New Dawn for “Portfolio ECS”

As you might have noticed, we have been leaning towards institutional trading lately (July, August Performance Overview).

Consequently, In line with our pledge to make money for our clients, we are shaking up our approach to Portfolio ECS at KeyToMarkets by

- Switching from automated to manual trading

- Moving activity from KeyToMarkets to RannForex (more on this below),

Portfolio ECS PAMM with KTM will remain active for ongoing experiments and testing. We were testing Tesla arbitrage trading but have decided to halt the activity of non-satisfactory results.

All active PAMM participants are welcome to remain in the PAMM, as we will be adding new EAs that we believe have the potential to deliver steady growth in the near future.

To gain exposure to our flagship discretionary trading, you will have to join via RannForex for now (Exness for allowed countries later in November), we explain the reasoning below.

Why Switch from KeyToMarkets for this Approach Only?

While KTMs liquidity providers for Athena EA and Zeus EA meet the standard and will run via KeyToMarkets, we were not able to replicate the results achieved with RannForex and on personal account with eToro, and therefore are not going to add our latest discretionary money management service under the umbrella of our Flagship service Portfolio ECS via KTM.

Portfolio ECS PAMM with KTM will be still active for arbitrage and other experiments, and you are welcome to keep your funds to remain a part of the experiment. The broker has recently switched their servers to the UK, we expect that to also have positive results with our grid trading.

For results similar to eToro and RannForex institutional, we encourage you to switch to the RannForex Portfolio ECS account. This is, currently, the only global solution where you can tap into flagship manual trading.

More on “Portfolio ECS” with RannForex

The approach switches from fully automated trading via EAs to fully discretionary (manual) trading. The switch is primarily related to two main factors:

- Recruitment and subsequent testing of a new money manager, with the “know-how” that we cannot disclose at the moment.

- Slower than expected and more resourceful pace of developing fully automated EA that can ensure high returns and lower DD.

The “Portfolio ECS” now revolves around news trading and relies strongly on access to the best liquidity providers and technology.

This approach is only possible thanks to the years of industry experience and the network we have been able to build to reach out a deal with seasoned money managers and have the backing of a reliable, ECN broker partner.

It’s been very successful with our institutional investors (Yamarkets, Rannforex) and private accounts, and we are finally excited to share it with you.

Below, you will find the latest reports at eToro and our summer testing with RannForex. In future, we are planning to make “Portfolio ECS” available via other brokers.

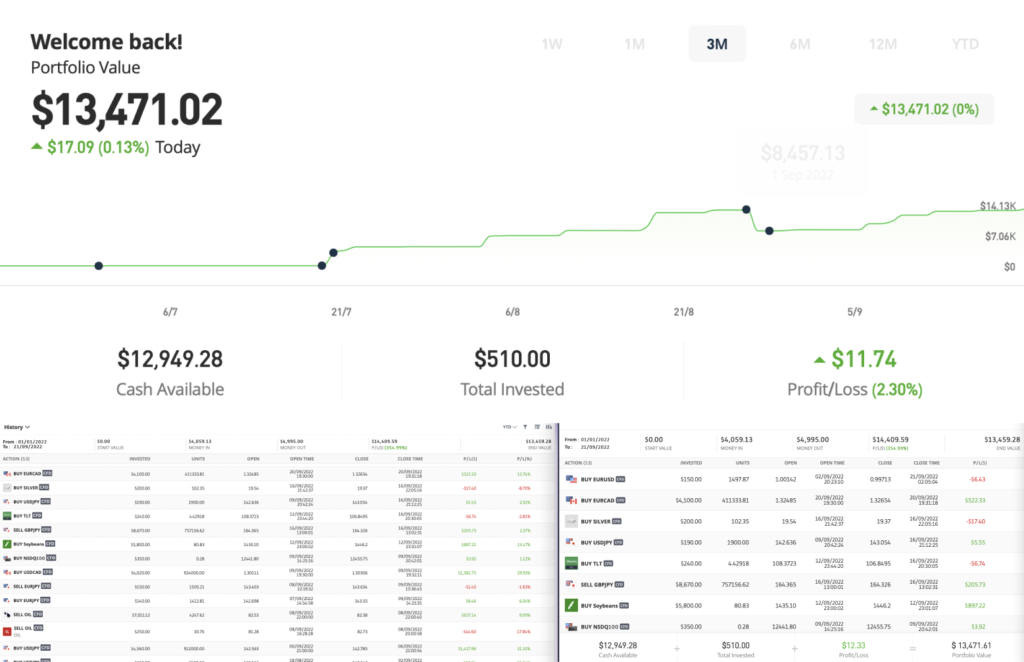

Statement with eToro (since eToro doesn’t offer MT4/5 we can’t show the performance transparently otherwise).

