Trading Results Overview – September 2021

Dear Traders,

Elite CurrenSea is proud to announce and present its best method yet: ECS Portfolio. From now on, the ECS Portfolio performance will be added to each monthly performance overview.

This article will review all the other systems as well, including ECS Zeus EA, ECS SWAT, ecs.LIVE, and Options.

P.S. If you are interested in knowing more about the ECS Portfolio method, feel free to

Summary of All Systems in September 2021

There was another positive month in September 2021. This makes it the 6th positive month of the last 8 months. See the table below for the full overview.

| System |

Performance

|

Draw-down

|

Total running performance |

| ECS Portfolio | +16.0% | 7.1% | +25.0% |

| EC Zeus EA (PAMM) | +1.7% | 1.4% | +63.7% |

| ZEA Retail Rental (€2.5k per account) |

+0.3%* | 0.04% | +89.4% |

| ecsLIVE | +5.9% | 2.79% | +61.18% |

| ECS SWAT EA | -2.8% | 10.1% | +44.68% |

| Options | -2.8% | – | +11.97% (from 04.2021) |

| Total Last 8 Months | +123.9% | – | – |

| Total September 2021 | +18.3% | Total May 2021 | +2.52% |

| Total August 2021 | +16.35% | Total April 2021 | -49.69% |

| Total July 2021 | -14.74% | Total March 2021 | +20.5% |

| Total June 2021 | +17.97% | Total Feb 2021 | +108.6% |

* Trading was halted large part of the month for maintenance reasons

ECS Portfolio

Elite CurrenSea is now officially sharing our newest, all-round approach called ECS Portfolio. It is replacing the EAs from Mislav Nikolic at Bull Capital, which have been removed from ECS due to strong volatility and weaker performance. Because we are not trading Ultima nor Rush with our own capital, we will not be adding them in the performance overview from September 2021 onward.

ECS Portfolio is a fully managed trading account by Elite CurrenSea (no action needed from the investor):

- It is a mixture of technical analysis, fundamental analysis, and news events.

- It uses semi-automated and automated systems.

- We have been trading the underlying strategies for 2 years with a total gain of +340%.

- The combined account has a live track record since June 2021.

We have explained everything that you need to know in our newest article, including how to join (no costs to join). Or you can also view the video with a full overview about ECS Portfolio.

So far, the ECS Portfolio account is off to a great start with +25% gains. September is the best month so far with +16%. The win rate was a little lower than usual but this is an exception. The reward to risk, however, compensated that more than enough.

| Performance ECS Portfolio | +16.0% |

| Total performance | +25.0% |

| Win Rate | 56% |

| Reward-To-Risk | 2 : 1 |

| Draw-Down | 7.1% |

| Net Pips | +3.7k |

Zeus EA

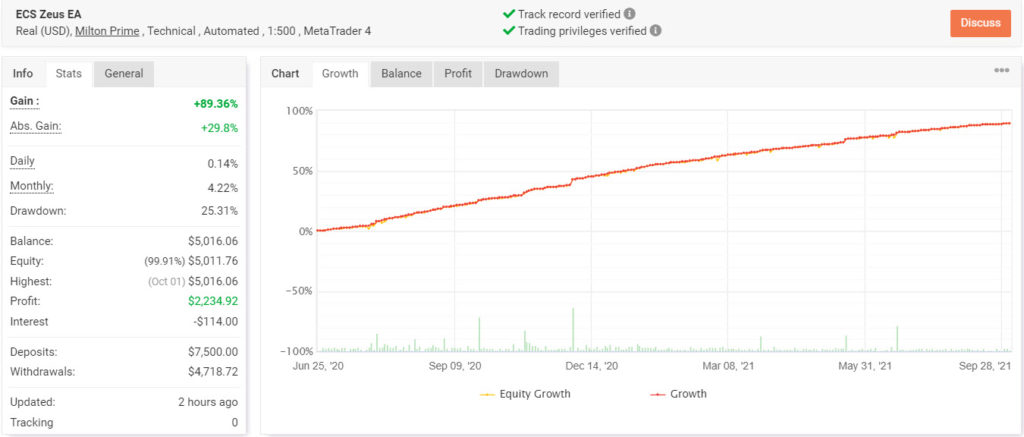

The Zeus EA had a slower month in September with +1.72% gains. The EUR/USD was a bit more impulsive and less choppy than usual, especially in the last week of September. This created less trades and profits than usual.

That said, it was yet another winning month for ECS Zeus. So far, we had zero losing months. There are two main options if you want to join the Zeus EA.

- One of them is to join the profit share module via our managed Zeus EA account. The managed account is free of any upfront costs but traders pay 20-25% of the profits.

