EUR/USD Analysis Mar 22 & Trading Results Overview Feb 22

Dear Traders,

The trading performance in February 2022 was one of the best months in the past 12 months – excluding our options trading which had its worst loss in a year due to increased market volatility.

Despite the global pressures on the financial markets due to the Russian invasion and war against Ukraine, the other Elite CurrenSea systems managed to handle the price volatility adequately.

We will also add a video that analyzes the EUR/USD, GBP/USD, the US stock market, Gold, Bitcoin, and Ethereum.

Video on EUR/USD, Financial Markets & Feb’s Performance

The EUR/USD is in a downtrend and a bearish push towards 1.10 is expected after retracing towards 1.12-1.1250. The GBP/USD could make a bullish bounce but the resistance is expected to push price towards the 88.6% Fibonacci retracement level.

We also review the performance of our trading systems during February 2022. Check out the video below:

Summary of All Systems in February 2022

The month of February 2022 made good gains. Here is a summary of all our main systems and methods:

| System |

Performance

|

Draw-down

|

Total running performance |

| Portfolio ECS | +6.5% | 9.4% | +40.0% |

| Zeus EA (PAMM) | +5.8% | 5.0% | +99.6% |

| Zeus EA Retail Rental (€2.5k / account) | +9.3% | 15.0% | +135.5% |

| Athena EA (PAMM) | +4.1% | 4.7% | +6.1% |

| Athena EA Rental 1 (min 4k) | +2.9% | 2.9% | +176.0% |

| Athena EA Rental 2 (min 4k) | +0.6% | 4.9% | +91.9% |

| SWAT EA | +1.2% | 12.1% | +68.9% |

| Options | -5.8% | – | +9.5% (from 04.2021) |

| Total Last 12 Months | +75.0% | – | – |

| Total February 2022 | Total August 2021 | +16.35% | |

| Total January 2022 | +15.8% | Total July 2021 | -14.74% |

| Total December 2021 | +13.6% | Total June 2021 | +17.97% |

| Total November 2021 | +22.9% | Total May 2021 | +2.52% |

| Total October 2021 | +11.5% | Total April 2021 | -49.69% |

| Total September 2021 | +18.3% | Total March 2021 | +20.5% |

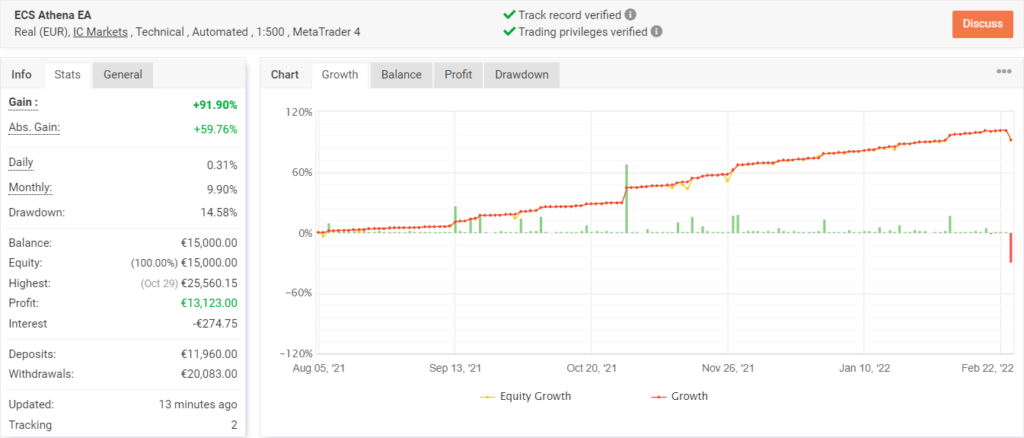

Athena EA

Athena EA’s performance saw its weakest month in more than a year. The system was not able to cope that well with the price volatility on the EUR/USD as other systems. But on the other hand, our accounts did manage to close with profits, albeit much smaller ones than usual.

