Tumultuous Week That Ends Well (so far) for Our Most Loyal Clients

How to begging better, this week, we took a step back and four steps forward. Unfortunately, the way people invest in our trading will not always allow them to tap into what we are brewing here (don’t need to go far, just look at the last couple of negative reviews).

The thing is, we take risks, oftentimes, don’t stop trading some assets when we do others, when decisions like this are made, sometimes, the risk management book goes off the drain, and we need to act here and now.

This is what happened over the past four days, a week that saw a Crypto crash (FTX demise), a Gold spike, and a colder-than-expected CPI report.

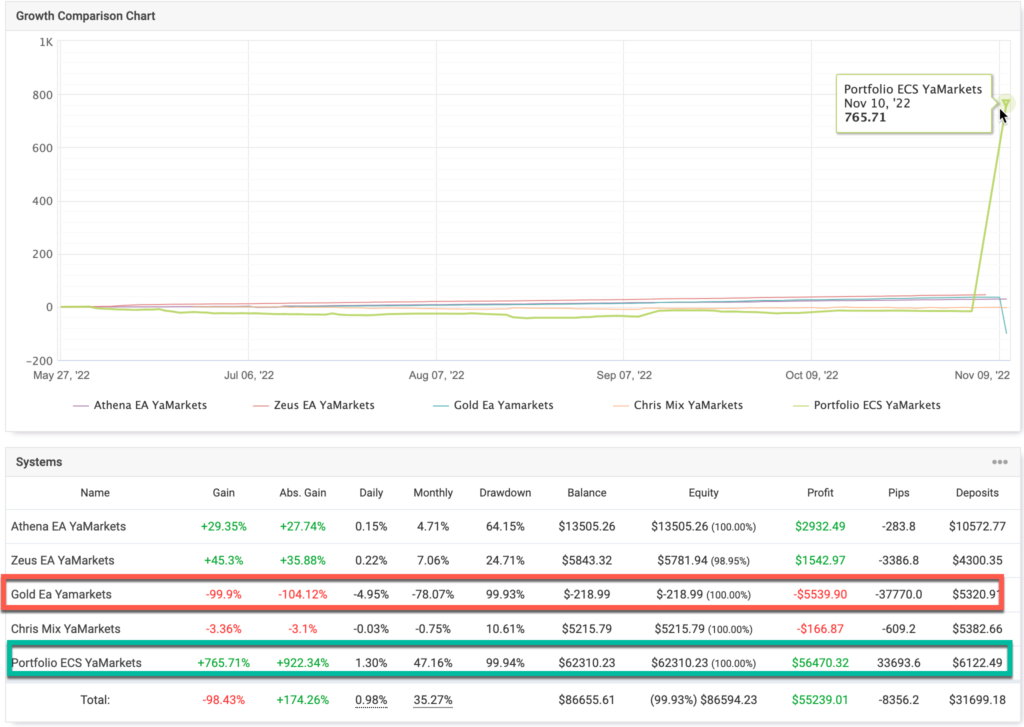

| Account | Pairs | 7 Day Performance (%) | 7 Day Performance ($) | All Time |

| Portfolio ECS KTM (non-grid) | Gold, EUR/USD | – 90% | – $2,9k | – 99% |

| Zeus EA KTM (grid) | Gold | – 87% | – $3,8k | – 82% |

| Zeus EA Gold RannForex (grid) | Gold | – 95% | – $1,7k | – 99% |

| Zeus EA Yamarkets Gold (grid) | Gold | – 99% | – $5k | – 99% |

| Athena EA (grid) | EUR/USD | 5% | +$850 | + 340% |

| Portfolio ECS RannForex (Discretionary) | multi-asset | 0% | $0 (no trades taken due to bad fills) | +19% |

