Manual & Auto Trading Performance | Forex, CFD & Options – January 2021

Dear Traders,

the performance in January 2021 was a mixed bag for us at Elite CurrenSea. This article reviews the statistics of all our EAs and the ecsLIVE service.

We also add the link to our live webinar with Chris Svorcik, who discusses the performance detail of the ecsLIVE signals and LOA.EA from Nenad Kerkez, the Zeus EA from ECS, and Ultima plus Rush from Bull Capital.

Check out the live webinar with Chris Svorcik for an interactive overview of the performance in January 2021.

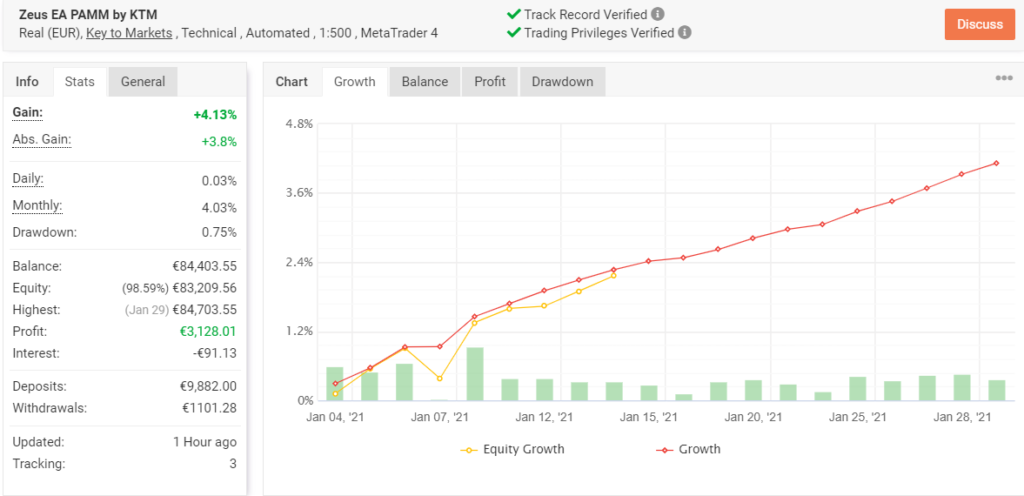

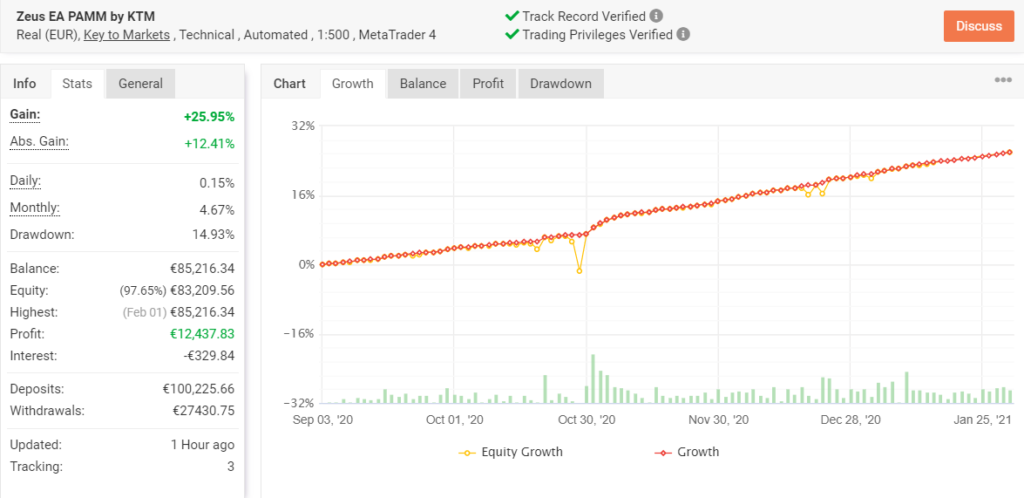

Zeus EA

The Zeus EA saw another positive month. So far, the Zeus EA has not shown any negative month in both 4.5 years of back-testing and 1.5 years of live trading.

