Ultima EA Performance Update End May 2020: Small +15% Gain

Dear traders,

the Ultima EA automated trading system had a draw-down about 1-2 weeks ago. After the string of losses, many traders were worried how the EA would behave.

Actually, the main reason why we trade with 5% risk per setup is because the losing streaks are usually short. The maximum, historical draw-down (DD) is 55% or 11 full losses in a row (5% per setup times 11 losses). But the DD drops to 37% (with 3% risk per setup) and to 14% (with 1% risk per setup) with lower risk levels.

This article will provide an update with the most recent results. We will also review the performance in the long run again. Plus emphasis why handling draw-downs is a key aspect for traders.

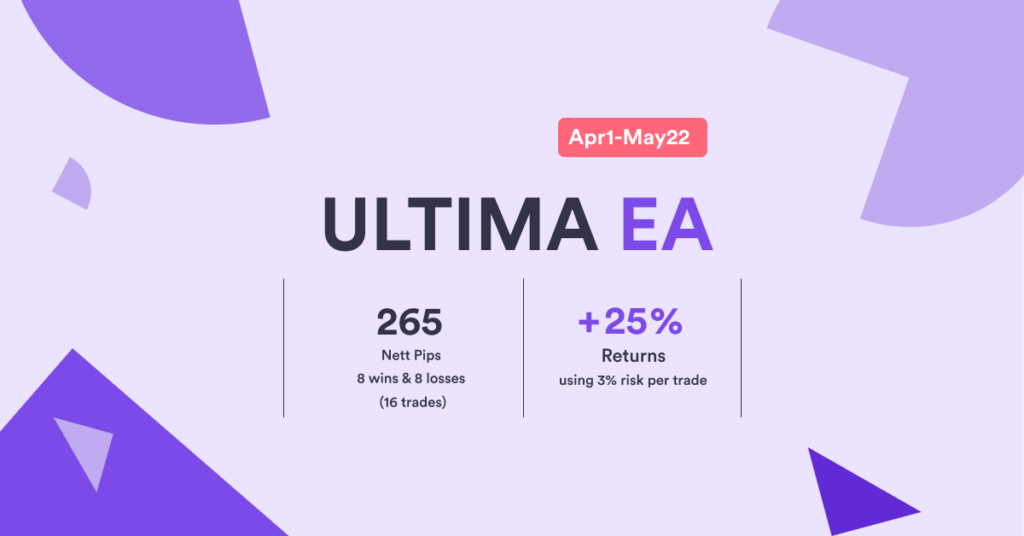

Performance in April and May 2020

First of all when discussing performance, we need to explain that we are speaking about our own Ultima EA performance when trading the EUR/USD pair on the 15 minute time frame using 5% risk per setup. The short-term performance can vary slightly depending on which broker you use. But in the long-run, the differences will usually even out.

Second of all, a trader’s performance will also vary depending on their starting moment. One trader who started at the beginning of May 2020 is probably ahead +15% in profit. But a trader that starts later could have a worse performance. Why? Here is the breakdown of results in May 2020:

- +/- 4 wins in the first week of May

- +/- 8 losses from 7 May to 15 May

- +/- 4 wins from 15 to 20 May

A trader who starts after those 4 early wins in May will have no cushion to soften the draw-down. They would run into a losing streak from the very start. However, a trader who starts after those 8 losses in mid May would start off with a small winning streak. As you can see, the moment when a trader starts will impact their performance in the short-run. Luckily 4 wins last week improved and gave a boost to the overall performance for everyone.

