounts booked +4% and +3% profits. Yet another profitable month for the Zeus EA and so far, there has not been a single losing month since we started trading this EA.

There are two main options if you want to join the Zeus EA.

- Join the profit share module via our managed Zeus EA account. The managed account is free of any upfront costs but traders pay 20-25% of the profits.

- The other one is to rent the EA for a month or year. The rental is free of profit share but does come at a rental fee.

| Performance PAMM Zeus EA | +3.96% |

| Total performance | +55.13% |

| Win Rate71 | 71% |

| Reward-To-Risk | 0.56 |

| Draw-Down | 10.83% |

| Net Pips | -16.7k |

What’s the main take?

The Zeus EA is very consistent. Traders who want to enjoy profits each and every month could benefit from the stable performance that Zeus EA is showing. Both Zeus EA accounts (first and second) are now +56-80% of profits since we started.

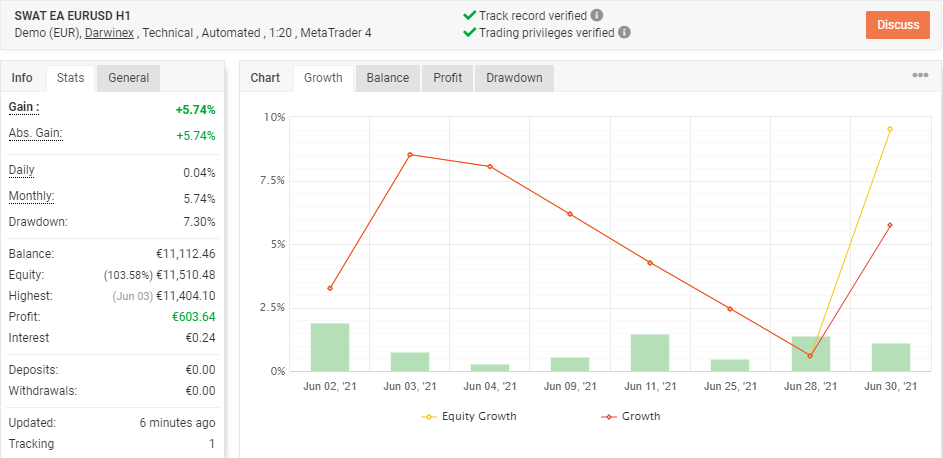

SWAT EA

The SWAT EA is performing well on the 1 hour charts of the EUR/USD and DAX 30 but had a weaker performance on the 15 minute chart. We decided to focus the SWAT EA for the moment on the EUR/USD 1H and DAX 30 1H.

| SWAT EA | EUR/USD 1H | DAX 1H | |

| Performance | +5.74% | -8.53% | |

| Total performance | +11.12% | +23.6% | |

| Win Rate | 33% | 20% | |

| Reward-To-Risk | 2.1 : 1 | 1.6 : 1 | |

| Draw-Down | 7.3% | 8.83% | |

| Net Pips | +13 | -275 |

What’s the main take?

The two SWAT EAS are up more than 34% in the first 5 months. Not bad. Of course, more data and trading is needed to make a better evaluation.

ecs.LIVE (by cammacd.BlackWidow)

ecs.LIVE (by cammacd.BlackWidow)

The Black Widow signals on ecs.LIVE ended up losing almost 10%. A tough month for Nenad Kerkez but the overall performance remains positive.

| Performance | -9.36% |

| Total performance | +22.51% |

| Win Rate | 53% |

| Reward-To-Risk | 0.6 |

| Draw-Down | 19.38% |

| Net Pips | -2.5k |

What’s the main take?

The ecs.LIVE service had a hefty draw-down of almost 20% in June. However, the losses were limited by numerous wins at the end of June. Therefore, the loss ended just below the 10% mark rather than at 20%.

Ultima EA

The Ultima EA from Mislav Nikolic be rented as a bundle with 3 trading systems: the Ultima on the EUR/USD 15 minute, Ultima Pro on GBP/USD 60 minute, and Rush EA on EUR/USD 5 minute.

