EUR/USD Analysis Feb 2022 & Trading Results Overview January

Dear Traders,

January 2022 closed with some decent profits. We review the performance of each system in a detailed breakdown.

We will also add a video that analyses the EUR/USD, GBP/USD, the US stock market, Gold, Bitcoin, and Ethereum.

Video on EUR/USD & January’s Performance

The EUR/USD is testing a critical resistance zone. A bearish bounce is expected but the bears must see a triangle pattern develop, otherwise a reversal could occur. The GBP/USD is showing an inverted head and shoulders pattern.

We also review the performance of our trading systems during January 2022. Check out the video below:

Summary of All Systems in November 2021

The month of January 2022 made some decent gains. Here is a summary of all our main systems and methods:

| System |

Performance

|

Draw-down

|

Total running performance |

| Portfolio | +1.3% | 0.8% | +31.7% |

| Zeus EA (PAMM) | +3.3% | 1.9% | +89.0% |

| Zeus EA Retail Rental (€2.5k / account) | +3.2% | 1.6% | +115.5% |

| Athena EA (PAMM) | +1.9% | 1.1% | +2.1% |

| Athena EA Rental 1 (min 4k) | +5.8% | 1.6% | +168.9% |

| Athena EA Rental 2 (min 4k) | +5.8% | 1.8% | +91.3% |

| Athena EA Rental 3 (min 4k) | +7.8% | 2.5% | +11.8% |

| SWAT EA | -6.4% | 7.8% | +66.9% |

| Options | -0.3% | – | +15.3% (from 04.2021) |

| Total Last 12 Months | +183.6% | – | – |

| Total January 2022 | +15.8% | Total July 2021 | -14.74% |

| Total December 2021 | +13.6% | Total June 2021 | +17.97% |

| Total November 2021 | +22.9% | Total May 2021 | +2.52% |

| Total October 2021 | +11.5% | Total April 2021 | -49.69% |

| Total September 2021 | +18.3% | Total March 2021 | +20.5% |

| Total August 2021 | +16.35% | Total Feb 2021 | +108.6% |

Athena EA

Athena EA has had a wonderful start. The newest automated system has been added to the Elite CurrenSea website in January 2022.

The three different rental accounts made good gains with almost +6%, +6%, and +8% whereas the PAMM account also closed in the green territory (+2%).

| Total performance Athena EA January | +21.3% |

| Total performance Athena EA – all time | +274.1% |

| Win Rate | 70% |

| Reward-To-Risk | 0.7 : 1 |

| Net Pips | -4,590 |

All four accounts can be followed via MyFXbook:

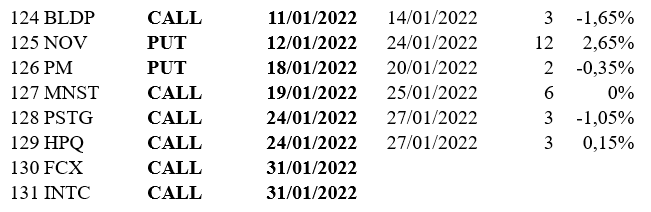

Options Trading

Downside finished or short rebound? January opened with an All Time High. But a very deep bearish correction occurred – a 12% decline to be precise, which is well over the 5% which was the maximum loss recorded in 2021.

Many factors probably supported this decline, such as

- Inflation data which was eventually recognized as non-temporary even by the Fed.

- Renewed fears over the Omicron variant.

- And War winds from Ukraine.

From this low point, the market has slowly recovered part of the loss. Now it will be necessary to understand if it is a simple short-term rebound or the recovery will continue at least in the medium term.

Our Options service from Marco Doni (CNBC Italy contributor) produced eight educational signals, two of which are still open. Those closed were equally divided between profit and loss both in numerical terms and in terms of the final result which currently averages -1%. Open trades, FCX and INTC, both Call, are at the time of writing in profit.

