How to build a well-balanced crypto portfolio for the next 5 years

Whenever we read or hear about investing in stocks and Forex, we always hear how important it is to have well-balanced portfolios. The same thing goes for cryptocurrencies as well. Despite cryptocurrencies being highly volatile assets, with proper planning and intelligent selection of tokens, we can easily create somewhat safe portfolios.

Creating this crypto portfolio is made easier by the fact that there are countless cryptocurrencies on the market. Of course, most of them won’t be investment-worthy, but we can still find many that will be good for both risky and safer portions of our portfolio.

Crypto portfolio

Starting your crypto investing journey can be as easy as purchasing Bitcoin or Ethereum and calling it a day. To be fair, this is not a bad approach since these two are market dominants and leaders. They have a high chance of keeping their value in the long run, and they can even increase in value very highly. But this is not an approach that is suggested by most investors since being dependent on one or two tokens is a risky endeavor. A good example of it is a recent crypto crash that saw both Bitcoin and Ethereum losing huge portions of their value. To have some sort of risk management, most investors will suggest having diversified portfolios containing both low and high-risk assets.

What is a crypto portfolio?

Let’s get the basics out first. A Crypto portfolio is just like any regular financial portfolio. This is a collection of cryptocurrencies that bring different levels of risk factors with them. These crypto portfolios also hold cryptocurrencies differentiated by type and purpose. These differences are usually in the utility of the token, what are they used for? Another important factor associated with crypto portfolios is the portfolio tracker. Of course, you can have some sort of spreadsheet, where you can manually input information about your holdings and other relevant information about your investment. But we can also utilize third-party portfolio tracker/manager applications which do hard work for us.

Diversified crypto portfolio

As we mentioned before, having a diversified crypto portfolio is something that every investor should try to build. But this does not mean that this is a perfect system that will guarantee high returns or returns at all. Diversified portfolios have their own pros and cons, and in the end, it is up to investors to decide which approach they would like to take. When making a diversified crypto portfolio, we are investing in one asset class and because of this, diversification can not be done here like we do while making traditional investment portfolios. Traditional portfolios contain different asset types, these could be stocks, bonds, forex, and even crypto, all in one portfolio. When making a crypto portfolio, this diversification is done based on the tokens themselves. Are these tokens, payment tokens, stablecoins, security tokens, utility tokens, or any other crypto type?

How to make a diversified crypto portfolio

What is considered a well-balanced crypto portfolio depends on what each investor thinks. Some might consider a portfolio with 4 cryptos a diversified one, while some might have 10-20 tokens in their portfolio before they call them a diversified one. But there are still some general guidelines that investors are following and these are following:

- Have 3 types of tokens in your portfolio. High, medium, and low-risk tokens and give them appropriate weight in your portfolio. Having a big portion of your portfolio taken up by high-risk cryptocurrencies is definitely not a great idea since with potential high gains there is an even bigger chance of you making huge losses. But also dedicating a really big portion of your portfolio to low-risk cryptos is also not a great idea. This will lower potential profits, as low-risk tokens usually don’t have huge price jumps, and even if you were to make some profit from them, you can still make losses or go somewhat even, if the risky portion of your portfolio fails.

- Constantly keep an eye on your portfolio and rebalance it if you see the need. The Crypto market suffers constant volatility so if you were to spot that some of your assets might not perform well in the long run after some market shifts, then rebalancing your portfolio is a must.

- Always have some portion of your portfolio allocated to stablecoins. On top of being safe assets as they always hold a $1 value, they are great for liquidity. When rebalancing your portfolio or adding new assets, stablecoins such as USDT and USDC are great assets to own as they are paired with most cryptocurrencies on different exchanges.

- Only invest as much as you are ready to lose. Cryptocurrencies are volatile tokens and even low-risk tokens suffer from constant volatility. This might cause your investment to fail and leave you counting your losses.

- Do intensive research. Yes, looking at different devices and tips is a good way to get a general idea of the market and portfolio creation but solely relying on those devices can have bad consequences. Look at different tokens, the teams behind these tokens, what are these tokens used for, and many others, and only after this make a final decision as to which cryptocurrencies should be in your portfolio.