The Ultima EA performance in the 2nd quarter 2021 was weak. June ended up negative too BUT there was a floating profit as a bunch of short setups were close to target. Let’s see if the targets get hit. If yes, then July 2021 should be off to a good start.

| Performance end of May 2021 | -13.06% (3% risk per setup) |

| Total performance end of May 2021 | -28.61% (4.2020) +388.61% (8.2019) |

| Win Rate | 22% |

| Reward-To-Risk | 2.1 : 1 |

| Draw-Down | 16.15% |

| Net Pips | -154 |

What’s the main take?

Ultima made 124.43% in 2019, 114.64+% in 2020, and about +1% in 2021. So far, the year 2021 has been slower than 2019 and 2020. Will the 2nd half of 2021 push the Ultima again into positive territory? We will soon find out.

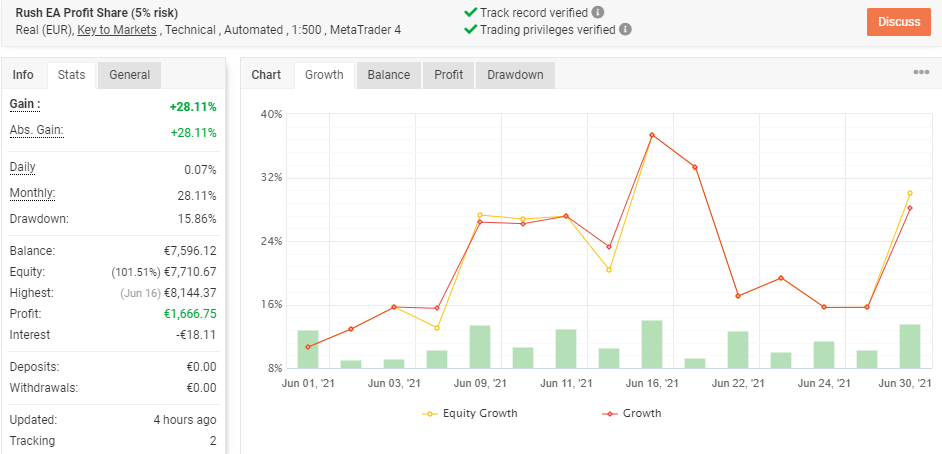

Rush EA

The Rush EA from Mislav Nikolic had a great result in June 2021. With a gain of 28%, the EA had a wonderful month and result.

| Performance | +28.11% |

| Total performance | -29.24% |

| Win Rate | 59% |

| Reward-To-Risk | 1.5 : 1 |

| Draw-Down | 15.86% |

| Net Pips | +383 |

What’s the main take?

Rush EA showed a nice comeback in June 2021. But it will need more consistent performance in July and August if it is able to stage a full recovery.

Options Trading

Options Trading

Are the bulls tired? June saw a market with reduced daily volatility. Price moved mainly sideways. This did not prevent it, however, from generating a new high and then having a more noticeable retracement. This reduced volatility is also confirmed by the Vix trend which has always remained below the level of 20, reached with a peak during the retracement mentioned above.

From the point of view of our educational signals, the June month generated a good number of opportunities, exactly nine. Mainly long setups with a single short signal which, moreover, obtained the best performance of the month closing with a profit of + 81%. At the moment there remains an open position, EXEL, entered on the last useful day of the month, which for the moment is slightly in profit.

| Performance | +8.10% |

| Performance since 04.2021 | +17.32% |

| Win rate | 62.5% |

| Reward to risk | 1.61 : 1 |

| Draw-Down/Loss | 5.15% |

What’s the main take?

Here are the Options trading ideas in June 2021:

Check out our option strategies from options expert Marco Doni !

Thanks and good trading,

Carlos Cordero

Mislav Nikolic

Marco Doni

Nenad Kerkez

Chris Svorcik

ECS team

Leave a Reply