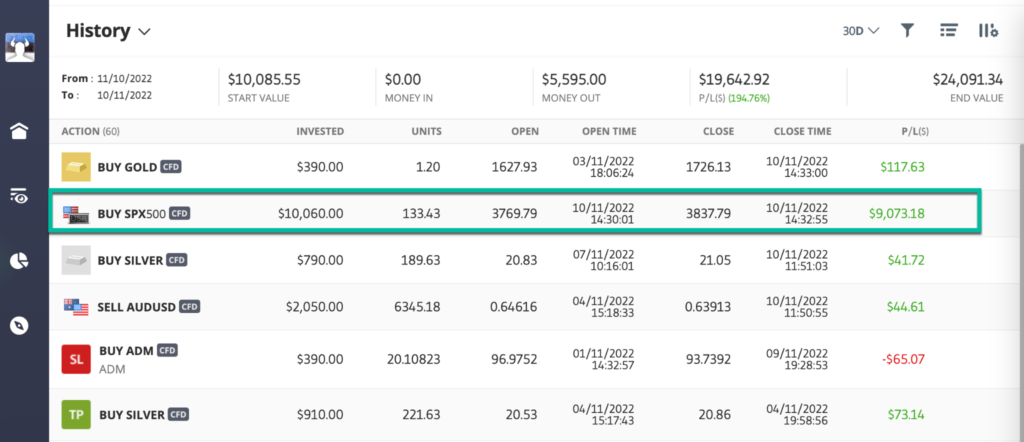

| Portfolio ECS Yamarkets (Discretionary) | multi-asset | + 928% | + $56.5k | + 765% |

| Portfolio ECS Exness (Discretionary) | multi-asset | +20% | + $1,2k | +11% |

| Portfolio ECS Etoro (Personal) | multi-asset | + 200% | + $9,5k | + 790% |

| Total (absolute) | ≈ + 760% | + $52.6k | + 1,210% |

Not all wins can make up for the burned out accounts, especially when retail clients come in and out at different periods, and a 1,000% growth over two years means nothing if your account has burnt along the way.

That is the frustration that we had to deal with when hearing from some of the clients and the reason we urge everyone to invest in all approaches, the PAMM option makes it affordable for the lack of cost for expenses EAs.

We still offer individual EAs like Athena EA, Zeus EA, and soon-to-be-released several other EAs, for that is how some traders prefer to speculate, but to make the job easier for us, we strongly advise your to consider the 0$ upfront cost model and equally dividing your investment among all of our active accounts.

Now, let’s see what exactly happened with each strategy.

The Good

YaMarkets

The broker was among the first institutional clients we onboarded this summer, and it seems like the first serious profit-taking event has arrived upon them.

Despite a bittersweet dissolution of Zeus EA Gold (Gold EA on screenshot) account, the Portfolio ECS (discretionary flagship) has caught the CPI-related moves today and registered one of the biggest single trades take profits (safely protected by a stop loss) to date.

eToro Personal

Earlier in October, we mentioned that to replicate Portfolio ECS (flagship discretionary) trading, the best route is to invest with either one of RannForex or Yamarkets.

At the time, we advised RannForex, but unfortunately, today, when the most profit-taking occurred, the trade has not registered, and therefore, only eToro clients (non-pamm, requires pro status) and Yamarkets have seen the biggest gains.

We are setting more time aside to make sure more retail clients can tap into similar opportunities, for those of you who did benefit, thanks for going to the longer route and trusting us with your funds.

The Bad

Missing an opportunity we have caught with Yamarkets Portfolio (discretionary) with RannForex for a reason of bad fill on the broker side, we are investigating this.

In the meantime, ready to onboard clients to the same approach with VT Markets and Exness and looking for two more brokers to diversify the risk.

Please reach out to us if you have an interest in similar exposure.

The Ugly

Our two gold heave EA-driven accounts with KTM, Zeus EA KTM PAMM & Portfolio ECS PAMM have basically been evaporated.

Mostly traded with our own funds, we allowed the EAs to run the game, but the gold had other plans, and we have not tamed the markets through manual intervention.

The risk was calculated based on the relatively small exposure of the overall portfolio of accounts. We are planning to continue trading GOLD-related EAs after recuperating losses.

This being said, some of the individual investors will not be pleased, and we fully understand the frustration, but as a money management firm, we are looking at the total portfolio at our disposal (therefore so strongly advocate for investing funds equally in all methods to gain institutional-grade exposure).

Overview

Before jumping to the key points, if you are still reading this, please consider what we said (and will keep saying) about putting funds in all of our active approaches equally. If your deposit is on the lower side, reach out, and we will try to make an exception to fit you in on a limited budget.

Now, back to the next steps for ECS:

- To improve EA trading, a lot of work has to be put into risk management (especially on an automated side), as the markets don’t seem to subside in volatility.

- We will protect the profits in November and reinvest it into better trading facilities and money management teams (the guys will be getting nice bonuses this month from the institutional side).

- We will work on helping retail clients to mimic the results we are reaching with eToro and institutional brokers by a more tailored approach to work with each individual client.

- More work on the freemium model, like the ecs.LIVE telegram channel

Leave a Reply