Updates on Next Steps after Ultima EA Hits Largest Draw-Down

Dear Traders,

The Ultima EA system has now seen the largest draw-down since June 2017. Due to draw-down going beyond the historical max of the past 3.5 years, some changes will be made with regard to the Ultima EA rental and profit share members.

This article explains the short-term approach during the current slump. The Ultima EA creator and Mislav Nikolic from Bull Capital as well Elite CurrenSea continue to trade the EA though despite the weak performance during the 2nd half of 2020.

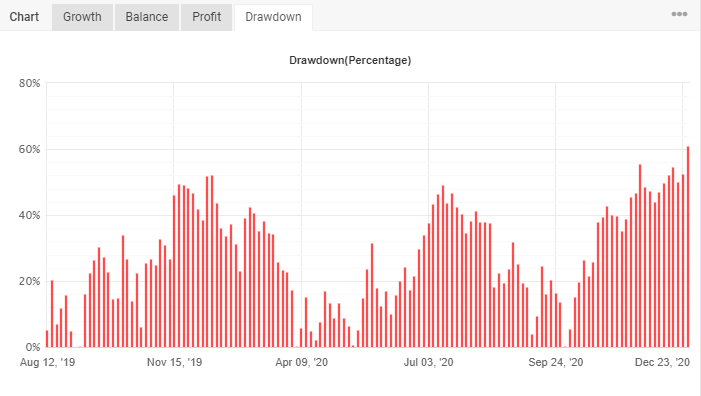

Ultima EA Performance and Draw-down Review

The Ultima EA account is now facing the most difficult period in the past 1.5 years – since the start of the live accounts in June 2019.

The largest draw-down is visible on all accounts, regardless of the draw-down. Of course, the draw-down is largest with the accounts that are trading with 5% risk per setup (this is not the total risk but risk per trade).

Here is an overview:

| Risk % per trade | Max DD since 2017 | DD 4 Jan 2021 | Start date | Current results |

