Another Successful US CPI Trading for Portfolio ECS

In continuation of the past month’s stellar 900% spike on YaMarkets, Portfolio ECS strikes again, successfully catching USD/JPY & NASDAQ moves that contribute to an aggregate 100% account growth on all accounts.

Let’s see what happened and how you can tap in for more news-related trading in the coming months.

Portfolio ECS December CPI Trading

| Broker | Performance (December/Yearly) | Days Active | Comment |

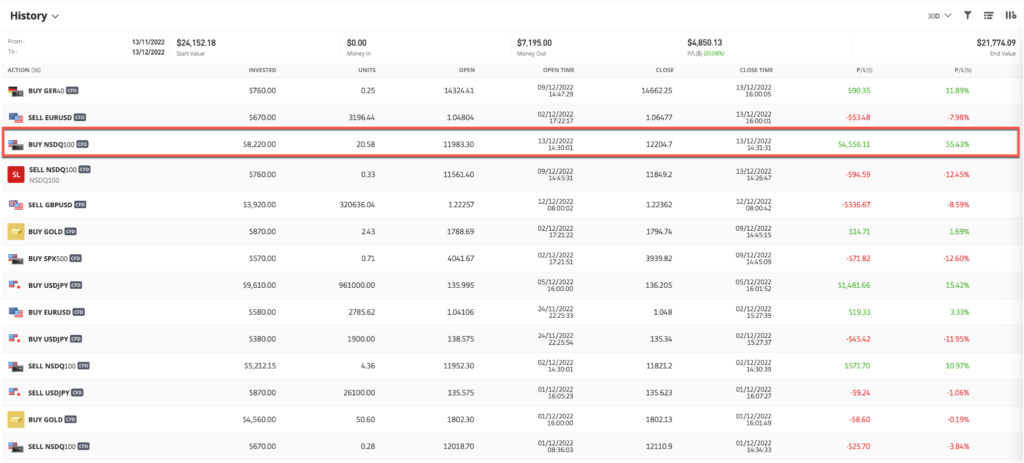

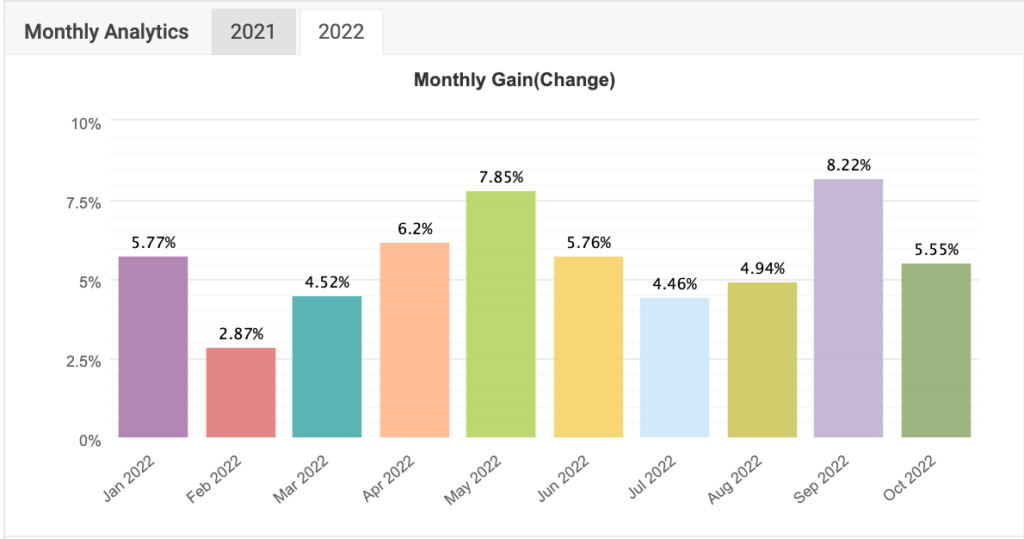

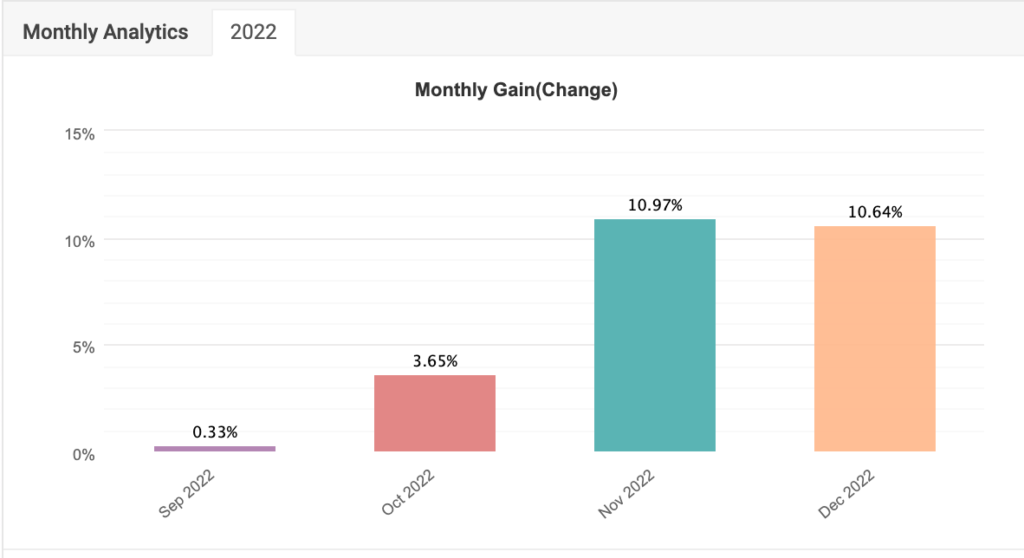

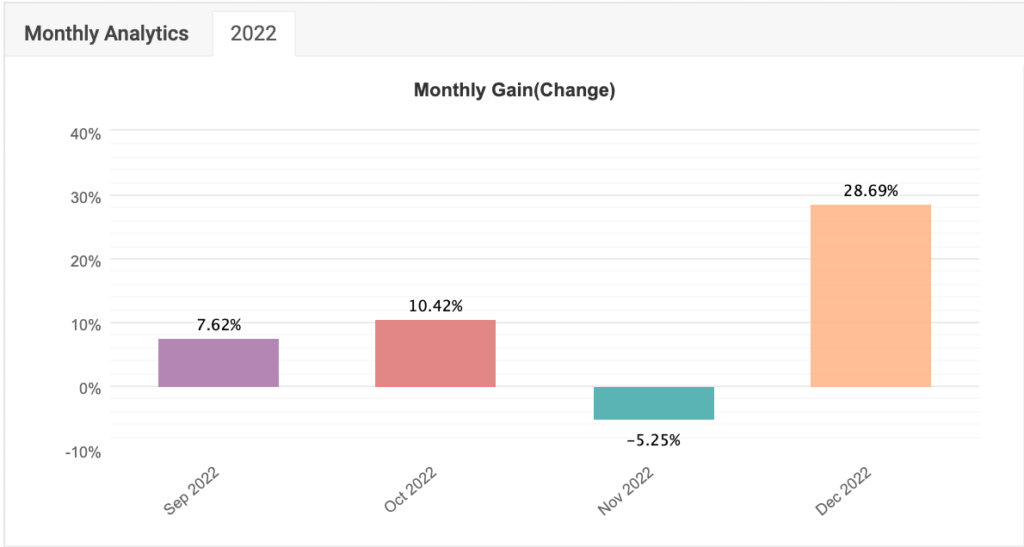

| eToro (see private statement) | +50%/+1,100% | 130 | NASDAQ Position closed at 55.4% in profit. To mimic results requires a PRO account with eToro + to reach out for further details personally. |

| RannForex | +25%/+50% | 150 | USD/JPY Move caught thanks to the sturdy ECN execution and decent fill with RannForex liquidity providers. |

| VT Markets | +25%/+35% | 30 | USD/JPY Move caught thanks to the sturdy ECN execution and decent fill with VT liquidity providers. |

After an issue with YaMarkets after generating 710% profit in November, we have halted all trading with the broker. A full story about the situation will follow on our website should the broker withhold our profits.

The Portfolio ECS discretionary approach has so far delivered the biggest return. When you consider the under 20% drawdown that we are aiming for the approach, the risk of the return-to-reward ratio of the approach makes it a no brainer.

See Full eToro Statement

See Full eToro Statement