Example of a well-balanced crypto portfolio

Since you can’t diversify your crypto portfolio by asset type since crypto is one asset, the diversification is done through the type of cryptocurrency we are investing in. Let’s go over some of the types of cryptocurrencies you can invest in and create a diversified portfolio.

Payment tokens

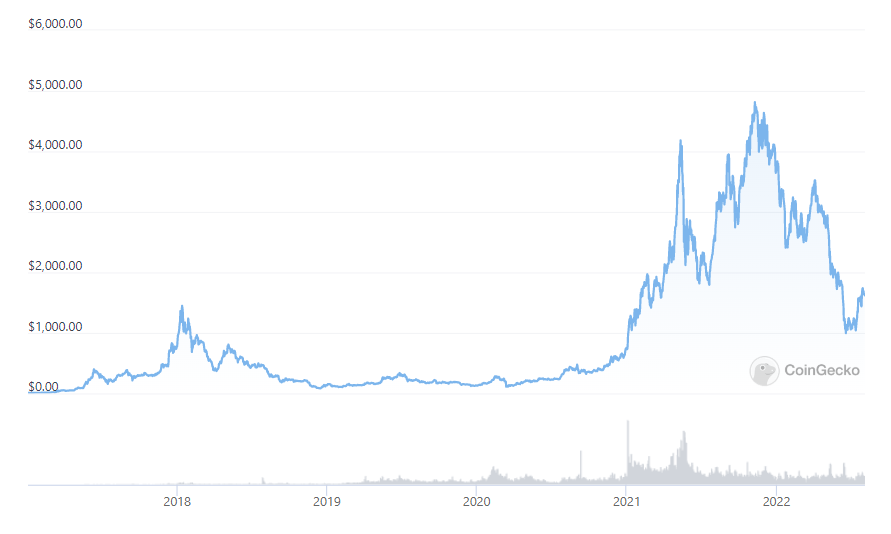

Bitcoin price chart 2017-2022

The original concept of cryptocurrencies was to be a decentralized payment system. Nowadays, there are not many tokens released with the sole purpose of being payment currencies, but still, the market is filled with a good selection of them in which we can invest in. Bitcoin is the best example of these tokens. Being the first cryptocurrency, Bitcoin is the most famous token on the market and most probably the safest option to invest in. This is a great low-risk asset to add to your portfolio for a long holding. Yes, it is a volatile token that saw price fluctuations pretty frequently, but if you purchase it at the right time, it will follow its traditional route and prices are most likely to go up. If you are not a fan of Bitcoin, there are other great options. XRP and Litecoin being good examples. So if you are looking for low-risk crypto payment tokens are great tokens to look at since they tend to follow somewhat of a pattern and are less likely to devalue completely without coming back.

Security tokens

Cryptocurrencies are decentralized assets that have really small oversight. But having assets that you know are being regulated by different financial institutions and agencies is another good low-risk investment opportunity. Security tokens are tokens issued by different crypto projects that might represent different stuff. For example, when companies are running ICOs they usually release security tokens and give investors opportunities to invest in them. These tokens are tokenized assets that might represent shares of companies or bonds, and they can even hold voting rights on projects. Since these tokens are connected to actual companies and represent them, they have to go through different regulations and checking processes by government agencies. BCAP token is a security token of choice for many investors. Launched in 2017, this was one of the first security tokens which managed to gather $10 million in funding in just a few hours of offering tokens to investors. You can purchase BCAP on exchanges such as Coinbase.

Utility tokens

Ethereum price chart 2017-2022

When it comes to mid-risk assets, investing in utility tokens is a way to go. Utility tokens come in different shapes and forms. These tokens can have different utilities associated with the project they are part of. Some might give you access to the different features of the project, some might be used for transactions, and many others. What makes them mid-risk is that they are dependent on project success but not entirely, and if we choose good projects, the possibility of them losing value is relatively low. One of the best utility tokens we can add to our portfolio is of course Ethereum. Ether is used to pay transactions on the Ethereum network, which is the biggest crypto network. Other good options for utility tokens that we have are Solana and BNB tokens.