| 5% per trade | 55% | 60.99% | Aug 2019 | +357.3% |

| 5% (profit share) | 55% | 62.35% | April 2020 | -29.8% |

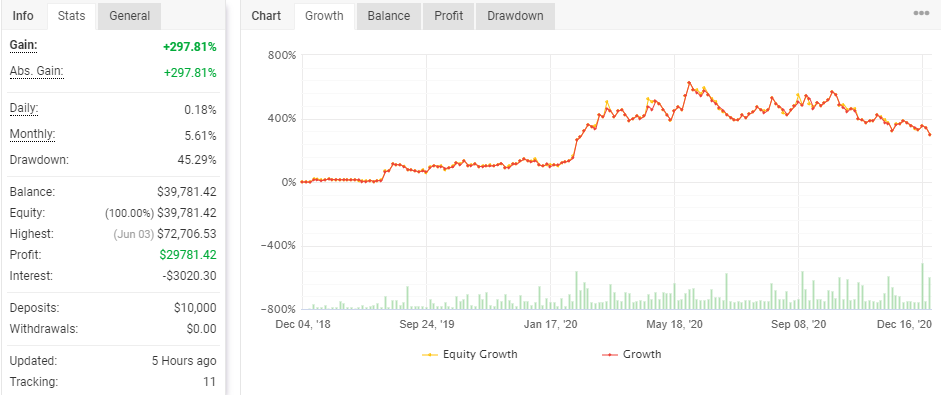

| 3% per trade | 37% | 45.29% | June 2019 | +297.8% |

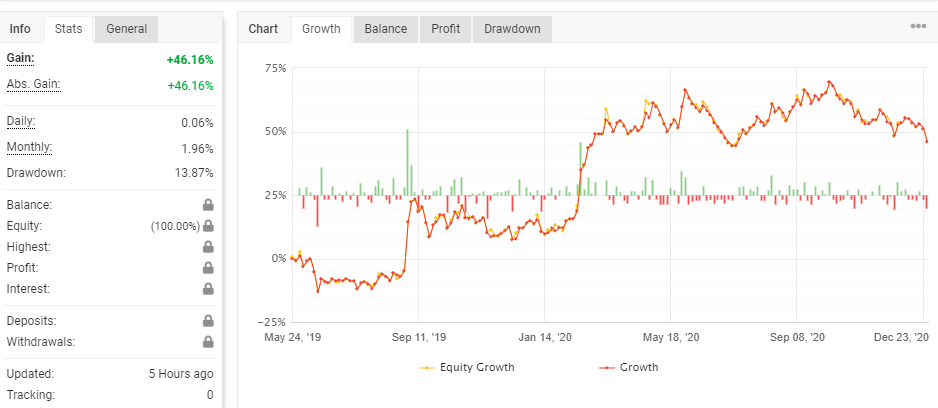

| 1% per trade | 14% | 13.87% | May 2019 | +46.2% |

As you can see from the above table, the draw-down has reached its worst point since June 2017 for the accounts with 3% and 5% risk per setup.

Although the long-term performance remains positive for each risk category (+46% for 1% risk, +297% for 3% risk, and +357% for 5% risk), the short-term performance since April 2020 has been negative (-29.8%).

Here is an overview of the equity curves for each risk category.

5% risk per trade since August 2019:

5% risk per trade since April 2020:

3% risk per trade since June 2019:

1% risk per trade since May 2019:

As you can see from the images, the performance was weaker in the 2nd half of 2020. But especially October, November and December 2020 have been the weakest.

We can see that even at the beginning of October 2020, the system performance made an all-time high or was close to an all-time high.

Now the system is in a downtrend (looking at the equity curve chart). And a clear higher high and higher low is needed before there is any chance of exiting the downtrend and re-entering a potential revival.

Steps After Draw-Down Breaches 3.5 Year Max

The breach of the draw-down beyond 60% is indicating a downtrend on the system. Because the draw-down could get worse, there are a couple of action points that we have taken and we think make sense in the current context.

Step 1: Lower current risk.

The Ultima EA and Rush EA profit share accounts that were trading with 5% risk per setup have been moved to 3% risk per setup.

Step 2: Only increase the risk to 5% again if an uptrend re-emerges.

The risk will stay at 3% per setup unless there is a clear improvement in the EA performances. We want to see a growth of at least 50% up to 100% before considering such an increase. There would also need to be a draw-down of at least 15-20% so we avoid increasing the risk at an equity high.

Step 3: Close Ultima EA and Rush EA for new members.

The doors will be closed to both EAs for new traders. No traders can rent the EAs or add capital to the profit share accounts until the draw-down stops and the performance improves. We will indicate when the doors will be reopened at any point in time.

Step 4: Read this if you are a renter reaching 1 year anniversary

Some of the EA renters are approaching the 1 year mark in February, March, and April 2021. It will be possible to get a free extension of the EA rental if you can show a negative or weak positive performance during this time. But you do need to wait till 2 weeks before your subscription finishes before writing us an email with the request for an extension.

Step 5: Consider your risk appetite and diversification options.

Although the system is hitting a rough patch – especially when trading with 3% risk or more – the creator of the EA Mislav Nikolic and Elite CurrenSea will continue trading the EA. The high risk approach has certainly shown its tough side for many of us. And in trading, there are no guarantees for future results. It is therefore ultimately up to every account holder to make a decision whether they continue with trading despite the draw-down, stop trading these EAs, and/or diversify funds in other EAs like Zeus EA, which offers a more consistent approach. The good news is that traders have full and immediate access to their PAMM accounts when they want to. If you don’t feel comfortable with the current situation, and currently invested in the PAMM, you are free to pull out. In trading, as well as investing, it’s best to not invest more than you can afford to lose.

More Information During Our Live Webinar

We will have a live webinar that addresses the draw-down on Ultima EA later this week. We will also review the December 2020 performance for all of our systems and EAs.

During the webinar, you will have the opportunity to ask questions in the live chat. But you can also ask questions beforehand via our google form as well.

The live webinar will be recorded and offered on our YouTube channel and added to our article on Saturday.

Sign-up for the live webinar on Friday 8 January at 11:15am GMT.

Good trading,

Chris Svorcik, Elite CurrenSea

Mislav Nikolic, Bull Capital

Leave a Reply