An impressive feature that showcases the consistency of the EA. Here are all of the January 2021 stats:

| Performance | +4.1% |

| Win Rate | 71% |

| Reward-To-Risk | 0.79:1 |

| Draw-Down | 0.75% |

| Net Pips | +5,524 |

What’s the main take?

The draw-down was extremely low (less than 1%) compared to a decent gain (+4.1%). With a high win rate and decent reward-to-risk ratio, the EA had again an excellent month after a stellar Q4 2020.

Here is the graph for January 2021 and then total stats below.

Live Webinar Discusses the Performance

Check out the live webinar with Chris Svorcik for an interactive overview of the performance in January 2021.

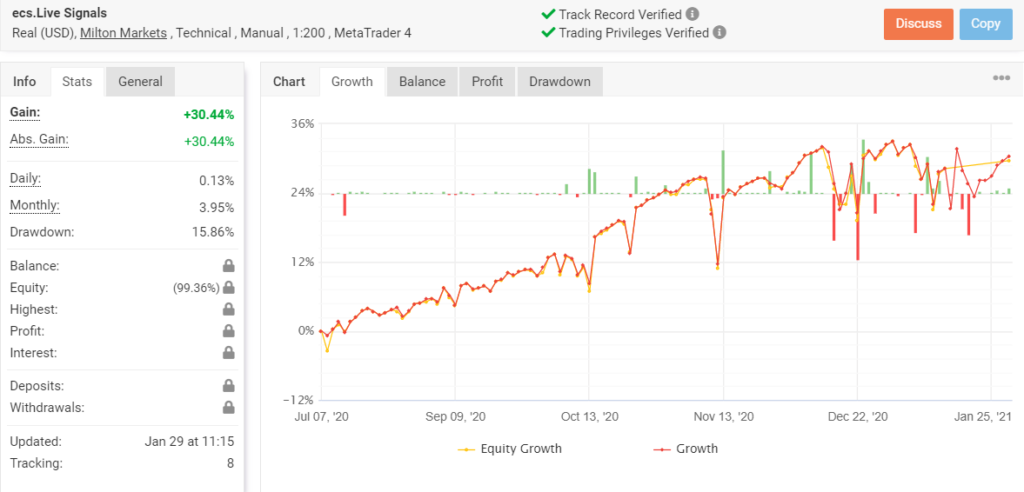

ecs.LIVE (By cammacd.BlackWidow)

The Black Widow closed for a very small loss that was close to break-even. However, the -1.44% on the MyFXbook account was created by the risk per setup choices. With equal risk per setup on all setups, the ecsLIVE signals could have been slightly positive for the members at +1.4% (per 1% risk).

| Performance | -1.44% |

| Win Rate | 64% |

| Reward-To-Risk | 0.45 |

| Draw-Down | 9.6% |

| Net Pips | -2,142 |

What’s the main take?

Although January 2021 was a tougher month than before, the draw-down that occurred in week 2 and 3 was still limited by an excellent 1st and 4th week. All in all, the total result was around break-even depending on the chosen risk per setup. Also the draw-down was limited to less than 10%.

Ultima EA

The Ultima EA from Mislav Nikolic at Bull Capital saw it break it’s losing streak in January 2021. But the gain was around break-even as traders saw a total of +1%. After 3 straight months of losses, traders were looking forward to more substantial gains. The EA was up quite a lot halfway the month with gains breaking above +35%. But a losing streak saw the gains go back to +1% by the end of the month.

| Performance | +1% |

| Win Rate | 41% |

| Reward-To-Risk | 1.79:1 |

| Draw-Down | 25.47% |

| Net Pips | +92 |

What’s the main take?

A volatile month but at least it was a month where Ultima EA was on the offense, pushing the account forward into positive territory compared to past months where the EA was in defence trying to erase losses from earlier in the month.

Rush EA

The Rush EA from Mislav Nikolic and Bull Capital had a tough start of the new 2021 year. After some ups and downs for most of January, the system unfortunately ended on a down note.

| Performance | -28.9% |

| Win Rate | 37% |

| Reward-To-Risk | 1.26:1 |

| Draw-Down | 33.1% |

| Net Pips | -247 |

What’s the main take?

