Weekly Waves 12 September: EUR/USD, USD/JPY and Bitcoin

September 12, 2022

4 min read

Hi Traders,

Our weekly Elliott Wave analysis reviews the EUR/USD weekly chart, the USD/JPY 4 hour chart, and the Bitcoin crypto currency daily chart.

EUR/USD Bullish Reversal After Strong Weekly Candle

The EUR/USD is showing a strong bullish weekly candlestick, which is expected to start a bullish correction

- The EUR/USD is building a bearish wave 3 (gray) impulse.

- However, the bullish weekly candle is expected to signal the end of wave 3.

- The strong bullish weekly candle looks like a strong reversal candle with a lower low but also a higher high and a close near the high, indicating buying pressure as last week closed.

- A break above the resistance zone (red box) and last week’s high should start a bullish impulse higher.

- This could start a wave A (pink) within a larger ABC (pink) correction of wave 4 (gray).

- The 23.6% and 38.2% Fibonacci retracement levels are expected to act and hold as resistance. A break above the 38.2/50% Fib zones could indicate a different wave pattern.

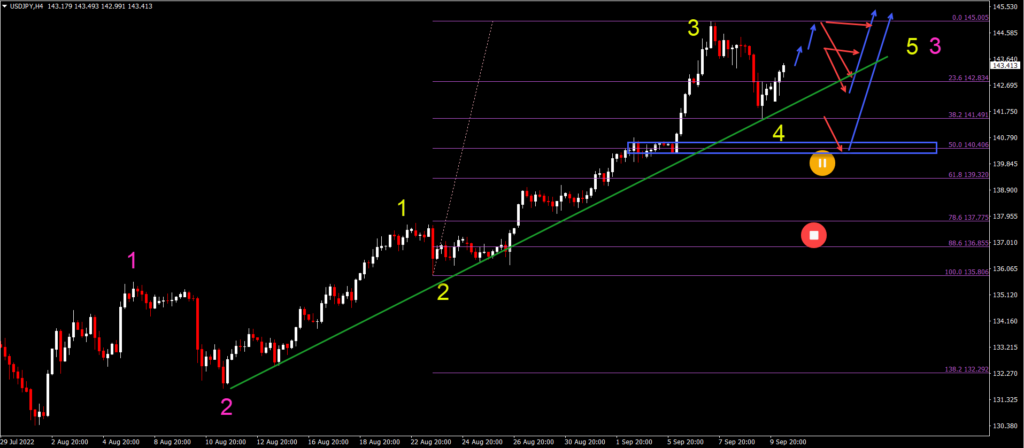

USD/JPY Bullish Bounce at 38.2% Fibonacci Level

The USD/JPY uptrend has been extremely strong since March 2022 with a price movement from 114 to 145 in a matter of months:

- The USD/JPY bullish impulse is very strong and is therefore expected to be a wave 3 (pink) of larger wave 3(s).

- Within the wave 3 (pink), there is an internal 5 wave pattern (yellow).

- This wave 4 (yellow) remains valid as long as price action respects the 38.2% and 50% Fibonacci retracement levels.

- The maximum retracement should be the support zone (blue box).

- A break below the support zone indicates a potentially different Elliott Wave pattern.

- The main bullish targets are 147.50 and 150.

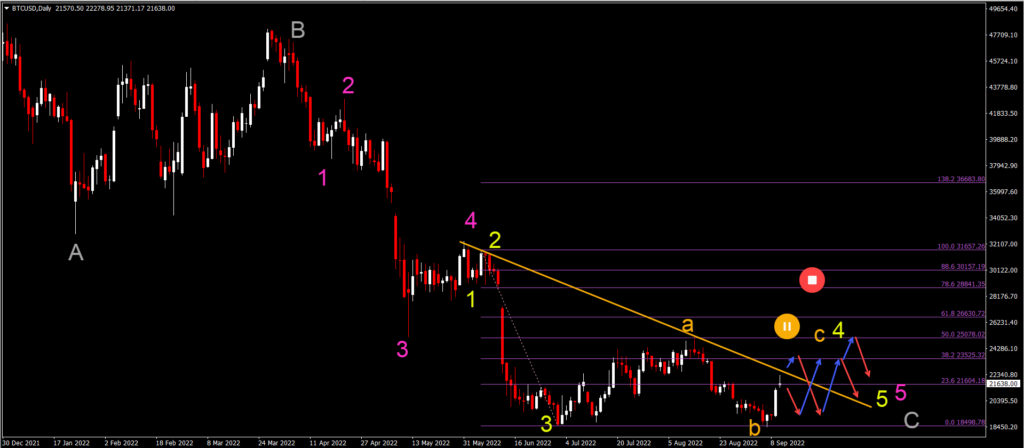

BTC/USD Bullish Retracement Faces Hefty Resistance Zones

Bitcoin (BTC/USD) made a strong bullish bounce at the previous bottom:

- The BTC/USD bullish rally at the previous bottom is in our analysis a wave B (orange) of a larger ABC (orange) in wave 4 (yellow).

- The wave 4 (yellow) of a larger wave 5 (pink) of wave C (gray) remains valid as long as price action respects the 38.2% and 50% Fibonacci resistance levels.

- A bearish continuation lower should aim at targets around $17.5k, $15k and perhaps as low as $10k.

- A break above the 50% Fibonacci level indicates that the wave B (orange) could have been wave 5 instead.

- This is certainly the case if price action breaks above 78.6% Fibonacci level, which means the end of the downtrend and wave C (gray).

Good trading,

Chris Svorcik

Leave a Reply