- The other one is to rent the EA for a month or year. The rental is free of profit share but does come at a rental fee.

| Performance PAMM Zeus EA | +1.72% |

| Total performance | +63.7% |

| Win Rate | 66% |

| Reward-To-Risk | 0.85 |

| Draw-Down | 1.4% |

| Net Pips | -3k |

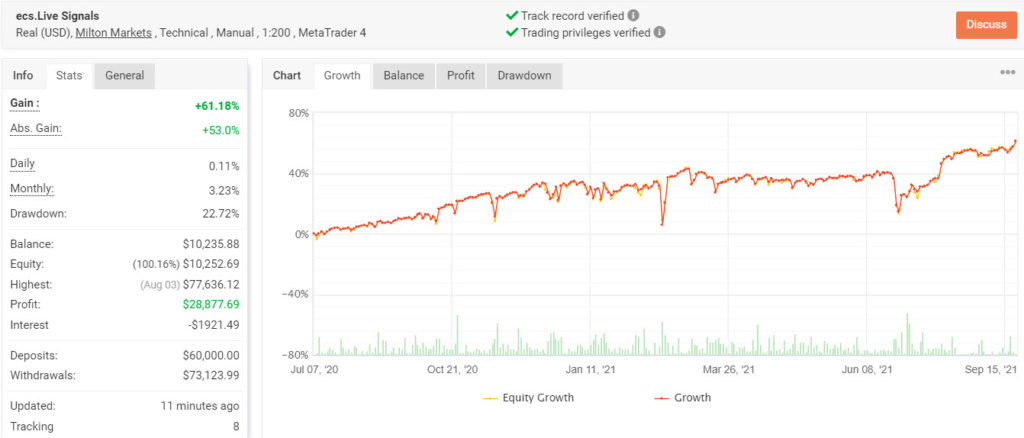

The Black Widow signals on ecs.LIVE from Nenad Kerkez made a good gain in September 2021. A profit of almost 6% was booked on his account.

The positive month pushed the account to an all-time high again. The lower than usual reward to risk ratio was more than compensated by the high win rate.

| Performance | +5.98% |

| Total performance | +61.18% |

| Win Rate | 81% |

| Reward-To-Risk | 0.44 |

| Draw-Down | 2.79% |

| Net Pips | +6.5k |

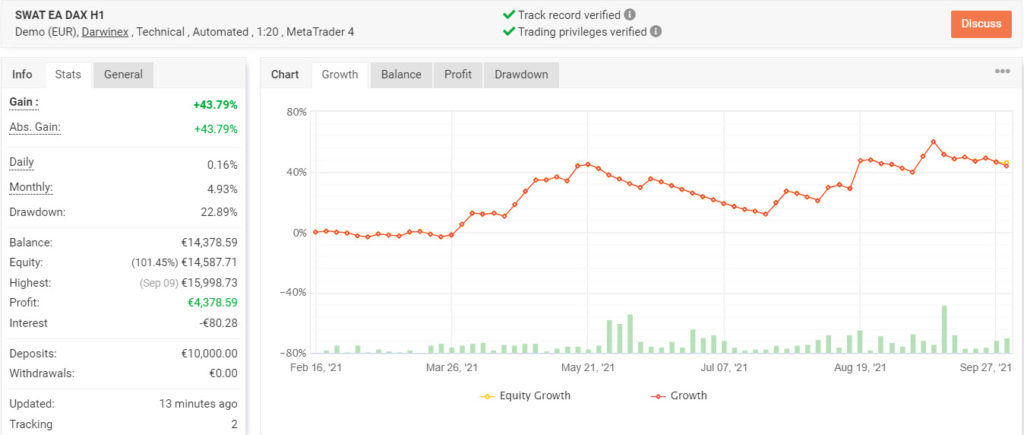

SWAT EA

The SWAT EA from Chris Svorcik is still in a testing phase but the overall performance has been pretty decent. The EUR/USD performance is just above break-even but the DAX shows a strong gain.

| SWAT EA | EUR/USD 1H | DAX 1H |

| Performance | -1.98% | -0.84% |

| Total performance | +2.69% | +43.8% |

| Win Rate | 36% | 31% |

| Reward-To-Risk | 1.2 : 1 | 2.14 : 1 |

| Draw-Down | 4.5% | 10.1% |

| Net Pips | -38 | +139 |

Options Trading

Are the bulls defeated? September opened with a new high on S&P 500… But then the market went into a retracement phase that continues to this day.

There are many reasons that generated this weakness in the market – just to name a few:

- The idea that inflation will not be as temporary as the Fed wanted us to believe.

- The announcement that tapering will start in November.

- The crisis of the giant Evergrande which could also have repercussions on this side of the ocean.

Contrary to what we had been used to in recent months, the market rebounded slightly but without much conviction after the sell-off in the middle of month.

On the contrary, after the rebound and failing to gain the lost ground; the descent began again… It almost retested the previous lows during the last day of the month.

Is the wind blowing from the March 2020 crisis turning? We will see in the next few weeks.

As regards our Options educational service, September was perhaps the most difficult month to manage after March 2020. The sudden and large movements of the market have created few opportunities and many counter-trend situations. This has highlighted weak stocks that still failed to restart and very strong stocks that remained overbought despite the weakness of the market.

The occasions evaluated as the best were all Call trades, in total six. Two closed in profit and the remaining in loss even if lower than the technical stop, due to an evident weakness that generated early exit conditions.

| Performance | -2.8% |

| Performance since 04.2021 | +11.97% |

| Win rate | 33% |

| Reward to risk | 0 |

| Draw-Down/Loss | -4.4% |

Check out our option strategies from options expert Marco Doni !

Or join ECS Portfolio as a fully managed trading account by Elite CurrenSea (no action needed from the investor).

Thanks and good trading,

Carlos Cordero

Marco Doni

Nenad Kerkez

Chris Svorcik

ECS team

Leave a Reply