What To Bet on if Eurozone Collapses into Recession by the End of 2022

It’s shaping up to be a very uncomfortable winter for Europe, with gas shortages, rationing, and potential blackouts all being possible.

As winter approaches, it’s a good time to think about the five big consequences that are likely to play out and how to prepare your portfolio for them.

1: The Consumer Suffers While Gas Producers Profit.

Although higher gas prices may be beneficial for gas producers, they could prove to be detrimental for European consumers and industries. Furthermore, this issue could have global spillover effects.

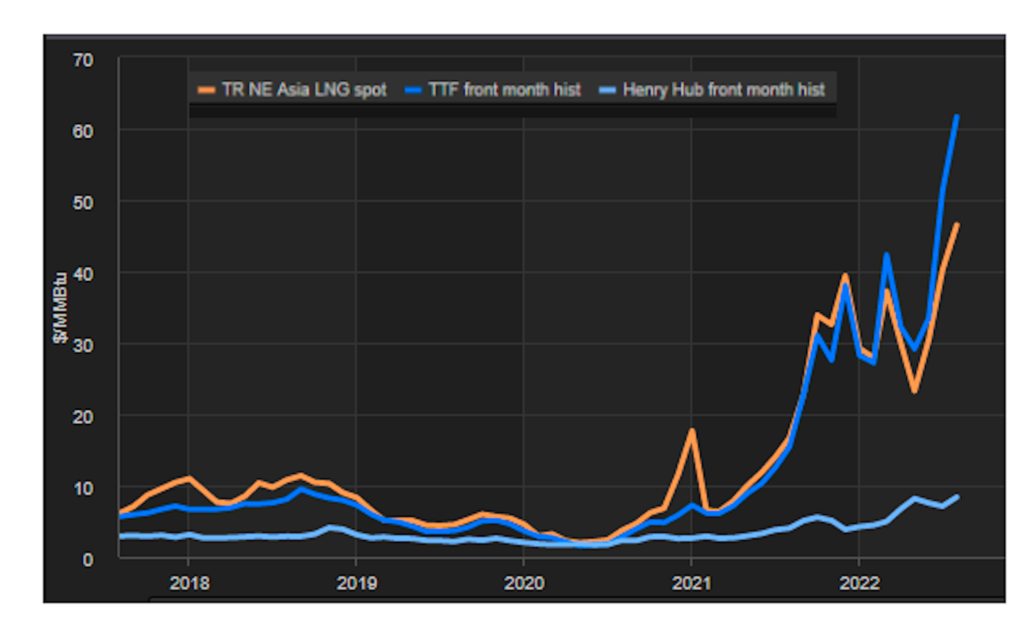

As an example, take the Dutch TTF gas price, represented by the dark blue line below. Its prices have increased sevenfold since the Russia-Ukraine war began in February.

The lack of pipeline gas in Europe has forced the bloc to turn to other energy sources, such as liquified natural gas (LNG), to supplement its needs. This has bid the price of LNG up to four times its recent four-year average.

Europe may be able to avoid blackouts this winter by outbidding other countries for natural gas, but it will come at a cost. LNG prices are likely to remain higher for longer, meaning higher energy bills for consumers and businesses.

Consumer discretionary stocks in Europe may not be the best investment right now, with high energy costs putting a strain on household budgets. Instead, consider investing in European gas producers like Equinor, Royal Dutch Shell, or BP, or companies that will benefit from strong LNG demand, such as Chesapeake, EQT Corp, Antero Resources, Golar LNG, and Cheniere Energy.

2: Heavy EU Industries Stumbling

The chart below shows the gas usage by industry relative to their contribution to economic activity in Germany. It is clear that gas rationing will have a significant impact on energy-intensive industries such as chemicals, autos, paper and pulp, and steel.

If electricity prices continue to rise, these sectors could see a hit to their bottom lines as rationing forces them to reduce output. This would result in less profitability, as fixed costs would remain the same but would be spread out over fewer goods produced.

Additionally, for industries that compete on a global cost curve – such as chemicals, paper and pulp, and steel – the higher costs per unit would make European industries less competitive compared to their counterparts in Asia and the US.

You might want to avoid European chemical, steel, and paper and pulp manufacturers. Instead, consider US chemical makers like Dow, LyondellBasell, and Huntsman. Click To Tweet They’ll probably benefit from higher chemical prices as European supply is challenged. A good strategy could also be to short European chemicals and go long US chemicals.

3. The Perceived Inevitability of European Recession

European economic growth is slowing down and inflationary pressures are increasing, due to lower consumer real disposable incomes and higher costs for industries. Production cutbacks are adding to the risks.

If a recession hits Europe, it could mean trouble for European stocks. However, the United States might be a better bet for investors.

If you’re looking for European exposure, you might want to consider investing in more defensive industries like pharmaceuticals and food and beverage. These industries would be more insulated from a recession.

Despite USD already obliterating EUR, the momentum is strong with the US Dollar. Many believe the US economy to be much better suited to steer away from a full-scale recession and economic downturn.

A longer-term EUR/USD short position (buying US Dollars) is therefore not such a bad idea. You can use Black Widow & SWAT to time the entry, as well as the ATR.pro indicator (currently available for free thanks to Exness).

4. Weak EURO Here to Stay

As mentioned above, the euro has taken a beating against the US dollar, and there could be more pain to come. Of course, the European Central Bank (ECB) has started hiking interest rates and is expected to hike rates again. (Higher rates usually help a country’s currency by increasing investors’ demand for it.)

The ECB is stuck between a rock and a hard place, trying to keep inflation in check while avoiding a sharp economic downturn. A recession would only weaken the euro, compounding the inflationary problem that Europe faces as it increases the price of imports for consumers and businesses.

5. Economic Downfall May Be Setting In

The longer the gas shortage continues, the greater the risk of consumers and industries adapting to a higher energy price environment, which could result in permanent demand destruction. Additionally, ending Europe’s dependence on Russian gas would lead to much higher gas prices across the bloc, making the continent less competitive in manufacturing and shrinking investment.

As energy costs continue to decline in certain regions, we could see a shift in new business investments and manufacturing.

For example, the petrochemical sector could follow the lead of European refining and begin to move to regions where they would have a cost advantage. This would allow industries to benefit from lower gas prices and create new opportunities for growth.

Safe Trading

Team of Elite CurrenSea 🇺🇦❤️

Leave a Reply