🔥 Bitcoin Breaks Above 21 Ema Resistance in 5 Waves 🔥

Dear traders,

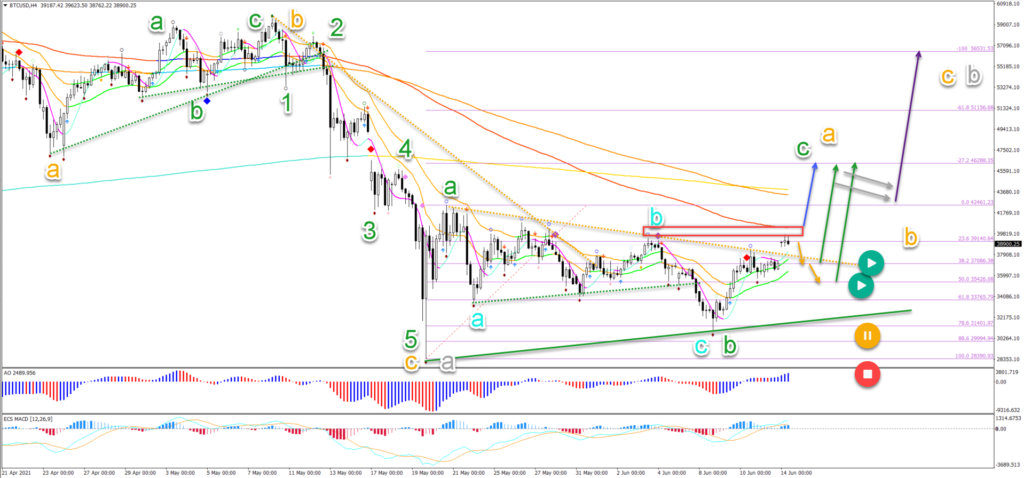

Bitcoin (BTC/USD) made a bullish bounce at the 78.6% Fibonacci retracement level. It was followed by a bullish breakout above the 21 ema resistance zone as expected in our analysis.

This article analyses the expected Elliott Wave and Fibonacci patterns on the Bitcoin 4 hour and 1 hour charts.

Price Charts and Technical Analysis

The BTC/USD made a strong bullish reversal after testing the previous bottom and Fibonacci retracement levels:

- The bullish reversal is probably part of a ABC (green) wave or even a potential 123.

- Price action managed to break above the resistance trend line (dotted orange) during the weekend.

- But price action still faces hefty resistance (red box) from the previous top and long-term moving averages.

- A bearish bounce (orange arrows) could retest the support again where a bullish bounce is expected (green arrows).

- A bullish breakout (blue arrow) could indicate an immediate push up. A bull flag pattern (grey arrows) could indicate even more upside (purple arrow).

- A break below the support line (green) places it on hold (orange circle) and a break below the bottom invalidates it (red circle).

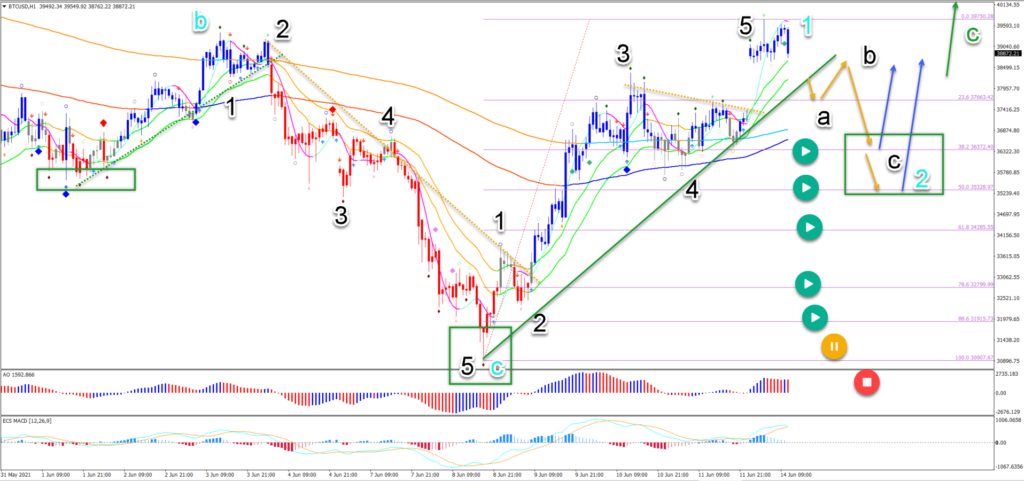

On the 1 hour chart, price action is showing strong bullish momentum:

- A 5 wave pattern (black 1-5) seems to be visible.

- The bullish 5 waves could complete a wave 1 (blue).

- A bearish ABC (black) could indicate a wave 2 (blue).

- The Fibonacci retracement levels of wave 2 could act as support (blue arrows).

- Especially the support zone (green box) could indicate a bounce due to the inverted head and shoulders pattern.

- All Fibonacci levels are potentially support levels.

- A break below the 88.6% Fib makes it less likely (orange circle) whereas a break below the bottom invalidates it (red circle).

The analysis has been done with the indicators and template from the SWAT method (simple wave analysis and trading). For more daily technical and wave analysis and updates, sign-up to our newsletter.

Leave a Reply