Ultima’s Battle Against Current Draw-Down is Not Unusual

Dear traders,

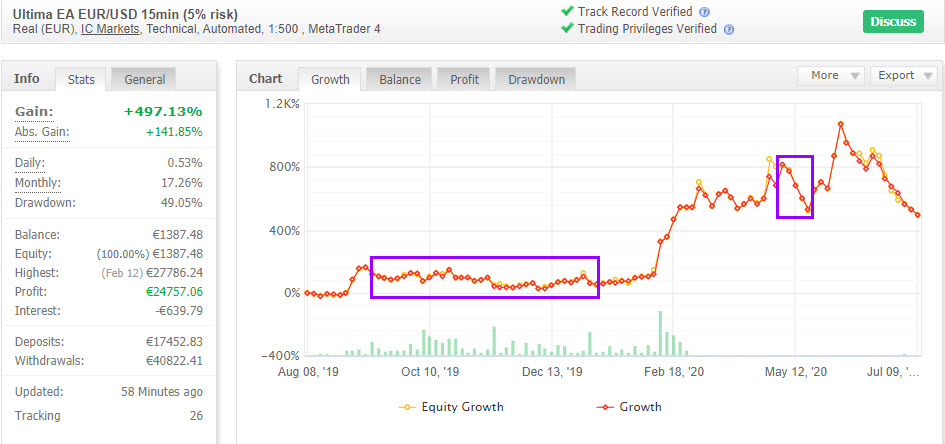

the Ultima EA has been experiencing a draw-down since the beginning of June. This is especially hard on the trading psychology of the investor.

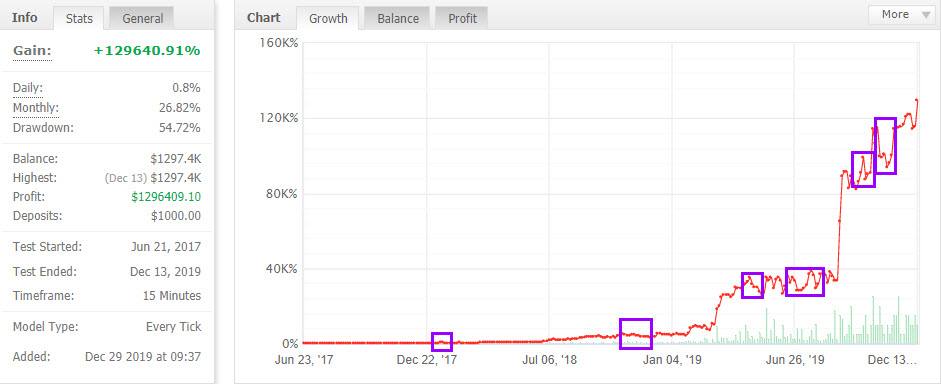

However, this is certainly not the first draw-down that Ultima EA has survived. In fact, we can see that Ultima managed to deal with similar situations in the past in both back-testing and live trading.

This article explains our 7 tips on how to handle draw-downs when trading Ultima EA with 5% risk per setup (which is known for its high risk approach and its potential for aggressive account building). Also, Mislav Nikolic, the Ultima EA creator, explains why being prepared for draw-downs is key.

Why Do Draw-Downs Occur?

Draw-downs are a natural part of trading because traders open and close positions relatively quickly. Trading is different than investing because investors can hold on to assets for a very long time and wait for the asset to become profitable.

Trading with leverage like with Forex and CFDs requires more precise timing of entries and exits. Traders do not have the luxury of time and hope like investors do. The benefit for leveraged trades is that they can pull out more profits in a shorter period of time, but this does entail more risk.

Due to leverage, traders are opening and closing multiple positions in a relatively short period of time with profits and losses. This in turn creates the possibility for both winning and losing streaks. The losses accumulate to what is known as a draw-down.

How to Handle Draw-Downs and Current Ultima EA DD?

The “heaviness” of a draw-down from a trading psychology point of view depends on a couple of factors, at the very least:

- Your own trading psychology – risk conservative or a risk seeker.

- Your goals of the particular trading system within your overall approach.

- Your risk capital allocated to trading within your overall assets and savings.

- The relative draw-down – handling a 5% draw-down is easier than 30% or 50%.

- The monthly distribution of profits and losses – the more profitable months, the easier it is to handle

Many traders, including ourselves, trade the Ultima EA with 5% risk per setup, which is the maximum risk allowed because higher risk creates too large of a draw-down. Even with 5% risk per setup, the draw-down in back-testing and live trading is around 50-55% of the trading capital.

Mislav Nikolic, the Ultima EA creator, explained it as follows: “The Ultima EA does a handsome job of protecting the capital when the market is ranging and earning excellent profits when the market is trending. The EA usually has a small losing streak, which is why we are even able to trade it with such a high risk approach as 5% risk per setup. But at times, this will create draw-downs and traders need to be prepared for it, otherwise they will give up and miss the next push up.”

On the flipside, the 5% risk per setup also allows the account to grow strongly, which is the main purpose of the Ultima EA: aggressive account growth. Back-testing and live trading show how the EA can gain hundreds of percent per year. This is only possible by risking high and expecting draw-downs and slow months to occur at times.

Here are 7 tips to handle draw-downs:

- Lower the risk per setup by (also) renting the Ultima EA.

You can change the risk per setup if you use the rental version. It is possible to rent the EA as well, even if you are already currently a profit share member. - Add a second Ultima EA rental.

Diversify the risk by trading two different types of accounts: 1 with higher risk and 1 with lower risk.

- Add other EAs to your overall EA portfolio.

- Choose a risk percentage and draw-down that you feel comfortable with.

If you are already renting the Ultima EA, then choose a risk level and expected draw-down that matches your own trading psychology and risk appetite.- 5% risk per setup = 50-55% expected drawdown

- 3% risk per setup = 35-40% expected drawdown

- 2% risk per setup = 20-30% expected drawdown

- 1% risk per setup = 12-15% expected drawdown

- 0.5% risk per setup = 5-10% expected drawdown

- Choose a trading capital that you can afford to lose and that you are ready to risk.

Always choose a risk capital where you can handle the ups and downs of the account. If you are already a profit share member, then make sure to be mentally prepared to handle 50-55% draw-down. - Reduce the capital beforehand, rather than stopping during a draw-down.

Some traders stop as soon as a draw-down occurs. We recommend traders to choose a capital level where they can handle the draw-down and keep trading. - See the trading as a long-term ball game.

The best approach is to risk capital that you can afford to lose and feel comfortable with losing and seeing a draw-down. Then choose a risk percentage that creates an expected draw-down you are OK with. Then let the account run for 6 to 12 months before evaluating it.

Draw-Down Examples From the Past

Traders would probably need to trade with 1% risk or less per setup if they wanted to avoid the worst kind of draw-downs over the past 5 years. But in turn, this lower risk is accompanied with lower profit potential.

The draw-down with 5% risk per setup has certainly happened before in both live trading and back-testing. Let’s review them.

(see link to myfxbook results)

(see link to myfxbook results)

Will the Ultima EA recover from the draw-down like it did with previous examples? Maybe yes, maybe not. We cannot forecast if and when any recovery will take place. Any EA trading Forex and CFD with leverage is a high risk approach. The risk when trading with 5% risk per setup is even more high risk. That said, the profit potential for growing the account in the long run is enormous. Whether the profit occurs in 2020 or perhaps in 2021, we do think that the odds are on our side.

Good trading,

Mislav Nikolic – Ultima EA creator

Chris Svorcik – Elite CurrenSea

Leave a Reply