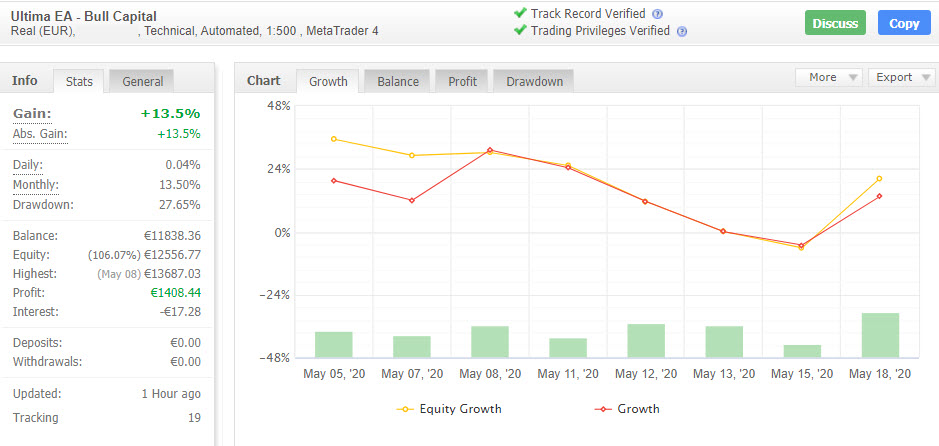

Considering those two aspects, my (Chris Svorcik) Ultima EA account is now up +15.4% in May 2020. The peak point was at +31.8% and the low point was at -9.7% (see image below).

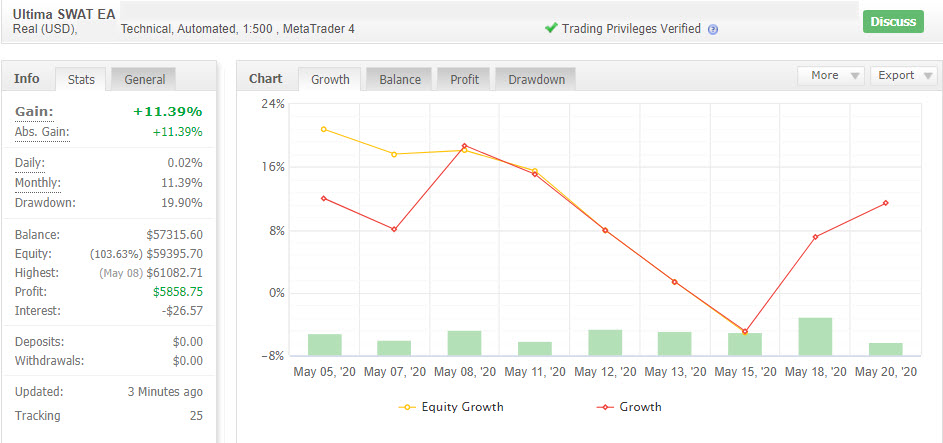

The account of Mislav Nikolic, the Ultima EA creator, is also ahead at the moment after a similar strong start, draw-down, followed by recovery. But keep in mind that most of the draw-down was from the profits earlier in May.

Our results show a similar trajectory when trading 3% risk per setup but of course with a lower peak and smaller draw-down.

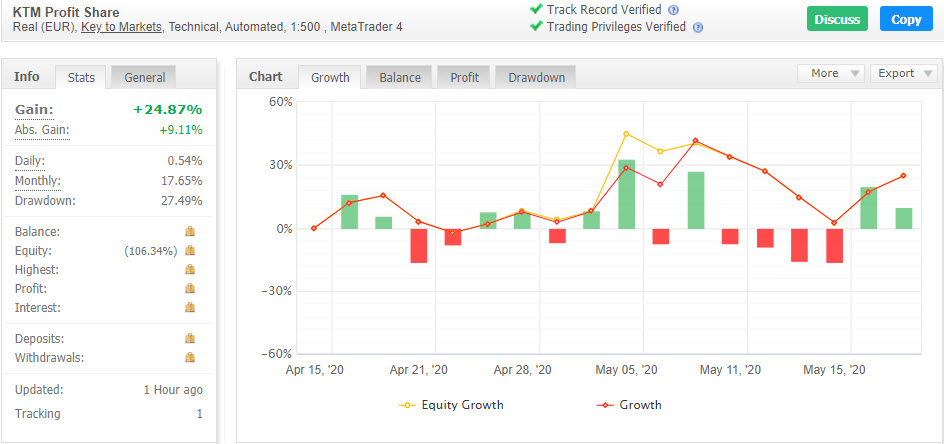

Performance for Profit Share Members from April 2020

The switch of brokers in March 2020 did not harm the profit share members from January and February. Why? Because March 2020 was a very quiet month with only few trade setups.

