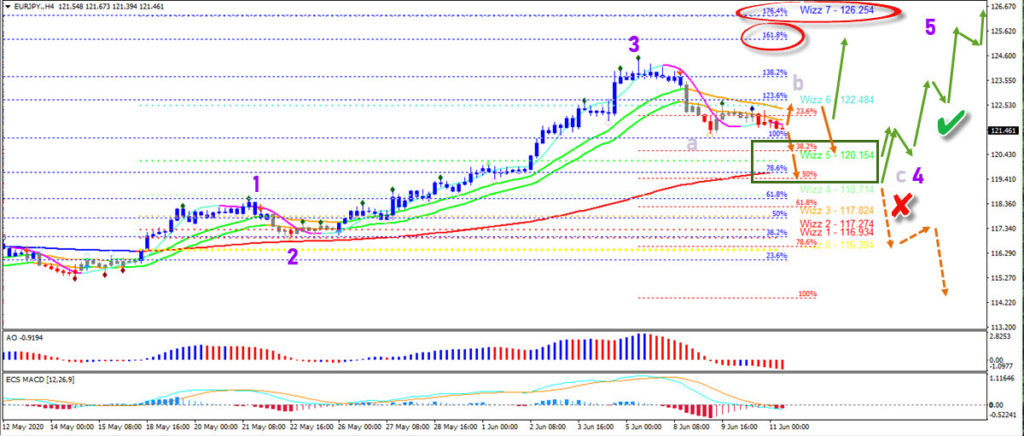

? EUR/JPY Aims for 144 ema after Breaking Below 21 ema Zone ?

Dear traders,

the EUR/JPY made a bearish bounce at the 21 ema zone after a bearish breakout below it (wave a). The bearish impulse will probably complete a counter trend move near or at the 144 ema close.

EUR/JPY

4 hour chart

The EUR/JPY remains bearish as long as price action stays below the 21 ema zone. Price is aiming for the 38.2% or 50% Fibonacci retracement levels. This can be a bouncing spot for the end of the wave 4 (purple).

A re break above the 21 ema zone is needed to confirm the uptrend. The targets are up at 25-126.50 where the 161.8 and 176.4% Fibs are located around the Wizz 7 level. A break below the 50% Fib invalidates (red x) the bullish outlook and indicates a downtrend (dotted orange arrows).

The analysis has been done with SWAT method (simple wave analysis and trading).

For more daily technical and wave analysis and updates, sign-up up to our newsletter.

Good trading,

Chris Svorcik

Elite CurrenSea

Leave a Reply