Weekly Waves 24 October: EUR/USD, Bitcoin and Gas

October 24, 2022

4 min read

Hi Traders,

Our weekly Elliott Wave analysis reviews the EUR/USD daily chart, the Natural Gas daily chart, and the Bitcoin weekly chart.

EUR/USD Trapped Between 0.95 and 1.00

The EUR/USD remains trapped between the 0.95 support level and parity (1.00) resistance zone:

- The EUR/USD did make a bullish bounce (wave A orange) as expected.

- But the bullish rebound was milder than we anticipated. Therefore, we changed the expected Elliott Wave pattern to a bearish ABC (orange).

- Another bounce at the previous bottom near 0.95 could confirm the end of wave B (green) and the start of wave C (green).

- The wave C could end up as a bullish 5 wave pattern finishing at the previous top near the 23.6% Fibonacci level.

- A downtrend continuation is expected once the ABC (green) completes the wave 4 (yellow).

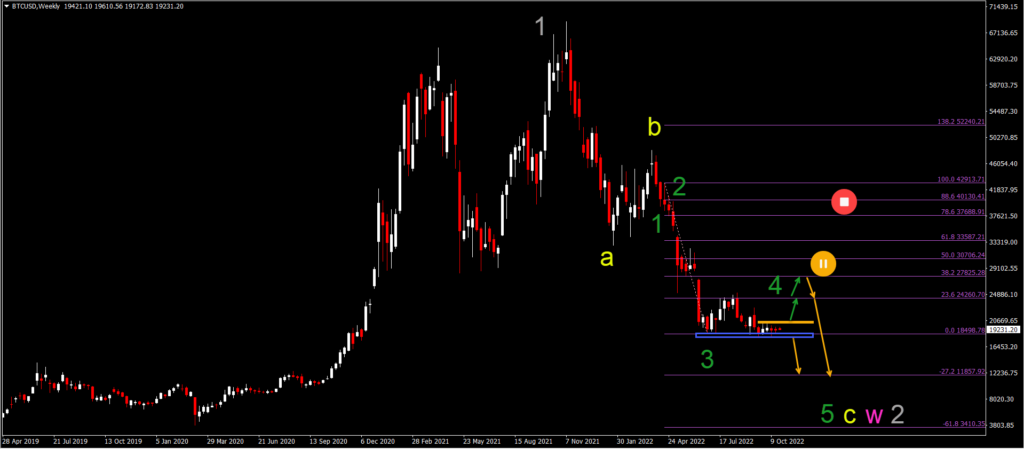

Bitcoin

Bitcoin (BTC/USD) is moving sideways between $19k and $20 resistance:

- BTC/USD is awaiting a break up or down.

- A bearish breakout (orange arrow) below the support zone (blue) could confirm a drop towards the $15k and $12k support zones.

- A bullish breakout (orange arrows) above the $20 resistance zone (orange) could indicate a retracement towards the 23.6% and 38.2% Fibonacci levels.

- A deeper bullish push upwards places this bearish Elliott Wave analysis on hold.

- The bearish swing could complete a wave 5 (green) of wave C (yellow) of a wave W (pink) of wave 2 (gray).

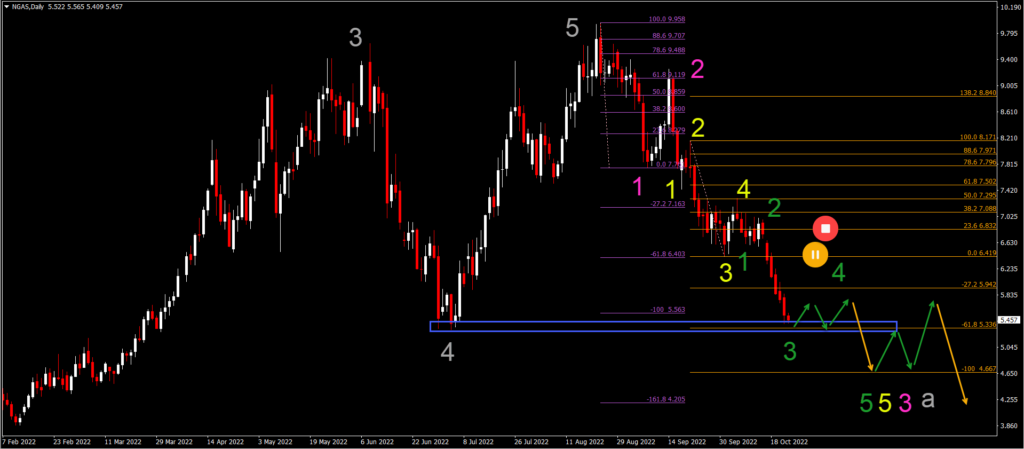

NGAS Strong Bearish Drop Approaches $5 Support

NGAS is dropping lower quickly as we anticipated last week:

- The bearish decline has been marked as a wave 3 (green).

- Price action could however stop at the support zone (blue) and make a bounce.

- A mild bullish correction marks the end of wave 3 (green) and the start of wave 4 (green).

- A bearish breakout (orange arrow) below the corrective pattern indicates a downtrend continuation towards the next Fibonacci target.

- This could complete wave 5 (green) of wave 5 (yellow) of wave 3 (pink) of A (gray).

- A deeper bullish retracement above $6.4 places this bearish Elliott Wave analysis on hold.

Good trading,

Chris Svorcik

Leave a Reply