Governance tokens

ApeCoin chart Mar-Aug 2022

And lastly the high-risk tokens. The highest risk tokens are usually governance tokens. These tokens are solely dependent on the success of the project and even if one small problem takes place around the project they tend to lose value. But if the project succeeds, these are the tokens that are showing the biggest gains. Governance tokens give holders the ability to make suggestions about the direction the project should go and also voting rights on these suggestions. They are part of the DeFi ecosystem and one of the best governance tokens that we can invest in is Apecoin which holds the governance rights in BAYC’s upcoming metaverse. This is a new token with not a lot of history, but considering BAYC status and demand for metaverse developments, we can confidently say that this is one of the best governance tokens to invest in. Other notable governance tokens are Uniswap, PancakeSwap, and Sushi tokens, which are tokens of decentralized exchanges.

Stablecoins

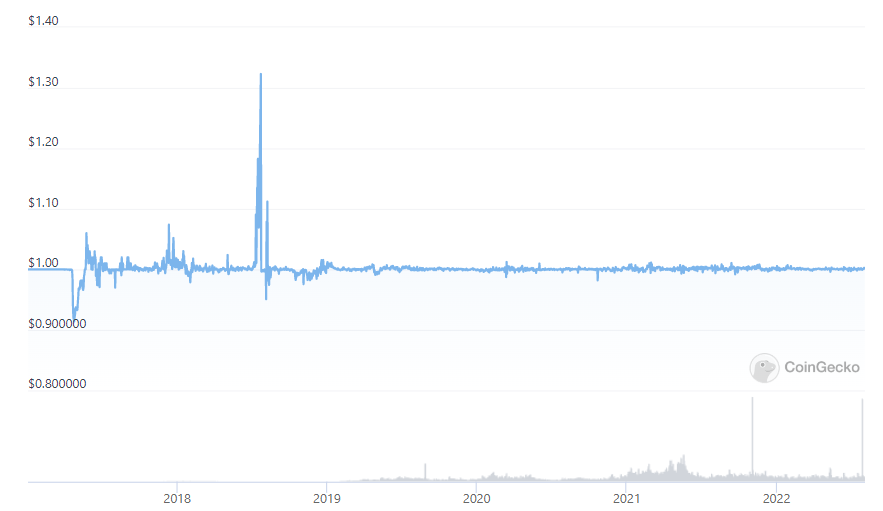

USDT price chart 2017-2022

Lastly, throw in some stablecoin to the mix for liquidity. Because of high volatility, you will most likely be required to balance out your portfolio from time to time in order to maximize profits and avoid potential losses. For this you will need liquidity and nothing brings better liquidity than stablecoins. They always hold a $1 value, which makes them the safest asset to hold and gives you the possibility to purchase almost any token using them. One of the best stablecoins to hold in your portfolio are USDT, USDC, and DAI. These tokens are pegged to the US dollar which makes it highly unlikely that anything was to happen to them unlike algorithmic stablecoins, such as UST which lost its whole value in a matter of days.

FAQs

Which cryptocurrency will be good for the next 5 years?

In general, making speculations as to which crypto will be good for long investment is hard. But if we go from historic data tokens such as Bitcoin and Ethereum have shown that despite periodical price drops they always tend to rebound and on each rebound hit new high peaks.

How do I make a well-balanced crypto portfolio?

The number one rule of making a balanced crypto portfolio is diversification. Make sure to have assets in your portfolio that have both high and low risks associated with them. Throw in some stablecoins in the mix, and you are ready to go. But keep in mind that you will need to rebalance your portfolio from time to time as the crypto market is highly volatile.

How many cryptos should be in your portfolio?

There are no set guidelines as to how many cryptos you should own as some might have 1-2 while some might hold 10+ tokens. But in general, most investors are holding between 4-9 cryptocurrencies in their portfolio as it diversifies the portfolio just enough.

Leave a Reply