Trading Results Overview – May 2021

Dear Traders,

the month of May ended up at a small profit of +2.52%. The winning systems included Zeus EA, ecsLIVE, the SWAT EA total, and the options signals. On the losing end were the Ultima EA and Rush EA from Mislav Nikolic.

Let’s review all of the trading systems in total and then one by one.

Summary of All Systems in April 2021

Here is a summary of all the trading systems and their performance in May 2021:

| System | Performance May 2021 |

Draw-down May 2021 |

Total running performance (31.05.2021) |

| Zeus EA 1 (PAMM) | +3.33% | 1.06% | +48.95% |

| ZEA Retail Rental (€2.5k per account) |

+3.62% | 1.78% | +77.5% |

| SWAT EA EUR/USD 1H | -8.4% | 17.02% | +5.09% |

| SWAT EA DAX 1H | +22.3% | 6.79% | +35.13% |

| SWAT EA DAX 15M | -2.85% | 5.96% | -13.18% |

| ecsLIVE | +6.25% | 3.28% | +35.28% |

| Ultima EA (Bull Capital) | -8.43% | 19.29% | -14.68% (4.2020) +531.66% (8.2019) |

| Rush EA (Bull Capital) | -5.9% | 33.22% | -45.11% |

| Options | +0.82% | – | +9.22% |

| Total Last 4 Months | +86.43% | – | – |

| Total May 2021 | +9.97% | ||

| Total April 2021 | -49.69% | – | – |

| Total March 2021 | +20.5% | – | – |

| Total Feb 2021 | +108.6% | – | – |

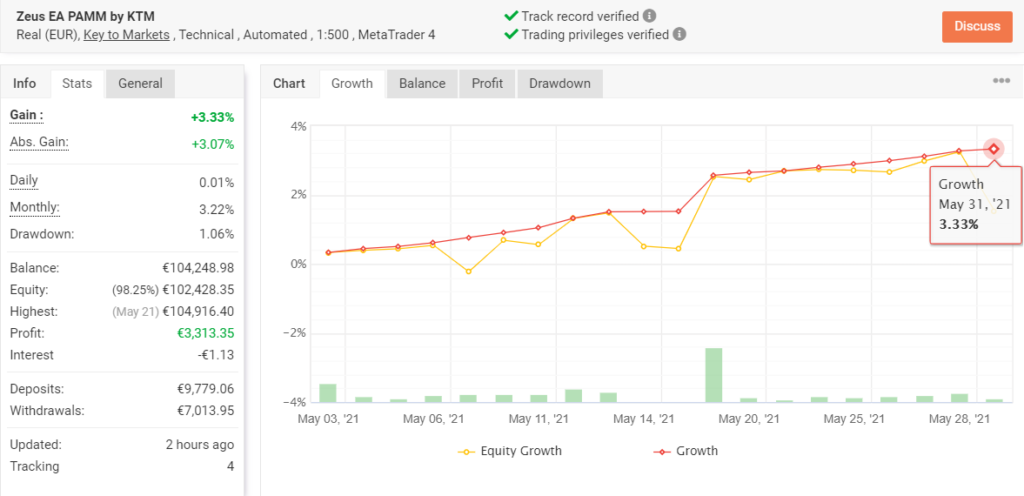

Zeus EA

The Zeus EA was again trading as a sturdy rock in stormy sea. Steady as it goes. Another profitable month means that Zeus EA is yet to have a losing month since we started live trading the trading system.

There are two main options if you want to join the Zeus EA. One of them is to join the profit share module via our managed Zeus EA account. The other one is to rent the EA for a month or year. The managed account is free of any upfront costs but traders pay 20-25% of the profits. The rental is free of profit share but does come at a rental fee.

| Performance PAMM Zeus EA | +3.33% |

| Total performance | +48.95% |

| Win Rate | 68% |

| Reward-To-Risk | 0.67 |

| Draw-Down | 1.06% |

| Net Pips | -8.4k |

What’s the main take?

The Zeus EA managed to gain +3.3 to +3.6% of profits in May with both of our accounts. Both Zeus EA accounts (first and second) remain consistent month after month. The totals are reaching +50-75% of profits since we started in 2020.