If you are looking to maximize the upside with our trading, consider investing equally in the following solutions via managed accounts, which would ensure the lowest risk and pre-paid cost.

- Portfolio ECS

- VT Markets

- RannForex

- eToro (requires Pro or FSA-based account with the broker)

- Exness (outside EU only)

- ECS Live (Managed)

- VT Markets

- RannForex

- Signals (manually copy signals via telegram)

- Athena EA EUR/USD (Grid Trading)

ECS Live Managed is a collection of fully automated trading, that would give you exposure to our best Expert Advisors optimized for low drawdown trading, namely – dynamic stop losses and take profits, as well as 24/5 oversight over the trading.

Athena EA (live for over two years now) is a grid trading approach, that is our most popular EA and has returned over 340% by now, is considered a more risky approach due to the absence of stop losses (which is basically the nature of the whole approach, more on it here).

All approaches but Portfolio ECS are also available as stand-alone Expert Advisors with which you can expect slightly higher than managed account returns, but at the expense of convenience when compared to managed accounts. Also, you will not have the experience of our risk management team.

All approaches but Portfolio ECS are also available as stand-alone Expert Advisors with which you can expect slightly higher than managed account returns, but at the expense of convenience when compared to managed accounts. Also, you will not have the experience of our risk management team.

Safe Trading

Team of Elite CurrenSea

Leave a Reply