Weekly Waves 14 November: EUR/USD, Bitcoin and Gold

Hi Traders,

Our weekly Elliott Wave analysis reviews the EUR/USD daily chart, the XAU/USD 1 hour chart and the Bitcoin weekly chart.

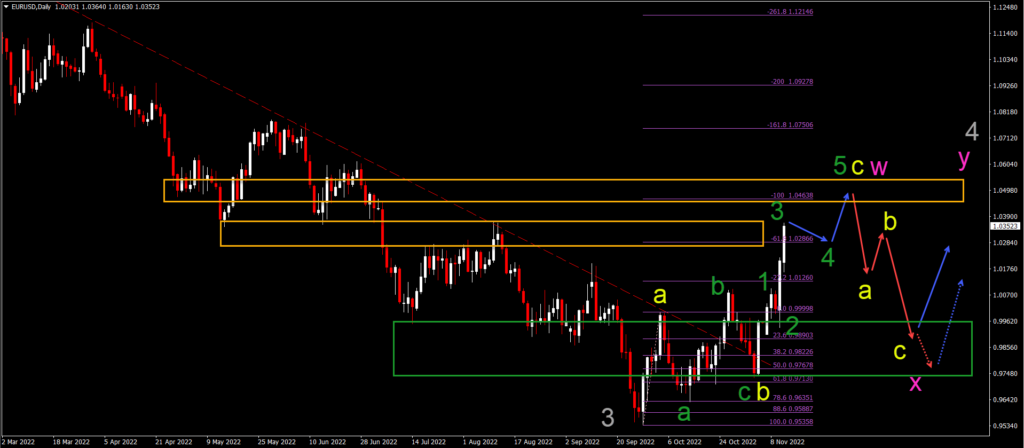

EUR/USD Bullish 400 Pips Price Rally

The EUR/USD made a very strong bullish swing last week. Price made a bullish bounce at 0.9950 and rallied 400 pips to reach 1.0350:

- The EUR/USD rally started after price action completed a bearish ABC (yellow) pattern in wave B (green).

- The EUR/USD tested and bounced at the 61.8% Fibonacci retracement support level.

- A larger ABC (yellow) zigzag seems to be unfolding within a complex WXY (pink) correction of wave 4 (gray).

- Within the wave C (yellow), price action is moving in a 5 wave pattern (green).

- We expect wave 3 (green) to finish soon, which is then followed by wave 4 (green) and wave 5 (green).

- The main target is the -100% Fibonacci level near 1.0450 and 1.05.

- A bearish ABC (red arrow) should emerge at this target zone.

Bitcoin Bearish Drop Bounces at $15k

Bitcoin (BTC/USD) broke below the support trend lines (dotted green) after moving sideways at the 78.6% Fibonacci support level for a couple of months:

- The BTC/USD bearish breakout below the 78.6% Fibonacci level confirms a continuation of the bearish wave C (yellow).

- The target of the bearish wave C (yellow) is now at the 88.6% Fibonacci level at $11.2k. Other rounds levels like $15k and $12.5k will also act as support.

- Price action already made a bounce at the $15k level but a further decline is possible after the bullish correction is completed.

- A falling wedge pattern (red arrows) could develop as price action inches closer to the $11k mark.

- Price action could complete a wave C (yellow) of wave 2 (pink) or a wave C of wave W (orange) of a larger wave 2’ (pink).

- A bullish bounce (blue arrows) could emerge at the 88.6% Fibonacci level.

Gold Bull Flag Patterns Hint at More Upside

Gold (XAU/USD) is moving up higher within a bullish trend channel after creating a double bottom chart pattern on the 4 hour and daily charts:

- The Gold chart made several bullish breakouts above the resistance trend line (dotted orange).

- Gold seems to be developing an impulsive price swing with a 5 wave pattern (green) in wave 3 (yellow).

- Price action is expected to continue higher (blue arrow) towards the -161.8% Fibonacci target.

- Once the wave 3 (green) is completed, a bearish retracement (red arrows) is expected within wave 4 (green).

- The wave 4 (green) remains valid as long as price action remains in the bullish channel.

- A bullish bounce should take place within wave 5 (green) of wave 5 (yellow).

Good trading,

Chris Svorcik

Leave a Reply