The volatility filter made sure that our performance was not impacted by the massive turmoil in the financial markets. It was an ideal time to switch brokers after a marvelous February 2020 performance with gains of more than 200%.

We restarted our profit sharing module in mid April with our new broker partner Key to Markets (KTM). If you are interested in starting an account with KTM, then you are able to get free SWAT 1.0 course or ecsLIVE access for 3 months.

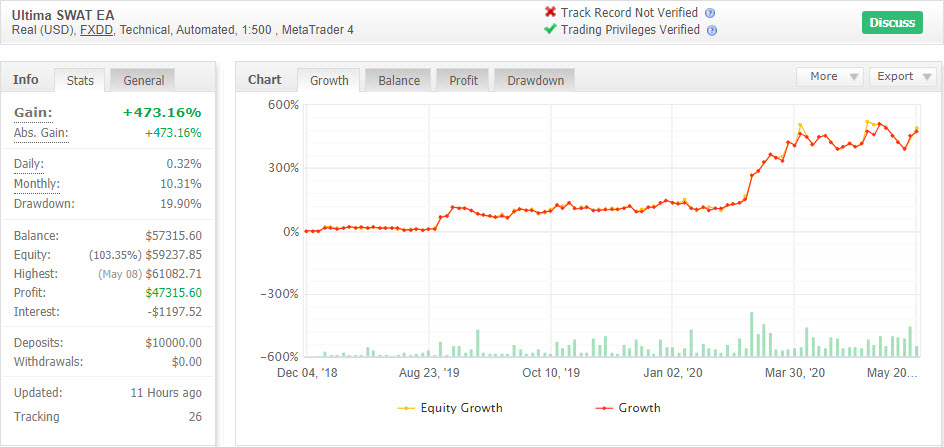

If traders started from mid April, then they are now ahead 24.87% (myfxbook link). April 2020 ended up with +7.8% and May 2020 is currently up +15.7%.

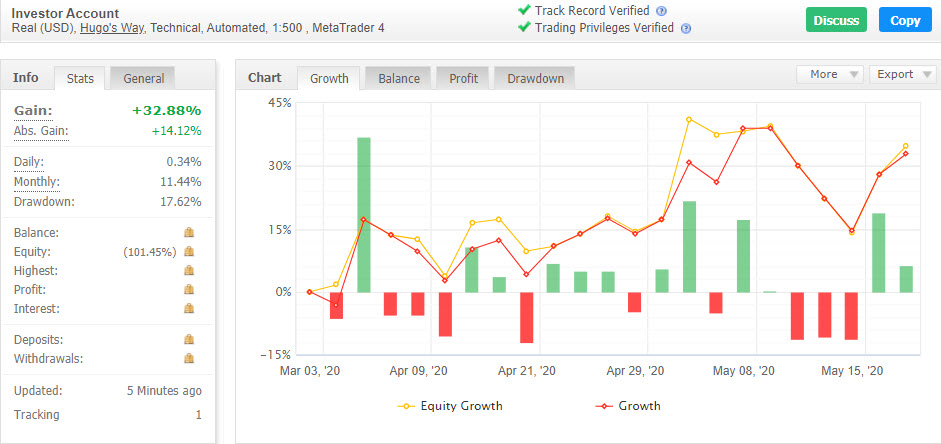

Performance for Ultima Renters from March 2020

From March 2020 onward, there is also the possibility of renting the Ultima EA. Although the performance will vary from trader to trader depending on:

- When they started

- What currency they trade

- What time frame they trade

- What broker they use (performance difference in the short-run)

- What risk percentage they use

That said, we are monitoring the account of 1 of the renters. They are only trading EUR/USD 15min with 5% risk per setup from March 2020.