Live Webinar Discusses the Performance

Feel free to also check out the webinar recording of our live webinar. Here we discuss the performance in May 2021.

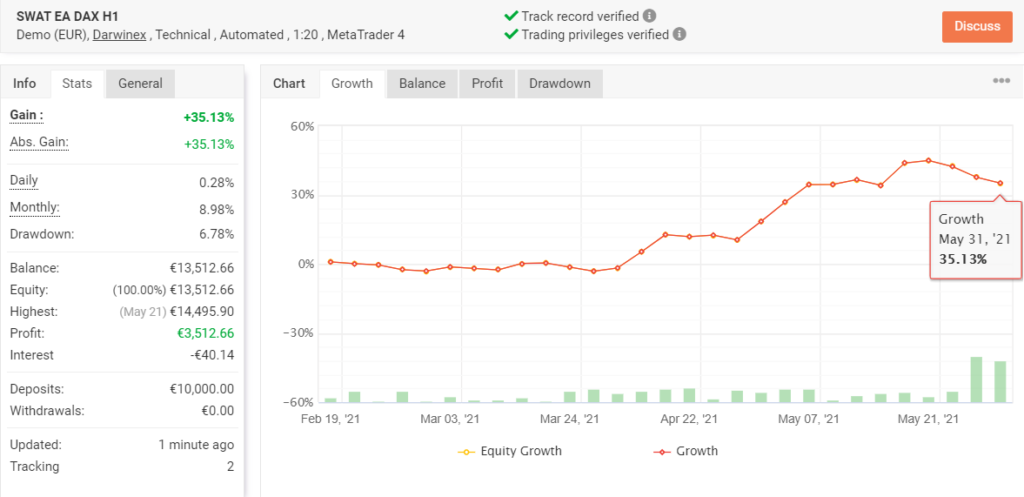

SWAT EA

The SWAT EA in total is showing about +37% of profits in its first 3.5 months of trading. The EUR/USD 1 hour chart had a great start but a sturdy draw-down is eating away its gains.

On the other hand, the DAX 1H trading has shown sturdy gains in May 2021. In fact, last month was the best month for this instrument. A gain of more than +20% pushed the total profitability above +35%.

| SWAT EA | EUR/USD 1H | DAX 1H | DAX 15M |

| Performance | -8.4% | +22.3% | -2.85% |

| Total performance | +5.09% | +35.13% | -13.18% |

| Win Rate | 23% | 53% | 28% |

| Reward-To-Risk | 1.2 : 1 | 2.4 : 1 | 2.1 : 1 |

| Draw-Down | 17.02% | 6.79% | 5.96% |

| Net Pips | -201 | +1678.5 | +83 |

What’s the main take?

So far so good. The results are looking promising in the first 3.5 months of live trading. We will now move on phase 2: real live trading with our own capital and not just a demo account.

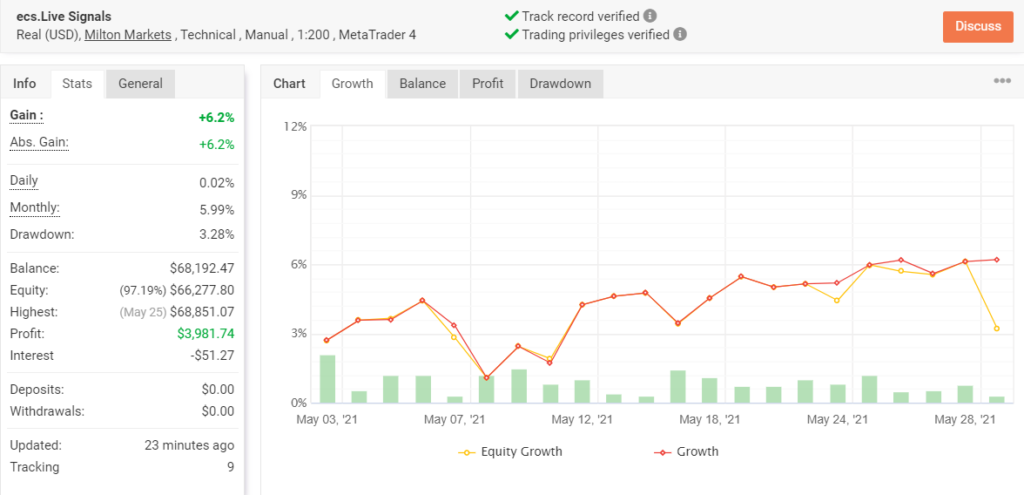

ecs.LIVE (by cammacd.BlackWidow)

