Weekly Waves 26 Apr: EUR/USD, Bitcoin and US30

April 26, 2022

4 min read

Hi Traders,

our weekly Elliott Wave analysis reviews the EUR/USD daily chart, the Bitcoin crypto currency daily chart, and US30 on the weekly chart.

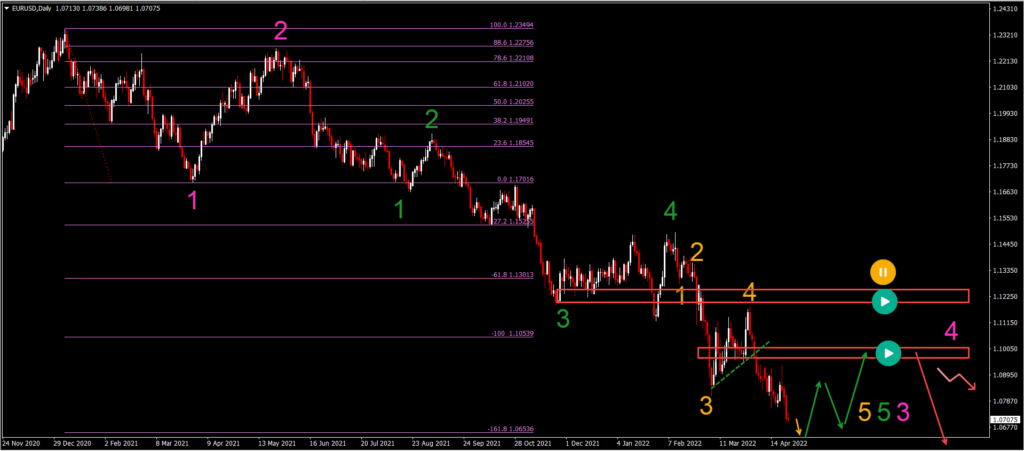

EUR/USD Confirms Bearish Wave 3 Pattern

The EUR/USD made a key bearish breakout below the support trend line (dotted green). Let’s review what the breakout indicates:

- The EUR/USD is now in a wave 3 (pink) rather than a wave C because price action is approaching the -161.8% Fibonacci target.

- The -161.8% Fibonacci target could be a bouncing spot. The strength of the bounce will depend if the wave 3 (pink) will complete at this target or the -200% Fib target.

- A strong bullish bounce could indicate the end of wave 3 (pink) and the start of wave 4 (pink).

- A mild bullish reaction indicates that the wave 3 (pink) is still developing and a bearish breakout should see price towards 1.05, 1.04, 1.025, and 1.00.

- A bullish retracement should usually be shallow which is usual for waves 4. The resistance boxes (red) are expected to stop price action from moving any higher.

BTC/USD Bullish Pinbar Confirms Double Bottom?

Bitcoin (BTC/USD) has printed another bullish candlestick pinbar:

- The BTC/USD bullish pinbar is the second one in recent history and offers a double bottom pattern at the support trend lines (green).

- We changed our Elliott Wave analysis to a bearish ABC (orange) pattern within wave B (green), compared to last week.

- Now price action is expected to make a bullish bounce within wave C (green). The Fibonacci levels are the main targets.

- A breakout above the resistance trend lines (orange) would confirm the development within that wave C (green).

- A larger ABC (pink) corrective pattern is expected within wave 4 (purple).

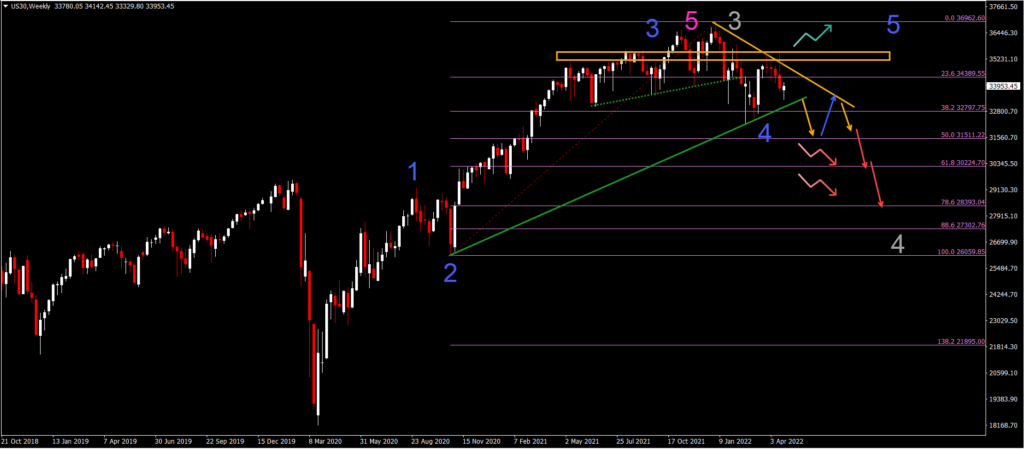

US30 Index Sinks Again at Heavy Resistance

The US30 made a strong bearish bounce at the resistance zone. Let’s review what it means for the US30 chart:

- The US30 weekly chart was unable to break above the resistance zone (orange). In fact, price action showed a strong bearish rejection (bearish weekly candle).

- The bearish rejection confirms a lower high. Price action already made several lower lows so a downtrend is already established.

- That said, the angle of the trend is still shallow and could easily fit within a wave 4 pattern.

- For a stronger and more serious downtrend to be confirmed, price action will need to break below the support trend line (green).

- Eventually a retest and break below the 50% Fibonacci is needed before a clear bearish reversal is expected (red arrows).

- The uptrend (green arrow) is only a factor if price action is able to break above the resistance box (orange).

Good trading,

Chris Svorcik

Leave a Reply