This trader is currently ahead 32.8% after +13.4% in March, +3.2% in April, and +13% in May (so far). Pretty good performance. Especially when comparing it to a draw-down of only 17.6%. The performance is also striking when taking into account that they missed the massive wins in February 2020.

Prominent Updates for Ultima EA Renters

Ultima EA renters will benefit from 3 enhancements developed by Mislav Nikolic.

- VPS. Mislav purchased software for not just monitoring all MT4 clients, but it will also automatically handle any issue. There are always issues with connections so uptime will be practically 100%, which they can never achieve on your own.

- Licensing improvements. From now on, you can reinstall the EA in a very simple way. Also, it is now easier to use the EA on a different account.

- There will be just 1 key for 15 min and 1h and both demo and live versions.

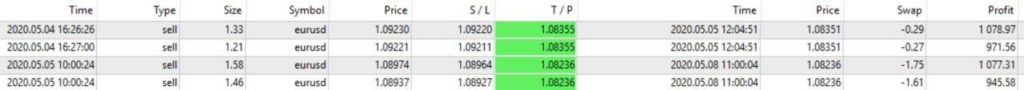

Most Prominent Trade Setups in May 2020

The best trades were arguably from the beginning of May 2020. There were 4 wins in a row that closed nicely at the 1.0825 zone.

Accepting Draw-downs

Draw-down is a sensitive topic for all traders and investors. This is understandable because drawdowns heavily impact a trader’s psychology. Most traders underestimate their tolerance for draw-downs. It shows why traders need to be prepared before these streaks happen.

These difficulties with trading psychology occur with both manual and automated trading. We must be able to deal with trading streaks and taking risks while not losing our nerves. Here are 3 solutions:

-

-

- Evaluate performance after long periods of time

Judging a system performance after a few trades or weeks is too premature to make any conclusion. It is vital to review the long-term statistics to make an accurate assessment. If a trader looks at small periods of time to evaluate the performance, they will most likely be unable to focus on the long-term edge. What is long-term? For Ultima EA, at the very minimum after 6 months. We prefer a year. For manual trading, you want to at least evaluate monthly and quarterly performance. - Trade with risk capital that you can afford to lose

Traders should always risk capital that they can afford to lose. Otherwise they will become too nervous with each trade and each winning or losing streak. The Ultima EA trades with 5% risk which is high. A small losing streak can create a draw-down. But the Ultima EA can trade with high risk because the expected losing streak is small and that allows us to aim at high profit targets. Traders need to choose a level of risk capital that they can afford to lose, which in turn allows them to stay calm during the ups and downs and allows them to see the long-term picture. The best is not to get attached to any trade or any winning or losing streak.

- Risk and trade with profits

As soon as you can, try to trade with the profits made rather than risking your own savings and capital. Of course, traders who just start cannot do that. But as soon as you have made some decent profits, you can use this tactic like Nenad, Mislav, and Chris do.

- Evaluate performance after long periods of time

-

Read more about draw-downs in our article “Living Through a Draw-Down is a Critical Skill for Traders”.

Long-term Performance Results

The long-term performance remains strong as time goes by. Our first account is now running for a full year. Our other 3 accounts are trading for 10 months.

The draw-down in May did send our performance downwards for a few days. But it’s important to keep in mind that the draw-down was from gains made earlier in May.

The accounts have made a nice bounce back up as well. So far, May is showing a modest but nice gain. One week in May is still remaining before the final result is known.

Here below is an overview of all 3 EUR/USD accounts. Please keep in mind that this update does not include the GBP/USD 60 min which is slower paced and currently stands at about break even.

EUR/USD 15 min 5% risk with start in August 2019

EUR/USD 15 min 5% risk with start in August 2019

EUR/USD 15 min 3% risk with start in June 2019

Interested in joining the Ultima EA?

Check out the Ultima EA page for more details.

Good trading,

Chris Svorcik & Mislav Nikolic

Leave a Reply