🔍 Bitcoin Surge: Real Uptrend Again or Larger Correction? 🔍

Dear traders,

Bitcoin (BTC/USD) is again showing strong bullish price action. After the bullish breakout, the next major hurdle is the previous top.

This article reviews the key patterns that help determine whether price action will break the top or reverse for one last bearish correction before the uptrend continues.

Price Charts and Technical Analysis

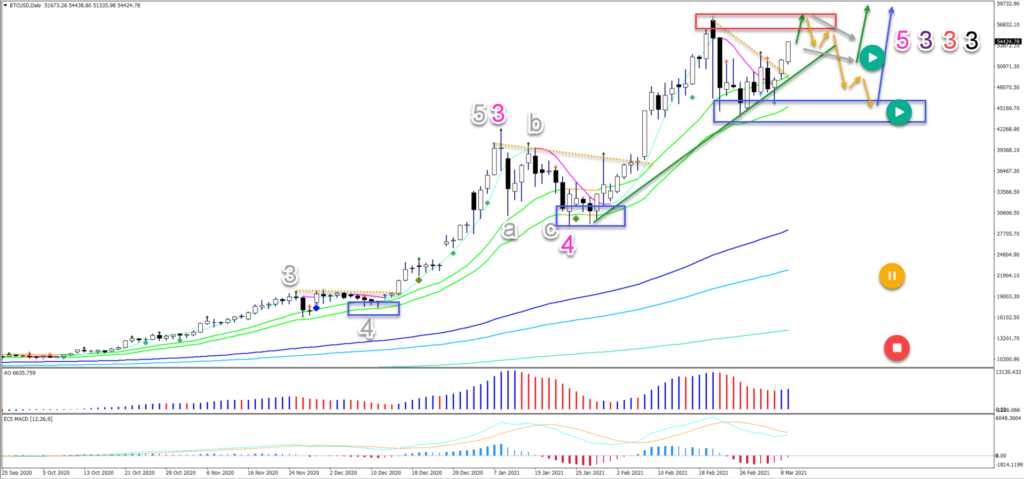

BTC/USD has made a bullish bounce again at the 21 ema zone. The 21 ema low and high have now acted as a support for the third time in a row (blue boxes). This indicates a strong trend:

- A bullish bounce at the 21 ema zone is usually part of a wave 3.

- The uptrend seems far from finished with multiple waves 3 still pending.

- The previous top (red box) will either create a bearish bounce (orange arrows) or a bull flag chart pattern (grey arrows).

- A reversal should reach the previous bottom (blue box) where the uptrend restarts (blue arrow).

- A bull flag pattern should see a bullish breakout and continuation (green arrow).

- The main intermediate targets are located at $65,000 and $75,000.

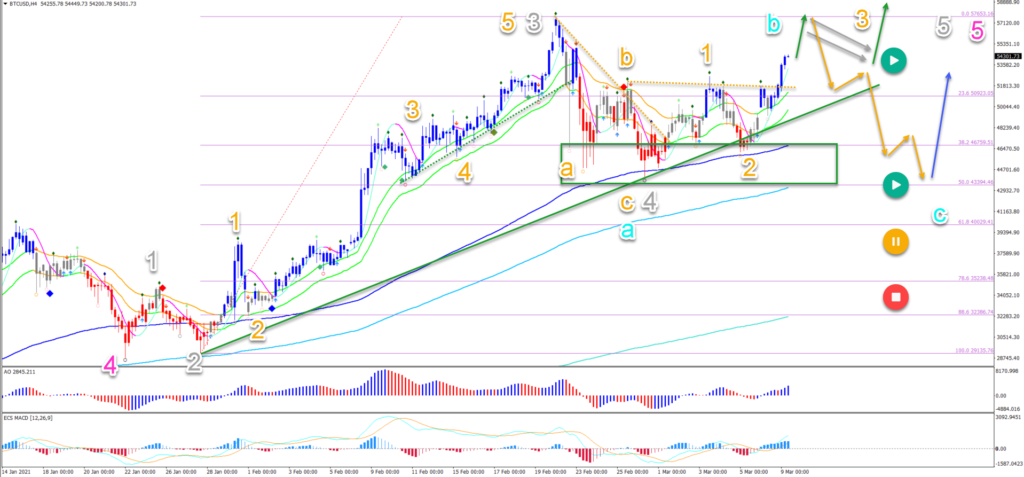

On the 1 hour chart, price action made a retracement to and bounced at the long-term moving averages. The correction was relatively lengthy and choppy, which is usual for a wave 4 (grey).

- Ultimately the 38.2-50% Fibonacci retracement zone acted as a support zone for a bullish bounce.

- The current push up could already be a new wave 1-2 (orange) but price action must build a bull flag chart pattern (grey arrows).

- A strong bearish reaction (orange arrows) could indicate an extension of the wave 4 (grey) via an ABC (light blue).

- Eventually the uptrend is expected to continue either immediately (green arrow) or after a pullback (blue arrow).

The analysis has been done with the indicators and template from the SWAT method (simple wave analysis and trading). For more daily technical and wave analysis and updates, sign-up to our newsletter.

Leave a Reply