? USD Interest Rate Cut to 0% Fuels EUR/USD Bullishness ?

Dear traders,

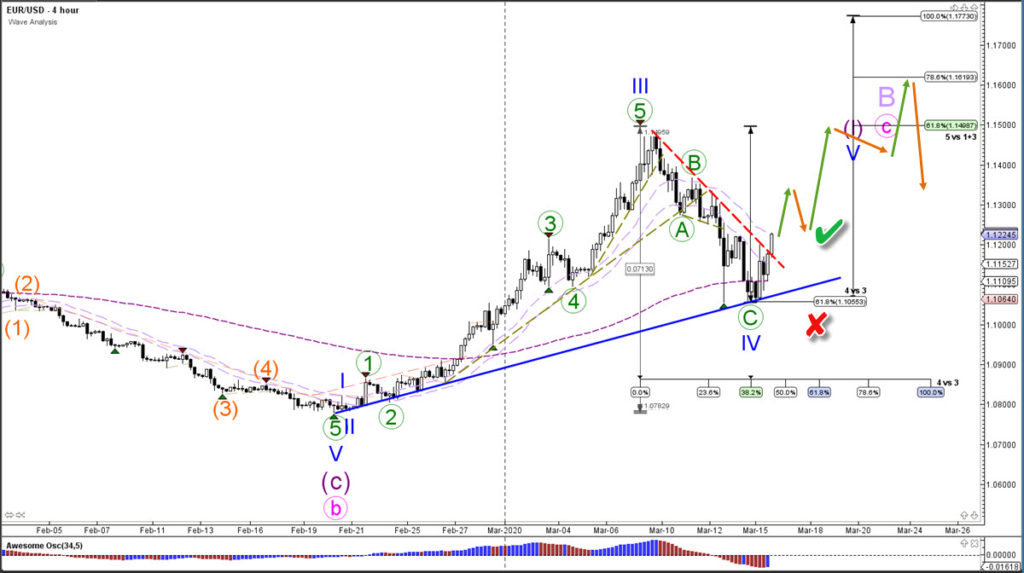

the US central bank made a historic and unprecedented decision to cut its interest rate from 1.25% to 0% over the weekend. The EUR/USD is posed to gain from the monetary easing after a bounce at the 61.8% Fibonacci level.

EUR/USD

4 hour

The EUR/USD seems to have completed a bearish wave C (green) of a larger wave 4 (blue). Price has bounced at the 61.8% Fib and is now breaking above the resistance trend line (dotte red). A bullish breakout, pullback, and continuation could confirm a move up towards the Fib targets of wave 5 (blue). The drastic rate cut by the US central bank from 1.25% to 0% could fuel the move up.

1 hour

The EUR/USD is on the way to the 161.8% Fibonacci target. A bullish continuation above 1.13 should confirm the development of a wave 3 (orange). Any continuation chart patterns like a bull flag could also indicate more upside.

The analysis has been done with SWAT method (simple wave analysis and trading).

For more daily technical and wave analysis and updates, sign-up up to our newsletter.

Good trading,

Chris Svorcik

Elite CurrenSea

Leave a Reply