Weekly Waves 22 August: EUR/USD, GBP/USD and Bitcoin

August 22, 2022

4 min read

Hi Traders,

Our weekly Elliott Wave analysis reviews the EUR/USD monthly chart, the GBP/USD 4 hour chart, and the Bitcoin crypto currency weekly chart.

EUR/USD Testing Key Support Zone at 0.9750

The EUR/USD is testing again the key parity (1.00) level:

- The EUR/USD is expected to decline further but a larger support zone and 78.6% Fibonacci level (blue box) could stop the downtrend around 0.9750.

- A bullish reaction at the support zone could indicate a larger bullish correction within the wave 4 (pink).

- The bullish rebound could take price back up the 23.6% and 38.2 Fibonacci retracement levels plus resistance trend line.

- Eventually a bearish continuation is expected towards the 88.6% Fibonacci retracement level and -27.2% Fibonacci target.

- A bearish breakout below the support 0.9750 indicates an immediate continuation lower.

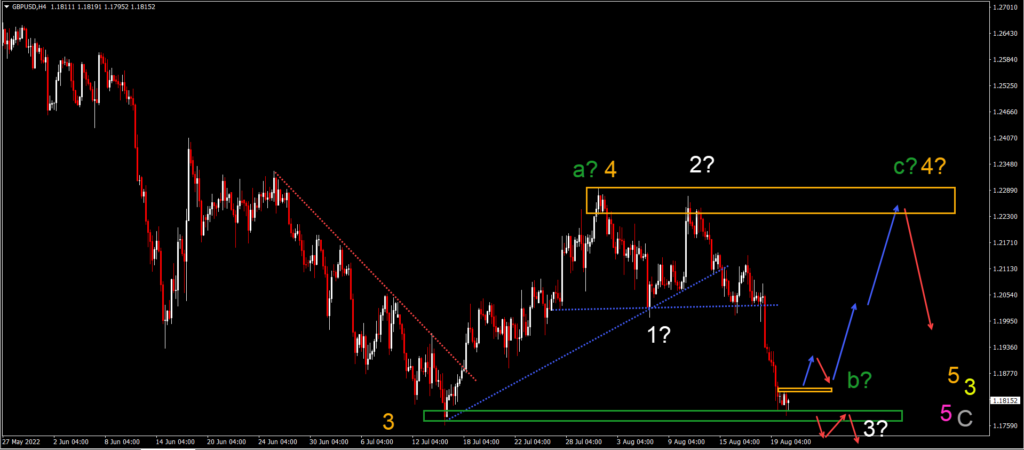

GBP/USD Testing Critical Bottom and Support

The GBP/USD is testing the previous bottom:

- The GBP/USD is testing a key support zone (green box).

- A bullish breakout above the resistance zone (orange) could indicate a rally (blue arrows) towards the previous top (orange box).

- In that case, price action is probably building an ABC (green) pattern in wave 4 (orange).

- A bearish breakout (red arrows) below the support (green box) could indicate an immediate downtrend towards 1.16 and 1.15.

- In that case, price action is probably building a wave 123 (white) impulse.

BTC/USD Wave Patterns Indicate Consolidation

Bitcoin (BTC/USD) is building a bullish retracement but price action is struggling to find any substantial move up:

- BTC/USD bearish breakout below the previous bottom (red arrows) indicates a downtrend continuation towards targets at $15k and $12.5k.

- A bullish bounce at or above the previous bottom could indicate a sideways movement.

- Price action could retrace upwards as high as the 38.2% Fibonacci retracement level but ultimately remain in a downtrend.

- Eventually one more lower low is possible to complete a wave C (yellow) or finish a wave Y (pink).

- A break above the 38.2% Fibonacci retracement level indicates a larger ABC (yellow) within wave Y (pink).

Good trading,

Chris Svorcik

Leave a Reply