The three different accounts made a total of 7.6% which is an average of about +2.5% per account.

| Total performance Athena EA January | +7.6% |

| Total performance Athena EA – all time | +274.1% |

| Win Rate | 70% |

| Reward-To-Risk | 0.65 : 1 |

All three accounts can be followed via myfxbook:

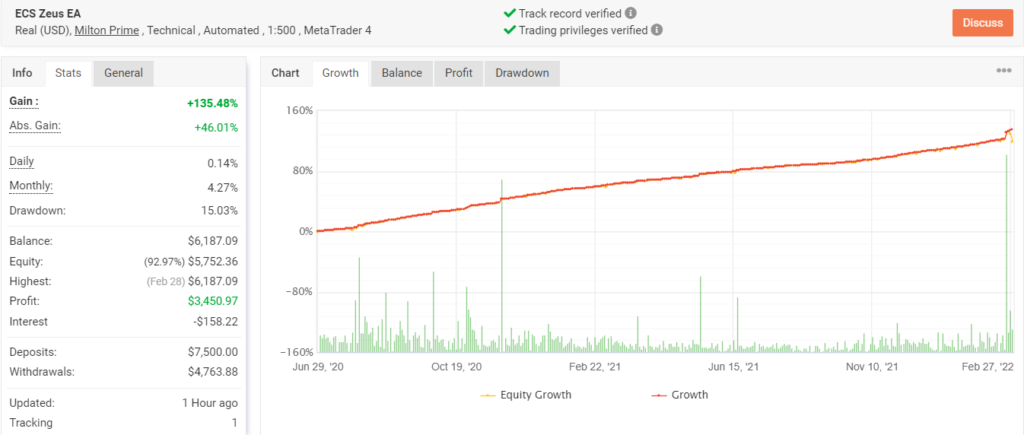

Zeus EA

Zeus EA

The Zeus EA had a remarkably strong performance in February 2022. The results were quite substantially higher than the usual, average gains of the grid trading approach.

The consistency remains an eye opener. Despite the volatility on the financial markets, Zeus EA has managed again to avoid a single losing month for multiple years in a row.

Zeus EA has never had one losing month after years of live trading. There are two ways to join:

| Performance PAMM Zeus EA | +5.8% / +9.3% |

| Total performance | +99.6% / +135.5% |

| Win Rate | 70% |

| Reward-To-Risk | 0.65 |

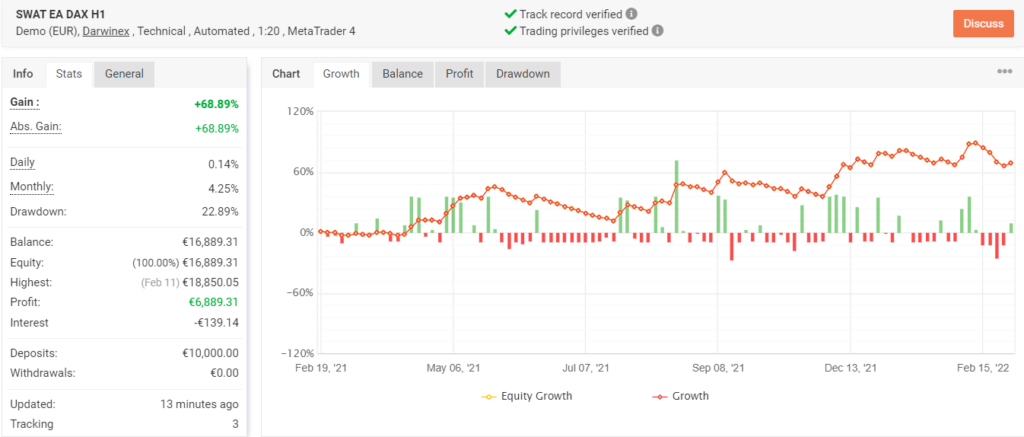

SWAT EA

The SWAT EA from Chris Svorcik has finished 1 year of live trading on the DAX instrument. Although January ended up in a loss, the February result managed to close for a small profit. The total result still shows an impressive +66.9% of profit. Not bad!

