Trade Journal: Mixed Results in a Very Slow Week

Dear Traders,

the CAMMACD scored 5 wins and 4 losses in a very slow week, where markets were mostly ranging. The CAMMACD.MTF scored 4 wins out of 5 trades.

This article will also see a contribution from Chris as he has restarted sending new ecs.SWAT.4H setups. He will also add an update about the status of the new SWAT course 2.0

Gold is Still Trending

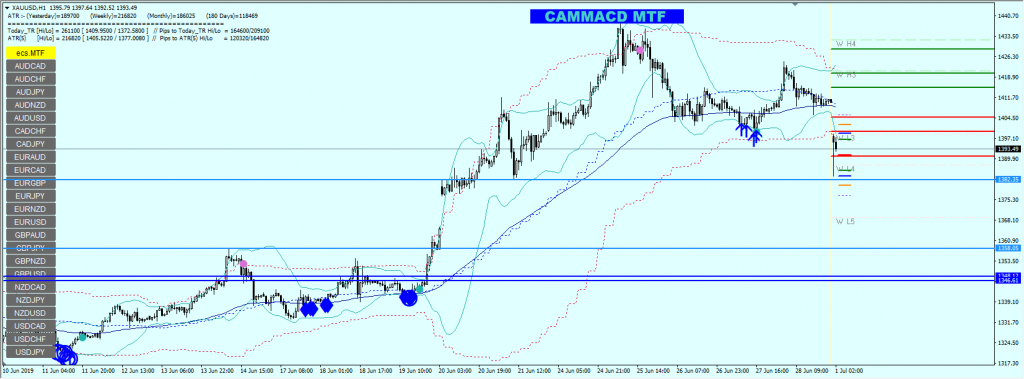

Diamonds, arrows, circles, and Super-Dots. They all mean something in the world of ecs.CAMMACD. See the Gold chart below. It has been a great performer with very good signals captured by CAMMACD.MTF. I really loved how the trade was executed and so far on Gold we had only winners.

Our new approach regarding stop losses takes only the ATR as the main pivot for placing stops. The new rule has taken place last week and I will continue using ecs.ATR-pro for placing stop losses.

Source: ecs.CAMMACD

The Holy Grail

Many traders believe that they will find a trading method which will earn millions forever. The strategy without losses, only wins. So far, I have come to believe that it is just a myth, unless we talk about money management. We don’t see any proof that the 100 % winning method actually exists. Every strategy needs to be flexible. Markets change. One of the reasons why we have webinars is to keep you updated on current market conditions.

Successful traders are always adapting their strategies to current market conditions. Remember guys, if you can make 1-5% profit per month, then you are doing much better than banks can give you, which can be around 2% per year. I always trust my own guns and that is why I really love CAMMACD strategy which I have been using for many years, with updates which has made it even better.

Trading For a Living

Oh, so common now… How many people make their living from acting or painting? Even from sports? Many people play poker too, but can they sustain a living from it? As I said, you need to be realistic. I have been asked many times in the past – “Can you trade for a living with $5,000 or even $10,000?”. My response is always – “Yes, if you want to live beneath the underpass”. You need to be consistently good, and you need to have much more money.

Not everyone has the skill or drive that makes them that successful, and it is not always your fault why you lose money. Sometimes it is just – the market itself. If, for example, a trader begins with $10,000, he or she might not be happy with the only $200 per month (realistic 2%/month) and then over leveraging inevitably happens. With over leveraging, revenge trading will come sooner or later. You can be sucked into a spiral of doom which can ruin you completely. Don’t let it happen. Be realistic. Be realistic. Anyhow, it’s now time for Chris to share his updates.

SWAT is Back with 4 HR Setups

The good news is that Chris has been working diligently on multiple updates of this ecs.SWAT method, which includes a new ecs.SWAT book, indicators, strategies, supporting materials and fully new course. The SWAT 2.0 update is expected to be completed in the 2nd half of 2019.

In the meantime, Chris will be sending again SWAT setups on the 4 hour chart and occasionally on the 1 hour chart. Many of the trades were focused on the NZD, at first weakness trades such as EUR/NZD and EUR/AUD buys. The EUR/AUD closed for a small -10 pip loss (-0.15%) whereas the EUR/NZD closed for full loss (-1%). The good news was that these trades were compensated by a GBP/NZD sell, which nicely closed for +131 pips and 1.82 : 1 reward to risk ratio. One win, but still in profit. Also my two EUR/USD buys went well, with one closing for +96 (1.63:1) and the other for 4 pips profit.

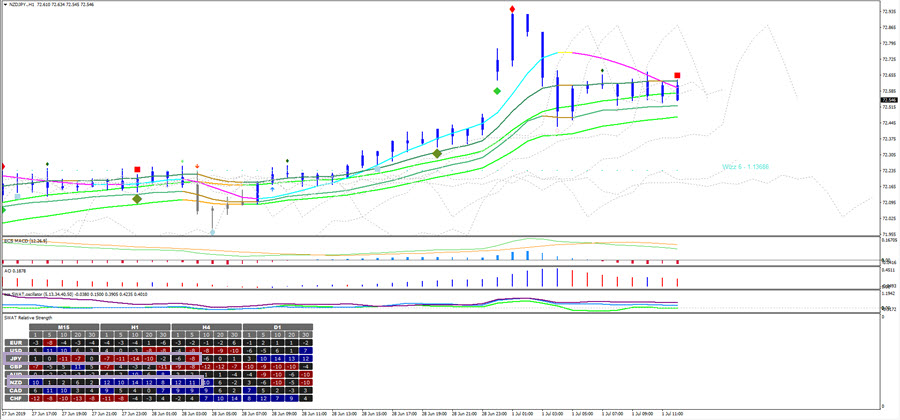

The best trade however was arguably the NZD/JPY buy from end of last week, which was my first SWAT.1H (1 hour) setup in a long time. My new SWAT relative strength vs weakness indicator (SWAT members, please be patient as it has not been released as yet) had spotted NZD strength and JPY weakness. The SWAT indicators did the rest (trigger, entry, SL, TP, trade management). I was thinking about a target at 72.92 or 72.94 but unfortunately choose the 94. 🙂 Otherwise the trade would have closed for +70 pips and more then 2:1 R:R. Now I’m still in the trade and moving trail SL below fractals. At the moment, +20 pips profit is locked in.

The best trade however was arguably the NZD/JPY buy from end of last week, which was my first SWAT.1H (1 hour) setup in a long time. My new SWAT relative strength vs weakness indicator (SWAT members, please be patient as it has not been released as yet) had spotted NZD strength and JPY weakness. The SWAT indicators did the rest (trigger, entry, SL, TP, trade management). I was thinking about a target at 72.92 or 72.94 but unfortunately choose the 94. 🙂 Otherwise the trade would have closed for +70 pips and more then 2:1 R:R. Now I’m still in the trade and moving trail SL below fractals. At the moment, +20 pips profit is locked in.

Cheers and safe trading,

Nenad and Chris

Leave a Reply