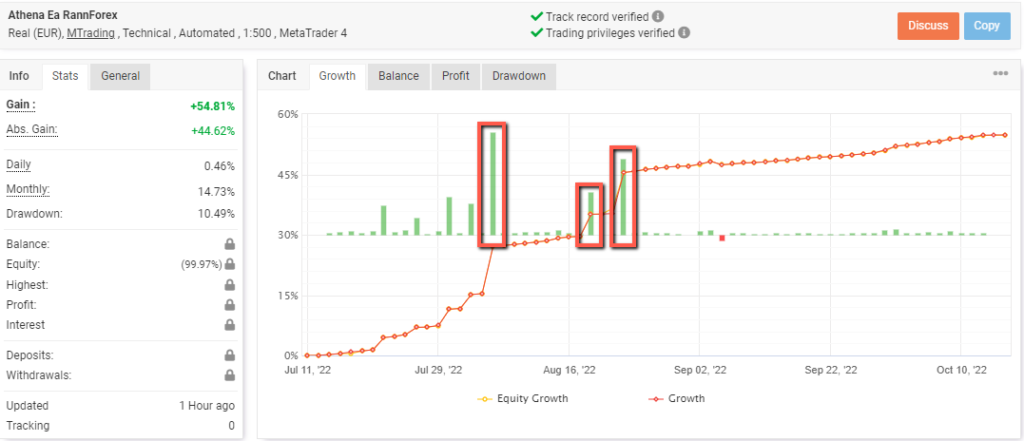

We have also tested the approach by blending it with Athena EA (grid robot) throughout summer.

Due to higher technology cost and fund management fees, the profit share fee on the RannForex account will be set at a hefty 50%.

This is the only profit share level that we are currently comfortable working with, once the Portfolio ECS with Rannforex reach above $0,5mln, we should be able to flatten the costs and improve the fee structure.

To join the Portfolio ECS with RannForex:

- Open an account with RannForex via our link

- Deposit Funds via the methods they support

- Join Pamm via the following link Link

We will be sending daily reports via a dedicated telegram group as well as email once we get up to speed.

Few Words on RannForex

Owned by AMTS, the brokerage is an A-Book model enterprise, relying solely on ECN technology. The owners are our friends and long-term partners, their technology powers Admiral’s trading tech.

Despite currently lacking a major license (applying for an FSA at the moment), thanks to a non-market-maker model, the broker has no conflict of interest with clients and pushes all of the trading straight to liquidity providers, hence never touching clients funds and having a conflict of interest with clients.

Unfortunately, with brokers like eToro we cannot provide this type of service via copy-trading, as a market maker (albeit a huge one), the broker is unlikely to move our profit down to it’s liquidity providers when/if we scale, whereas RannForex can move the flow down the line, where it should comfortably blend with the billions of dollars of volume by other financial institutions.