Our goal is now to see the second year of trading and see if the results are just as consistent and reliable.

| Performance | +1.2% |

| Total performance | +68.9% |

| Win Rate | 40% |

| Reward-To-Risk | 1.6 : 1 |

| Net Pips | -149 |

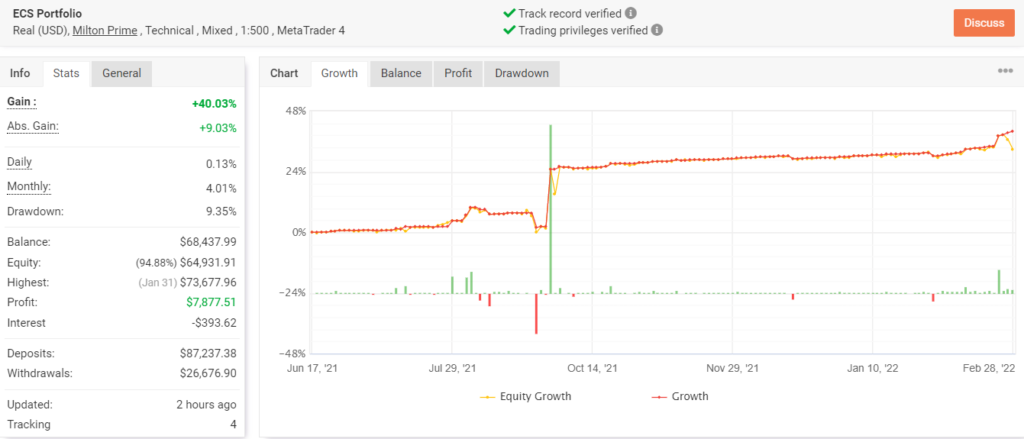

Portfolio Method

ECS Portfolio managed to offer a good gain. This occurred after a few months with slower profits. The sturdy performance was therefore a welcome sight for us and all of our investors.

The total profits now crossed the +40% mark. We are happy with this performance and also appreciate the low risk and draw-down connected to the results.

That said, due to war in Ukraine, the overall risk appetite and number of trading opportunities were less than usual in February and we expect March to be the same..

ECS Portfolio is a fully managed trading account. It offers an all-round method which trades a wide range of systems and instruments. There are also a mixture of styles such as fundamental, news, and technical analysis.

| Performance ECS Portfolio | +6.5% |

| Total performance | +40.0% |

| Win Rate | 63% |

| Reward-To-Risk | 0.7 : 1 |

Options Trading

War Winds. Last month closed with the question of whether the bottom had been reached. February replied with a “no”.

The recovery in prices was just a rebound that led to a new decline – a drop of more than 14% from the highs.

Political news from around the world contributed to worsening sentiment already strained by inflation news and measures about interest rates announced by the Fed.

The first half of March will most likely provide us with indications on the direction of the next few months at least until the beginning of the summer.

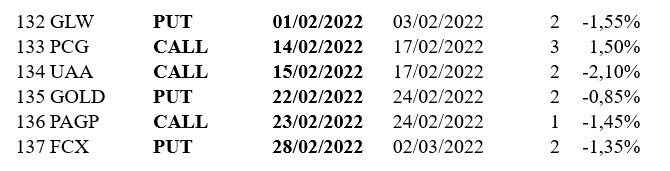

The educational signals service this month produced six signals equally split between Call and Put, of which only one closed in profit. Many signals have stopped before going in the following days in the desired direction, this is also part of the market game.

Our Options service from Marco Doni (CNBC Italy contributor)

| Performance | -5.8% |

| Performance since 04.2021 | +9.5% |

| Win rate | 17% |

Leave a Reply