🔥 Trade the London Open Automatically on EUR/AUD and Bitcoin 🔥

Dear Traders,

Elite CurrenSea is offering a new and updated EA of the London Open Advanced (LOA). The LOA.EA is a CAMMACD system from Nenad Kerkez and has already been offered for years on our website as an EA.

But thanks to our friend and programmer Carlos Cordero, the LOA.EA results have been improved and now offer more than a decade (!) of back-testing. This article explains what traders can expect from the LOA.EA, the historical back-testing from 2010-2020, and the ongoing live trading.

More importantly, you will learn how traders can trade the EA on the Forex market (EUR/AUD pair) and on the cryptocurrency market (Bitcoin (XBT/USD)).

Ps. feel free to join the live webinar as well on Monday 5 October 2020 at 4pm GMT.

London Open Advanced (LOA) EA Explained

The LOA.EA is created by Nenad Kerkez as part of his full ecs.CAMMACD course. Our friend and programmer Carlos Cordero refined the rules and enhanced the system.

The London Open Advanced trading system is based on a breakout strategy during the London open of the trading day. Therefore, there is about one trade setup per day on average per instrument.

Two instruments have stood out above the rest. Carlos tested the LOA on several instruments but two of them showed the best results:

- EUR/AUD

Back-tested for 10.5 years. The test starts in January 2010 and ends a decade later in July 2020. The average monthly performance was +5.73% per month. - BTC/USD via XBTUSD (trading Bitcoin with 8:1 leverage)

Back-tested for almost 3.5 years. The test starts in May 2017 and ends almost 3.5 years later in September 2020. The average monthly performance was +6.64% per month.

LOA.EA Back-Testing Results with EUR/AUD

Although 5.7% per month is not that high for Forex & CFD trading with leverage standards, traders should keep in mind the following aspects:

- Tested for 10 years indicates its longevity

- Draw-down was small with a maximum draw-down of 35% during the 10 years

- 67% of the months ended up with profits

- The remaining losing months (33%) saw 62% end up with smaller losses (5% or less) and only 38% of the months with more than 5% loss (12.7% of the months lost more than 5% of the total)

- The worst one monthly result was -21.39% in April 2017.

- The best one monthly result was +63.47%.

- Almost 50% of the entire back-test ended up with +5% gains or more.

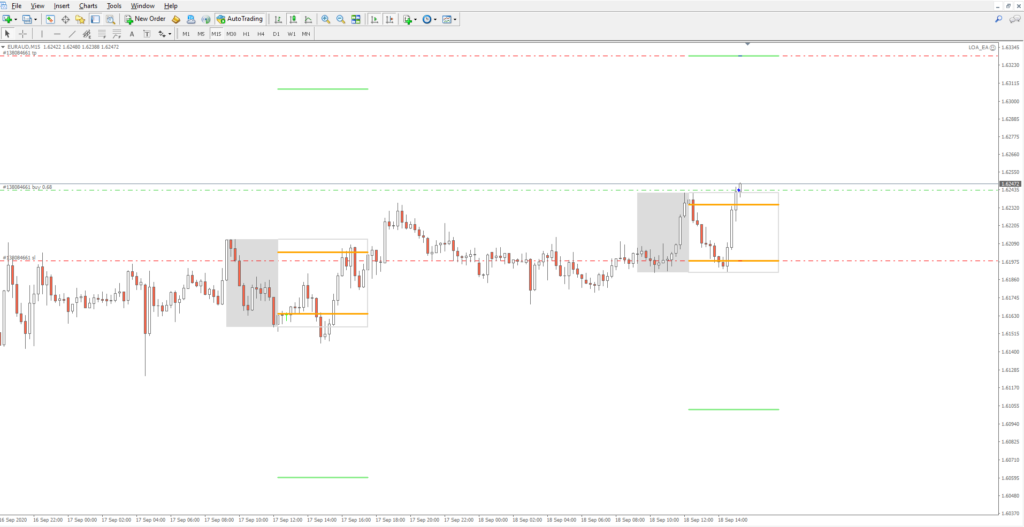

The image below shows the results during our 10.5 year test.

