Portfolio ECS vs Traditional Investing: Future, Present, Past

The topic of ECS transformation into money management has been long in the making, but given the bumpy 2021 and 2022 start of the transition from “education & trading system” into automated trading and money management, kept us humble.

If the primary focus of the past two years – has been to protect a legacy, Nenad & Chris has helped us build, while also turning profit for the clients during this pivotal phase, now is the time to reap the benefits!

Let’s look at the latest result and see how you can tap into some of our best trading up to now.

What is Portfolio ECS?

In 2021 we first encouraged clients to join in on the idea of one managed account that uses multiple of our top-performing EAs simultaneously to diversify exposure to changing market dynamics at the time. Given that we already had the proven software (expert advisors), trading chops, and confidence, the idea of combining all of it under one account and offering it to all clients seemed like a no-brainer.

Unfortunately, having made two mistakes initially: picking the wrong custodian broker (that’s the story for another time), and prioritizing onboarding flexibility over our flexibility with trading, forced us to spread extra focus on user experience rather than taking extra risks with trading.

Consequently, we had to postpone the launch with retail clients and focus on trading our own funds, plus whatever the brokers were ready to invest in our idea.

Fortunately, the decision to focus on trading has paid off, and we are now here to “brag” about the results, hoping you can give this investment opportunity a shot.

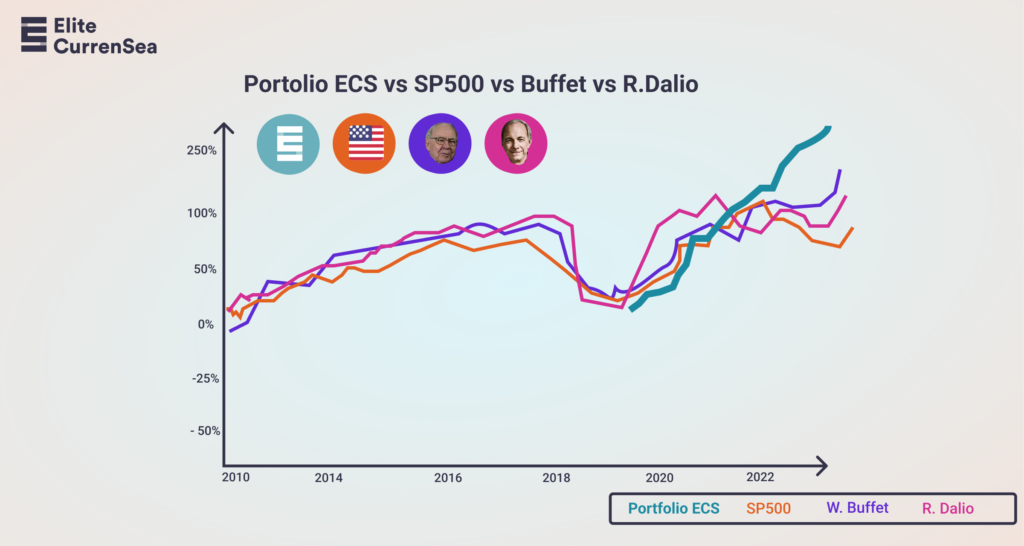

Below are the results for Portfolio ECS as compared to what we believe are some stellar opportunities of the past decade – where the conservative growth meets barely noticeable drawdowns and requires little to no involvement from the investor.

| Investment | Yearly ROI | Max DD | Pros | Cons | Final Word |

| Bridgewater (Ray Dalio) since 1994 | 17.8% | 6% (22% covid) |

|

|

Beast for multiplying existing capital, shielding against inflation. Despite its name, 2021 showed that it’s still prone to Black Swan events. Ray Dalio also called USD “trash” in 2021 – the year of its biggest growth. He’s retired since; hence, the change of leader presents a new uncertainty. |

| SP500 2012-2021 | 16% | 11% (35% covid) |

|

|

Quantitive Easing (QE) & Historically Low-Interest rates made it one of the best long-term investment strategies of the past decade. |

| Berkshire Hathaway (Warren Buffet) 2012-2021 | 15.6% | 9% (20% covid) |

|

|

On annualized returns basis should be good enough to beat inflation, especially if you let it compound, but it’s often time hard to emulate. Also, they are most likely to go through a leadership change. |

| SP500 (our forecast) 2022-2025 | 8% | 15% |

|

|

US Equities does not seem to offer as much growth in the following decade, on an annualized returns basis, but should be good enough to beat inflation, especially if you let it compound. |

| Portfolio ECS (after profit share) 2019-2022 | 84% | 15% |

|

|

Strives on high-impact news trading, thanks to high hit rate, extra volatility was a plus. Strict risk management allowed for dd never to exceed 15%. |

| Portfolio ECS (forecast after profit share) 2022-2024 | 95% | 20% |

|

|

Our flagship approach going forward. With uncertainty and likely 2023 recession (tradition markets down), more investment in trading infrastructure, higher profit expectations. |

| Portfolio + EAs (forecast after profit share) 2022-2024 | 120% | 25% |

|

|

Same as above + more automated accounts trading smaller accounts to also make profit on ranging markets and scalp day to day profits when the market is more stale. |

Since it’s our ambition to make riskier, leveraged trading gains affordable for normal people, as soon as we see profit share from retail matching the institutional, we will invest more time and effort in simplifying the workflows and reducing the fees.

