🔥 Bitcoin Completes Decline After Lower Low and Strong Push Up 🔥

Dear traders,

Bitcoin (BTC/USD) made a new lower low as expected in our previous Elliott Wave analysis. The strong bullish bounce could indicate the temporary end of the bearish pullback.

This article reviews how the uptrend might take shape in the next upcoming week.

Price Charts and Technical Analysis

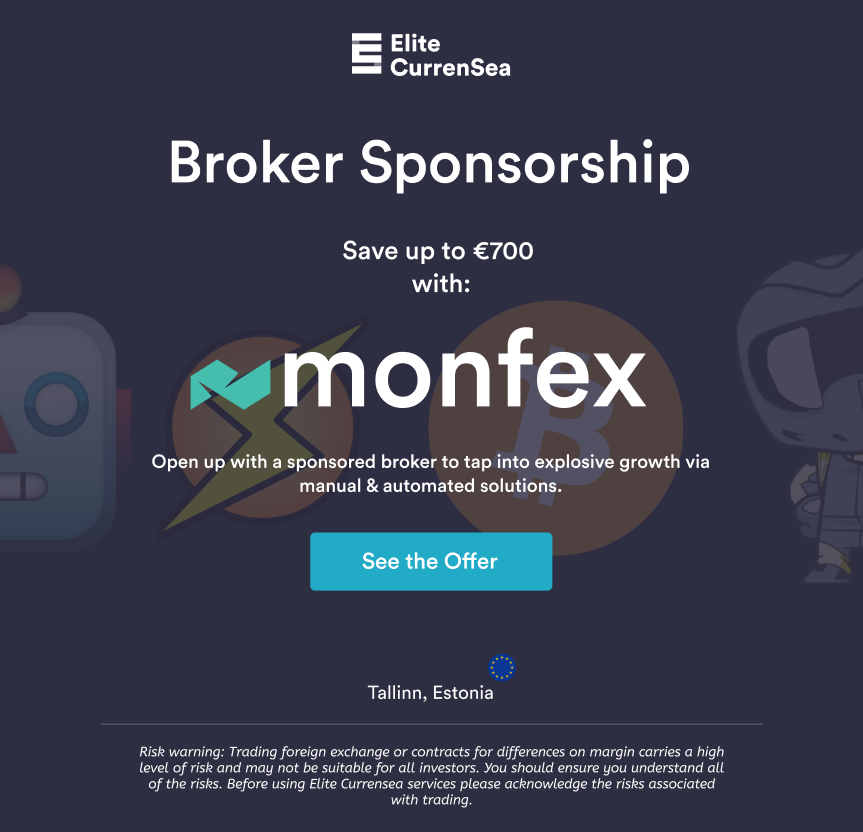

The BTC/USD chart is showing a complete 5 bearish waves down (orange) in wave 5 (grey) of wave A (pink). The alternative is an ABC (red) pattern down:

- A bullish ABC up could indicate a wave B (pink). In that case, another price swing down could be a wave C (pink).

- Considering the strength of the uptrend on the higher time frames, the pullback in wave C could be shallow.

- A 5 wave pattern (rather than an ABC) could indicate a wave 1 and wave 2 rather than B and C. This scenario is also bullish.

- An immediate push up (green arrow) is likely to test the resistance zone (orange box).

- A bearish bounce could decline to test the support (blue box) and inverted head and shoulders level.

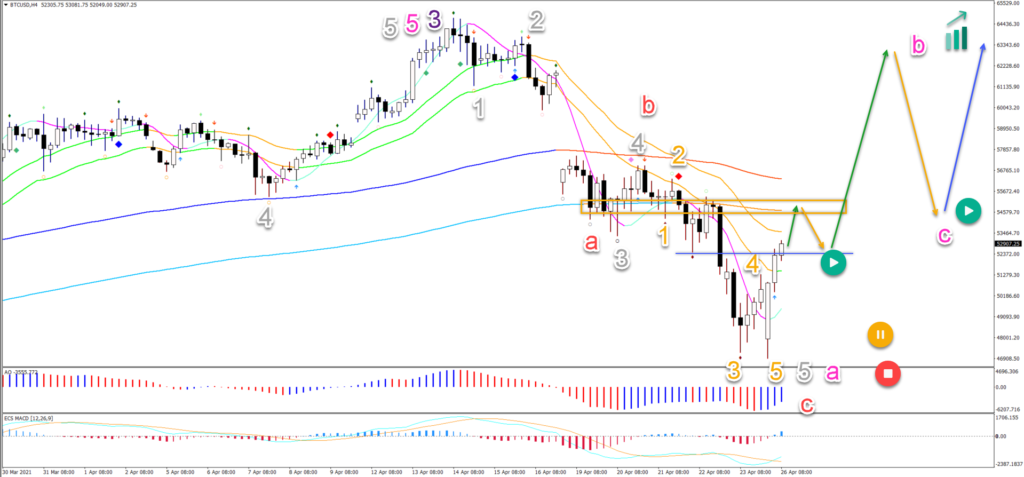

On the 1 hour chart, price action is facing a key resistance trend line (orange) after a strong bullish impulse up. Considering the recent price action, the bulls seems to be back in control:

- The bearish wave 5 seems completed.

- The bullish price action is showing larger bullish candles with closes near the high, indicating bull control.

- Price action managed to break above and away from the 21 ema zone, which changed the angle of the 21 EMAs to up.

- Either a breakout (green arrow) or a bounce up after a pullback (orange and green arrows) is likely.

- The next target is the Fibonacci levels and resistance zone (red box).

- At resistance, price action could make a pullback (orange arrows) but a bullish continuation is expected (blue arrows).

The analysis has been done with the indicators and template from the SWAT method (simple wave analysis and trading). For more daily technical and wave analysis and updates, sign-up to our newsletter.

Leave a Reply