The Rush EA needs a winning month after 2 losing months back-to-back. The period from July to November 2020 was profitable, which indicates the potential for this EA to fight back. Let’s see if it can muster a comeback in February 2021.

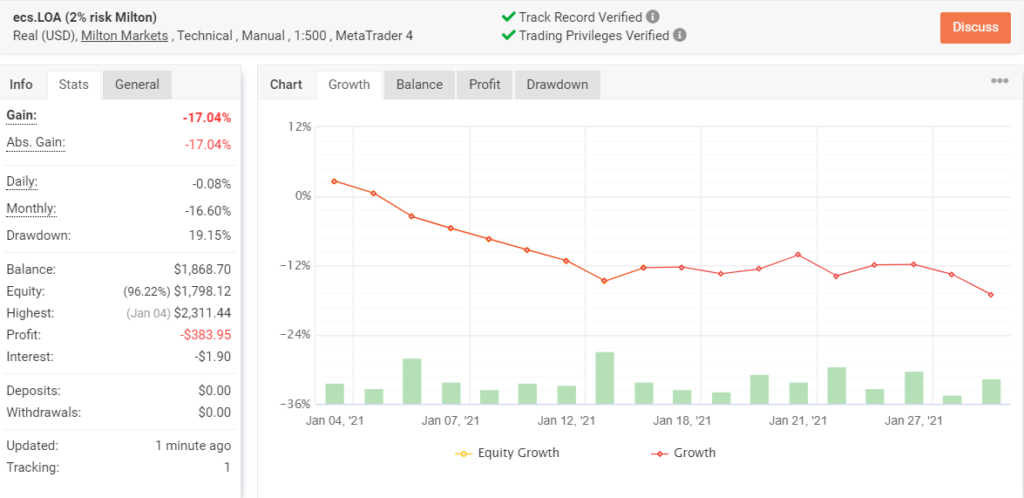

LOA.EA

The LOA.EA is losing more ground. That said, the EA did not break the historical maximum draw-down as it stays above that critical threshold. The current draw-down stands at 31% whereas the historical max is around 35-36%.

| Performance EUR/AUD | -17% |

| Win Rate | 39% |

| Reward-To-Risk | 1.09:1 |

| Draw-Down | 19.2% |

| Net Pips | -472 pips |

What’s the main take?

The LOA.EA has also been struggling during the past 3 months since the start of November 2020. The upcoming February and March trading months will be key to see if it is able to rebound back up again or not.

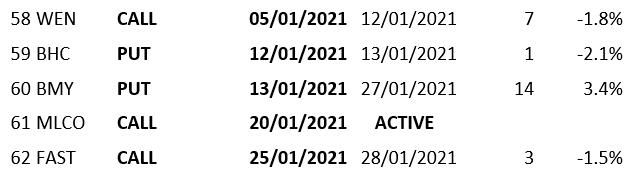

Options Trading

Higher and higher. We had a very bullish trend once again with the market swinging in a fairly narrow range for much of the month.

The last few days have been characterized by an increase in volatility accompanied by a rather marked retracement and a much wider range of fluctuations in prices.

This movement has certainly contributed to negatively influencing the signals entered following the uptrend.

However, the bearish wave helped to give strength to our short signal on BMY which had been languishing for days in a lateral phase allowing us to realize a 68% profit.

We were also able to balance the signals not going to target.

| Performance Dec (+8%) + Jan (-0.5%) | +7.5% |

| Draw-Down/Loss | 3.9% |

What’s the main take?

Although January ended up slightly negative, the month of December closed with a final profit of 8%, thanks to the positive result recorded with ATUS which more than offset the negative closing of NLOK.

Check out our option strategies from options expert Marco Doni !

Thanks and good trading,

Carlos Cordero

Mislav Nikolic

Marco Doni

Nenad Kerkez

Chris Svorcik

ECS team

Leave a Reply