The LOA.EA has a somewhat lower profit factor than other EAs, but this compensated by other favourable statistics:

- Win rate 45.5% with average reward to risk ratio of 1.55 : 1

- Short average trade length of just under 18 hours

- A total of 2,400 + trades – sufficient data to properly test the system

- Very low chance of losing the entire account, hence low risk EA

LOA.EA Decade’s Back-Testing from 2010 to 2020 on EUR/AUD

The LOA.EA was tested on multiple currency pairs and with multiple risk settings. The best results were achieved on the EUR/AUD and 1 pip spread and Bitcoin (next paragraph). Other currency pairs mostly had positive results but the EUR/AUD and Bitcoin outperformed the others.

The back-testing shown in this LOA EA myfxbook link summarizes the results while trading the EUR/AUD with 2% risk and 1 pip spread. Keep in mind that trading with a higher spread will worsen the overall expected result in the long run.

The average expected gain per month is +5.73% when trading with 2% risk per setup. Some years are better than others. Here is a summary of their results:

| Year | Yearly results | Quarterly results |

| 2020 | +59.77% (Jan – Jul 2020) | all 2 quarters were positive |

| 2019 | +5.81% | 3 out of 4 quarters were positive / negative quarter was -18.03% |

| 2018 | +80.48% | all 4 quarters were positive |

| 2017 | +68.56% | 3 out of 4 quarters were positive / negative quarter was -5.49% |

| 2016 | +81.42% | 3 out of 4 quarters were positive / negative quarter was -1.86% |

| 2015 | +26.6% | 3 out of 4 quarters were positive / negative quarter was -7.16% |

| 2014 | +10.25% | 2 out of 4 quarters were positive / negative quarters were -3.51% & -9.49% |

| 2013 | +60.01% | 3 out of 4 quarters were positive / negative quarter was -2.64% |

| 2012 | +247.53% | all 4 quarters were positive |

| 2011 | +94.08% | 3 out of 4 quarters were positive / negative quarter was -5.26% |

| 2010 | +106.28% | all 4 quarters were positive |

As you can see from the table above, there were only 8 quarters negative out of a total of 42. This means that 80% of the quarters ended up positive and only 20% negative.

There were 3 full years that only had positive quarters. The year 2020 is also off to a good start with 2 out of 2 being positive.

Out of the 8 negative quarters, only one quarter lost more than 10% with a loss of -18.03% with an average loss of -6.68% if there was a losing month.

Eight out of 11 years are ahead +/-60% or more (including the 2020 year so far with +59%).

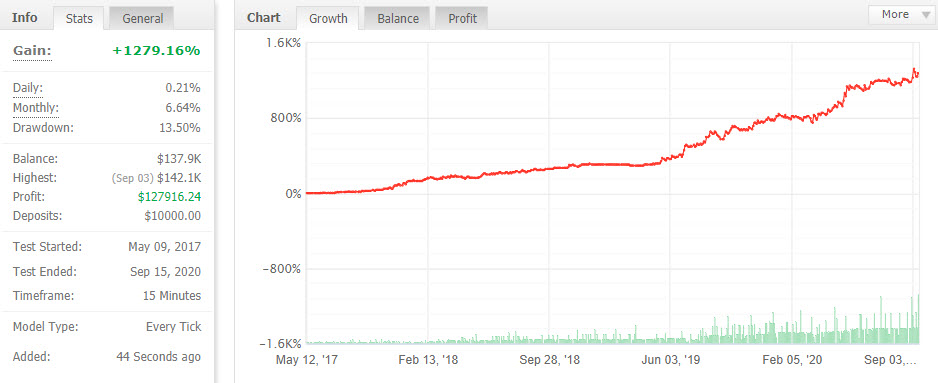

LOA.EA Back-Testing Results with Bitcoin

Our demo and live trading with Bitcoin has been still limited, which is why we are still waiting for the final green light before traders can trade with it themselves on a live account. Trading it on a demo account, however, is fine. The back-testing has shown very interesting results so far.