| Performance | -0.3% |

| Performance since 04.2021 | +15.3% |

| Win rate | 50% |

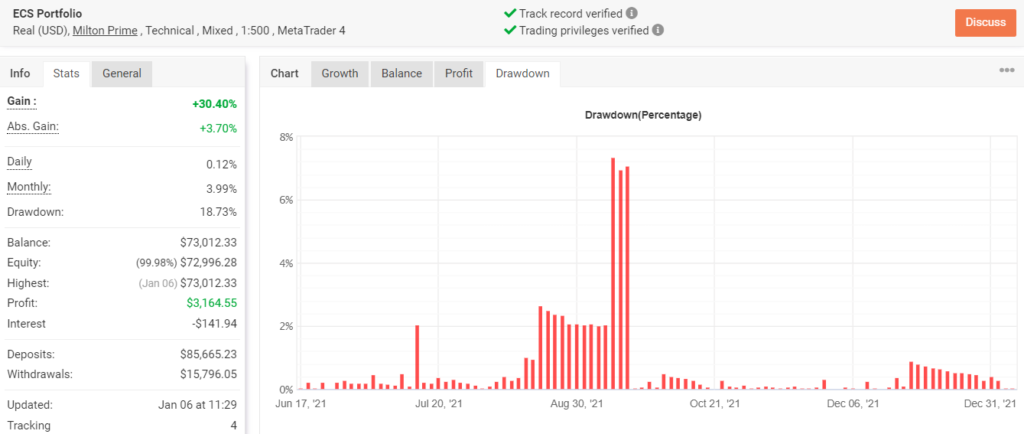

Portfolio Method

ECS Portfolio is still struggling to show the profits that we expect. That said, it has not had a single losing month either. Our key matrix is to see an improvement in the performance during the first half of 2022.

That said, the gains are lower than expected and we hope to see better results in the first half of the year 2022.

ECS Portfolio is our all-round method which trades a wide range of systems and instruments. There are also a mixture of styles such as fundamental, news, and technical analysis. It is a fully managed trading account. Click To Tweet

| Performance ECS Portfolio | +1.3% |

| Total performance | +31.7% |

| Win Rate | 73% |

| Reward-To-Risk | 0.65 : 1 |

| Net Pips | +44 |

Zeus EA

The Zeus EA managed account has had another stable performance. Although the profit was a little less than the previous month, it was yet another winning month. So far, Zeus EA has not had a single losing month.

Zeus EA has never had one losing month after years of live trading. There are two ways to join:

| Performance PAMM Zeus EA | +3.3% / +3.2% |

| Total performance | +89.0% / +115.5% |

| Win Rate | 70% |

| Reward-To-Risk | 0.65 |

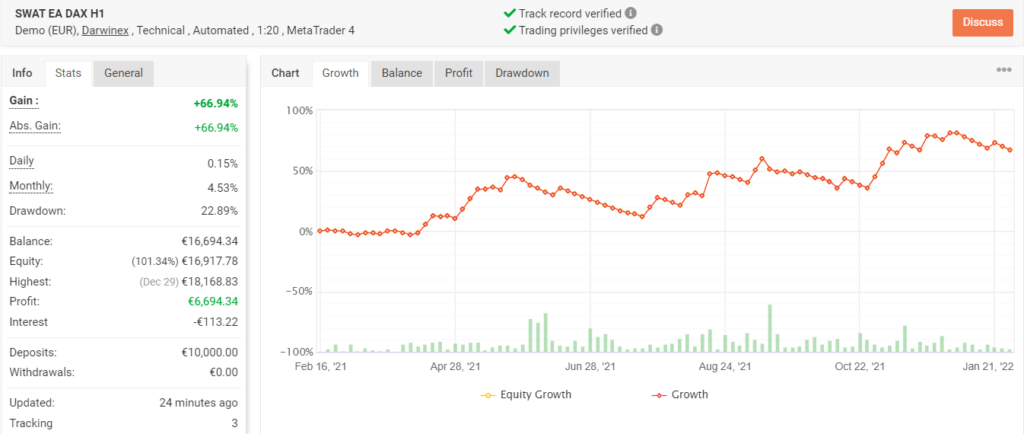

SWAT EA

The SWAT EA from Chris Svorcik has almost finished 1 year of live trading on the DAX instrument. Although January ended up in a loss, the total result still shows an impressive +66.9% of profit. Not bad!

Our goal is now to see the second year of trading and see if the results are just as a consistent and reliable.

| Performance | -6.4% |

| Total performance | +66.9% |

| Win Rate | 26% |

| Reward-To-Risk | 1.3 : 1 |

| Net Pips | -912 |

Leave a Reply