Now, let’s look at each investment class separately.

SP500 2012-2022 16.6% Average Annual Growth

Investing in SP500 has possibly been one of the most effective decisions for a long-term investment since the pre-dot-com crash times.

The sheer amount of time (and nerves) an investor could have saved on amassing so much passive income is abnormal for passive Unfortunately, for the next 10 years, the results don’t might not turn out to be as promising.

You see, thanks to the years of Quantitative Easing, historically low interest rates, and generally, booming global economy (especially China), FAANG stocks (the heavy-weight champion of SP500) as well as other cheap-capital thirsty companies, has sent the index into the stratosphere (200% growth in 12 years).

But then… Covid pandemic, War in Ukraine, US balance sheet deleveraging (Quantitative Tightening in the US) China’s slowing down, all contributing to the a prospect of mild to the severe global recession and repercussions echoing for the years to come.

Taking this into account, our best bet is that even with all future growth, The SP500 index will probably return up to 8% yearly growth over the next decade the best Click To Tweet – which, don’t get us wrong, is still a very good (if not wishfull) result, quite likely, in fact, quite likely that most of the asset management firms will not be able to beat these numbers.

This of course, by no means, implies a lack of opportunities in equities; but one thing is clear – it should get harder to pick winning stocks.

Bridgewater & Berkshire Hathaway,

We would be lying if we said we don’t admire these two hedge firms, their results are often above SP500, and when things don’t got their way, it never deviates from the world’s biggest index.

Unfortunately, oftentimes, despite plethora of resources that help you to mimic the investments of Bridgewater and BH, following the guidance can still prove to be confusing.

In other words, the timing on some investment will not match yours, and sometimes it’s all that matters.

Don’t get us wrong, if you are looking at a 10-year time period, most of the “timing issue” should be marginalized, but some trades may still slip your attention, and even if they don’t, the time put into actively following these two firms (unlike Portfolio ECS 😉), will keep you busy digesting news and analyzing company fillings reports.

Why We are Excited About the Opportunities

As you can see from the table above, since we started discretionary trading with Portfolio ECS, we have coincidentally also tapped into the turning point in the markets about two years ago.

At the time, the Covid craze was subsiding, Russia had yet to invade Ukraine, and inflation was still “transitional.”

As a result, even since the end of 2019, we managed to turn 9% per month (113%/year), without drawdowns ever reaching above 15%.

Of course, the 10-year period the SP500 has been killing it over the past ten years shows is a more reliable timeframe to bet on, but, the main advantage of CFD trading (an danger) is that, in two years, we captured 200% (after profit share payments), which is still higher than the most popular US equities index did in 10 years!

It’s not exactly an apples-to-apples comparison; a savvy investor can reasonably object (and will be right), but if you into alternative investment (speculation), we want you to know, that we have been getting increasingly good at it over the past eight years.

Not everything went as smoothly as we would have hoped; two of our best-performing MT4 Expert Advisors, Ultima EA and Zeus EA EUR/USD, stopped delivering after year and two and a half years, respectively.

Consequently, some people lost money, but many made very handsome returns as well.

Zeus EA exploded after reaching 150% growth in under two years due to the war in Ukraine and a respective USD spike that we couldn’t tame with grids.

Meanwhile, Ultima EA just stopped capturing the moves, after reaching 250% in under five months, as the market has changed.

This hasn’t stopped us though, and now, we now offer seven different in-house EAs, plus a flagship discretionary trading.

But we digress.

After our eight years of back and forwards, you are now able to bet on our trading coming into the future.

We speculate across several asset classes, using both automated (EA-based) and manual (news-based) approaches that we run with a help of team of experienced money managers who are eager to take swings at the market, and, as the history shows, are resilient enough to recover from losses.

To join Portfolio ECS or Portfolio ECS + trade our EAs, follow these steps:

- Open an account with VT Markets, Exness, or RannForex (we will add more brokers)

- Join Portfolio ECS PAMM via a respective offer

- Join Athene EA + other out-of-beta EAs Managed accounts (optional).

- When trading the grid-based EAs (Athena EA at the time of writing), consider withdrawing your initial investment after the profit is made, and reinvest in non-grid if unforgettable with the concept.

For the best results with Portfolio ECS, it’s preferable to have multiple broker accounts.

Unfortunately, some brokers with the best trading conditions, don’t offer money management software, otherwise, require an asset management license we haven’t yet gotten approved.

But, if you are looking to try with a bit of more manual effort, reach out to us and we will suggest a solution on how you can tap into these opportunities anyway.

Once we see returns from retail flow, we will invest in making necessary organizational changes to be able to take your funds directly for management.

Safe Trading

Team of Elite CurrenSea 🇺🇦❤️

Leave a Reply