Trading Bitcoin via XTB/USD managed to get +6.64% per month but much less draw-down. Here is a full overview:

- Tested for almost 3.5 years.

- Draw-down was small with a maximum draw-down of just 13.5%

- 90.2% of the months ended up with profits

- The remaining losing months (9.8%) saw 100% end up with smaller losses (5% or less) and none (0%) of the months with more than 5% loss

- The worst one monthly result was -4.93%.

- The best one monthly result was +32.92%.

- 48.8% of the entire back-test ended up with +5% gains or more.

The image below shows the results during our 3.5 year test.

Here are the main stats for the LOA.EA with Bitcoin:

- High profit factor of 1.61 (!)

- Win rate 40.5% with average reward to risk ratio of 2.37 : 1

- Short average trade length of 1 day

- A total of 655 trades

- Very low chance of losing the entire account, hence low risk EA (risk of ruin is only 6.52% chance to lose 10%, 0.31% chance for -20%, 0.1% chance of losing 30% and less than 0.01% for losing 40% or more)

LOA.EA Decade’s Back-Testing on Bitcoin

The back-testing shown in this LOA EA myfxbook link summarizes the results while trading the Bitcoin (XBT/USD) with 2% risk, maximum of 8:1 leverage and 50 pip spread. Keep in mind that trading with a higher spread will worsen the overall expected result in the long run.

The average expected gain per month is +6.28% when trading with 2.5% risk per setup. Here is a summary of their results:

| Year | Yearly results | Quarterly results |

| 2020 | 48.15% (Jan – Sep 2020) | all quarters were positive (till mid Sep 2020) |

| 2019 | 82.17% | 3 out of 4 quarters were positive / negative quarter was -4.63% |

| 2018 | 63.28% | all 4 quarters were positive |

| 2017 | 89.41% (May – Dec 2017) | all 4 quarters were positive |

As you can see from the table above, there was only 1 quarter negative out of a total of 15.

LOA.EA Live Trading

Yes, we are trading the trading system with 2 live accounts on the EUR/AUD but only for 2-3 months now. We will be adding the Bitcoin pair after sufficient demo testing has been completed.

Considering the slower nature of this EA, the real accounts will only see some decent growth in a year’s time. The main reason why we are trading it ourselves is because of the lengthy quality back-testing that was completed.

Here are the two LOA.EA trading accounts on myfxbook:

How to Start Trading the LOA.EA

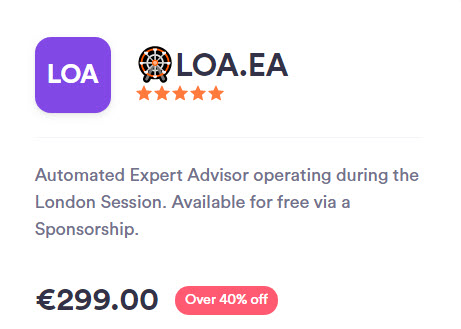

The LOA.EA can either be purchased with a 40% discount for 299 euro rather than 499 euro. Or traders can receive it for free if they sign-up via one of our partnered brokers via the Elite CurrenSea page.

Here is a summary of the choices:

As LOA.EA member, you will receive two indicators:

- The LOA.EA itself which determines the automated trading

- The LOA indicator which plots the exits (stop loss and targets) on the chart so traders can see the key levels

- The LOA EA guide how to start trading

For more information about the LOA.EA, do not forget that we are hosting a live webinar.

Join the live webinar on Monday 5 October at 4pm GMT

You can see the recording on our YouTube channel or via our ECS blog posts.

Good trading!

Leave a Reply