The Black Widow signals on ecs.LIVE were back on track in May 2021. With a gain of +6.25%, traders were able to see decent profits in combination with a high win rate of almost 75%.

| Performance | +6.25% |

| Total performance | +35.28% |

| Win Rate | 74% |

| Reward-To-Risk | 0.5 |

| Draw-Down | 3.28% |

| Net Pips | +1662 |

What’s the main take?

The ecs.LIVE service had a steady performance in May 2021 with little surprises. There were no major draw-downs and the account mostly saw a positive slope throughout the entire month. The ecsLIVE service is our main manual signal approach, together with the Options signals.

Ultima EA

The Ultima EA from Mislav Nikolic can now be rented as a bundle of 3 trading systems. Included in the bundle are the trading systems the Ultima on the EUR/USD 15 minute, Ultima Pro on GBP/USD 60 minute, and Rush EA on EUR/USD 5 minute.

The Ultima EA itself is showing a weaker performance in the 2nd quarter of 2021. The first quarter of 2021 started with a good performance of more than 50% using less risk than in 2020 (3% risk per setup rather than 5%). But April and May 2021 were showing losses. May ended up at -8.4%.

| Performance end of May 2021 | -8.43% (3% risk per setup) |

| Total performance end of May 2021 | -17.88% (4.2020) +531.66% (8.2019) |

| Win Rate | 42% |

| Reward-To-Risk | 1.2 : 1 |

| Draw-Down | 19.29% |

| Net Pips | -72.6 |

What’s the main take?

Although Ultima EA had two losing months in a row, the entire year of 2021 is still ahead +16% in total. The month of June will determine whether the entire 2nd quarter will end up in a loss or if the system can still close in positive territory.

Rush EA

The Rush EA from Mislav Nikolic has been added to the Ultima EA bundle. The performance on our account has been weaker than performance on Mislav’s account, who had +12.47% in May 2021 and +88.7% in total.

| Performance | -5.9% |

| Total performance | -45.11% |

| Win Rate | 43% |

| Reward-To-Risk | 1.13 : 1 |

| Draw-Down | 33.22% |

| Net Pips | +66.4 |

What’s the main take?

Two weeks again, an important change occured: all setups are copied from Mislav’s main account so now larger gap should occur between Elite CurrenSea and Mislav ‘s performance.

Options Trading

Interlocutory May. After starting the month with a new S&P500’s record, Wall Street began a reversal phase that resulted in a drop of about 6.5%. From this low point, the market has restarted its uptrend again but without a decisive push. The S&R seems to have stabilized around the $ 4200 area.

The retracement phase following the high of the beginning of the month gave us the opportunity of some entries in the counter trend direction with good results. On the other hand, the opportunities were limited as the retracement was short.

Our trades were equally split between Call and Put entries with an average profit of 3%, however two positions have not yet closed, making this figure provisional.

| Performance | +0.82% |

| Performance since 04.2021 | +9.22% |

| Win rate | 50% |

| Reward to risk | 1.64 : 1 |

| Draw-Down/Loss | 1.68% |

What’s the main take?

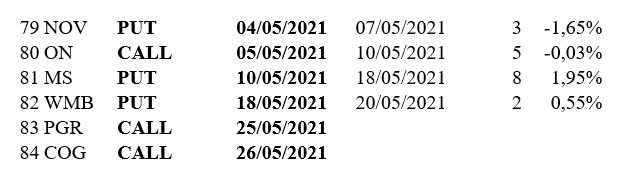

Here are the Options trading ideas in May 2021:

Check out our option strategies from options expert Marco Doni !

Thanks and good trading,

Carlos Cordero

Mislav Nikolic

Marco Doni

Nenad Kerkez

Chris Svorcik

ECS team

Leave a Reply