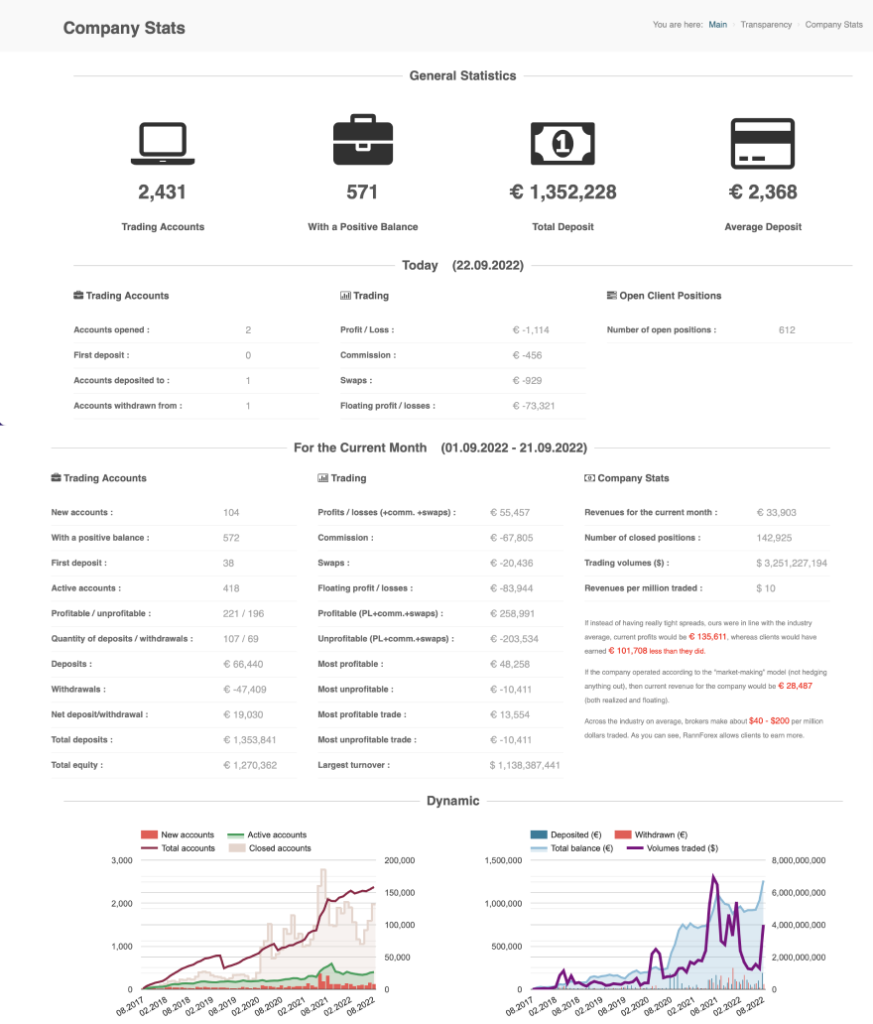

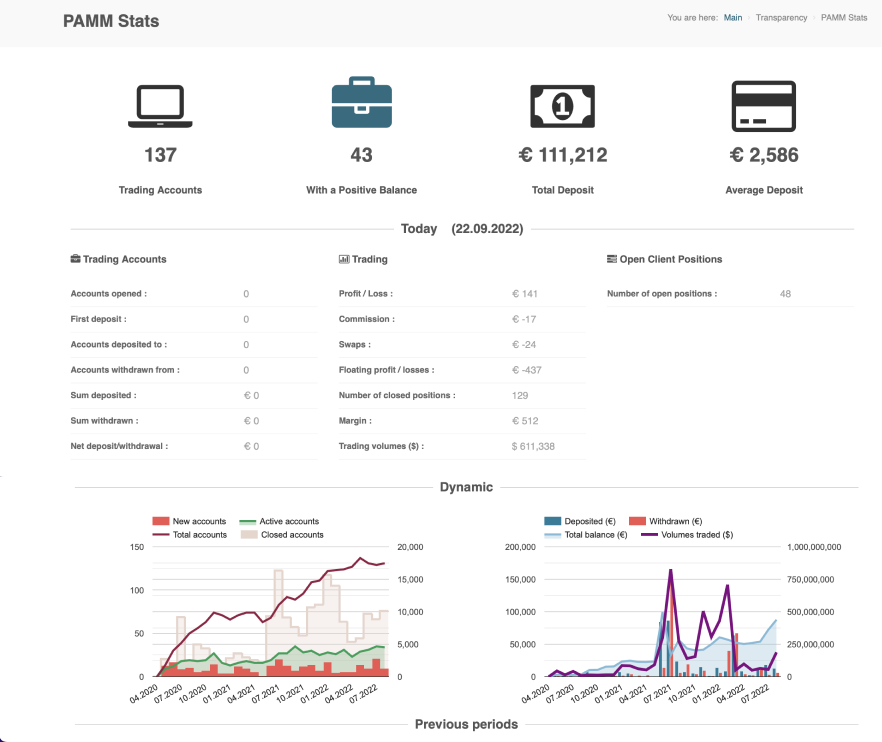

As a side note, RannForex’s pledge to transparency is astounding, the brokerage shows all its PAMM volumes, clients profitability, broker profitability, and other more interesting stats you can see for yourself via their PAMM website page.

We have already benefited from their liquidity during summer, as indicated in the performance overview for July and August.

On the bright side, our test with RannForex so far, shows that we can mimic the performance on personal accounts, and we are already up to a good start. We don’t promise the 500% in 3 months, that we have reached with eToro due to various factors, but to stick to 10% per month of steady profit without exposing you to drawdowns above 30%

This being said, we will keep our eyes peeled for more brokers to differentiate the exposure should we feel that RannForex may not be able to successfully hide our winning flow. But that is the good problem to solve in future.

What went down with Portfolio ECS KTM and Milton?

After the substantial dradown of Portfolio ECS at Milton and KTM, both traded by non-grid EAs (Zeus EA, Athena EA), we have reconsidered our approach, we have decided to keep Portfolio ECS on manual trading during summer, with a help of a fund manager.

We will be working on more automated solutions to add to Portfolio ECS later on, but for now, we have to scale down the non-grid trading and bring the flagship account back to the estimated monthly performance.

Performance in 2022 So Far

| Strategy | Results All Time High (ATH) | Results (Total) | Days active (total) | Broker |

| Athena EA (Grid) | 326% | 326% | 660 | IC Markets |

| Zeus EA Gold (Grid) | 36% | 36% | 175 | KeyToMarkets PAMM |

| Zeus EA EUR/USD (Grid Legacy) | 130% (2019-2021) |

-80% | 800 | KeyToMarkets PAMM |

| Portfolio ECS (Non-Grid, Automated) | -70% | 120 | KeyToMarkets & Milton Prime (stopped) | |

| Portfolio ECS (Discretionary) | 740% | 740% | 45 | eToro (personal) |

| Portfolio ECS (Discretionary) | 17% | 17% | 35 | RannForex PAMM |

It has been a tough year for the ECS team, our co-founder had to relocate his family from Ukraine, one of our money managers got stuck in the basement while Russian tanks were roaming around Kyiv, and not all trading has gone according to plan.

However, the team of ECS is grateful for your continued support and faith in our services. We are actively testing new Forex & CFD approaches as we speak and are very excited to finally find a footing with a decent discretionary approach and the broker to support our vision (not only on paper, but through technology and expertise).

Should you have any questions about the way to tap into our trading most effectively, please reach out via [email protected]

Safe Trading

Team of Elite CurrenSea 🇺🇦❤️

Leave a Reply