EUR/USD Analysis Apr 22 & Trading Results Overview Mar 22

Dear Traders,

The markets remained very volatile in March 2022, with large and negative consequences for 2 of our systems unfortunately. Although Zeus EA and the Portfolio method managed to survive the shock waves in February 2022, the price volatility was too large to handle in March 2022. Let’s review the performance for each system.

We will also add a video that analyzes the EUR/USD, GBP/USD, the US stock market, Gold, Bitcoin and Ethereum.

Video on EUR/USD, Financial Markets & March’s Performance

The EUR/USD EUR/USD is stuck between critical support and resistance levels. A breakout is needed before a new trend can emerge.

We also review the performance of our trading systems during April 2022. Check out the video below:

Summary of All Systems in March 2022

The month of March 2022 made good gains. Here is a summary of all our main systems and methods:

| System |

Performance

|

Total running performance |

| Portfolio ECS | -41.7% | -18.4% |

| Zeus EA (PAMM) | -39.3% | +21.2% |

| Zeus EA Retail Rental (€2.5k / account) | -60.6% | -7.3% |

| Athena EA (PAMM) | +2.4% | +2.4% |

| Athena EA Rental (min 4k) | +13.5% | +170.7% |

| SWAT EA | +0.2% | +69.3% |

| Options | +1.5% | +11.0% (from 04.2021) |

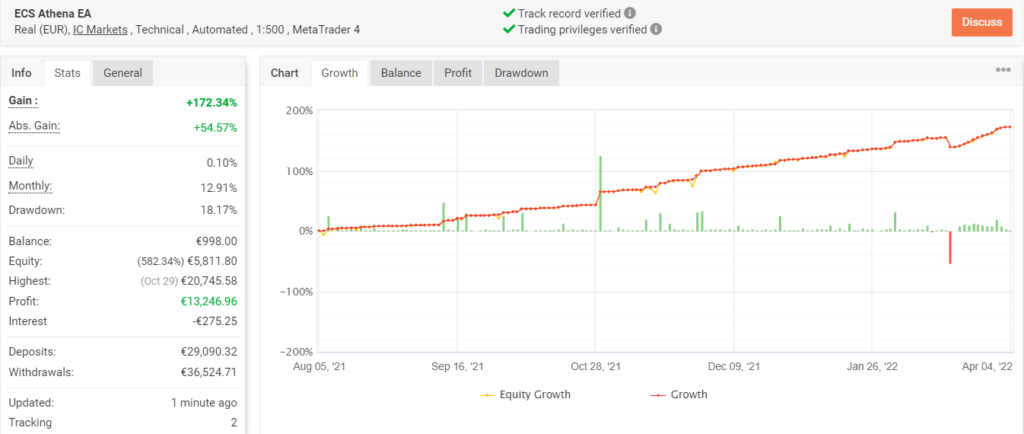

Athena EA

Athena EA’s performance struggled in February 2022 when it only made +0.2% return. But considering the volatile global events that are taking place, the break-even in February can still easily be considered a good result.

Luckily, March 2022 saw the EA bounce back with a good performance: +13.5% was an excellent month despite harsh and volatile price movements. Those strong price changes did have a negative impact, unfortunately, on our other systems and methods like Portfolio ECS and Zeus EA but not on the Athena EA.

| Total performance Athena EA March | +13.5% |

| Total performance Athena EA – all time | +170.7% |

Both accounts can be followed via Myfxbook:

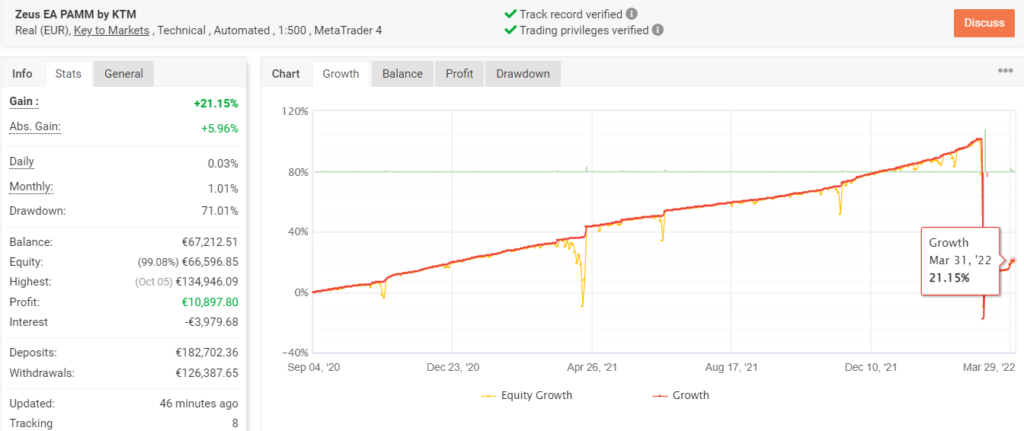

Zeus EA

The Zeus EA had a remarkably strong performance in February 2022 but weak performance in March 2022. The strong price volatility had not yet finished by the end of February and Zeus EA was unable to avoid a strong hit.

The overall performance of the PAMM remains slightly in the positive with +21%, despite the large loss of -39% in March. The rental lost more with -60% and is overall now at -7%. This means that all of the rental profits were lost in March 2022 and the EA will need to start again from scratch. But overall, the losses were mostly from previously gained profits.

Zeus EA has never had one losing month after years of live trading. There are two ways to join:

| Performance Zeus EA | -39.3% (PAMM) / -60.6% |

| Total performance | +21.2% (PAMM) / -7.3% |

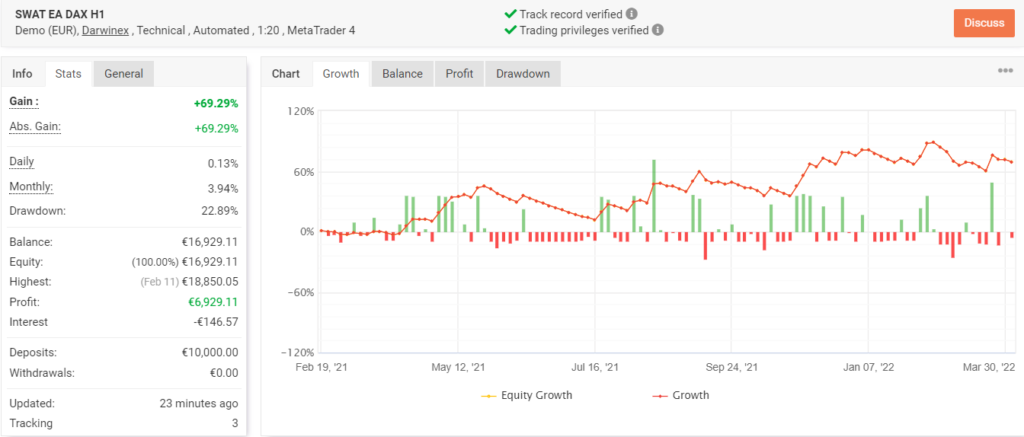

SWAT EA

The SWAT EA from Chris Svorcik has finished 1 year of live trading and is now starting its second year. The performance was about break-even in March 2022 but the overall results remain clearly in positive territory.

| Performance | +0.2% |

| Total performance | +69.3% |

Portfolio Method

ECS Portfolio had a good performance in February 2022 but the tidal waves in March 2022 were too much to handle for this method. A rather large loss occurred last month with a -41.7% loss taking place.

The overall loss, however, still remains within reason. The portfolio method is now down -18.4% but had some decent results since the losses took place, showing a positive restart with different systems that have been added.

ECS Portfolio is a fully managed trading account. It offers an all-round method which trades a wide range of systems and instruments. There are also a mixture of styles such as fundamental, news, and technical analysis.

| Performance ECS Portfolio | -41.7% |

| Total performance | -18.4% |

Options Trading

Restart in progress? Last month we had indicated the first fortnight of the month as a critical period in which we could probably see how the market would develop in the medium term.

In that period, the SP500 created a double low on the 14th day and then increased sharply, breaking the February highs.

This signal, if accompanied by a break of the March high in April could generate a bullish second quarter. As always, the market will reveal to us its intentions to us during the month.

The educational service generated 6 signals, 4 calls and 2 puts. One signal closed at breakeven, two in profit and two in loss. The last signal on Ebay remains open and currently results in a profit of about 38%. We await the closing to calculate the average monthly profit which is currently 6%.

Our Options service from Marco Doni (CNBC Italy contributor)

| Performance | +1.5% |

| Performance since 04.2021 | +11.0% |

| Win rate | 60% |

Leave a Reply