The Classical Series on Trading Fibonacci in Forex

Elite CurrenSea is presenting to you a grand series of articles (see bottom) and Youtube videos on using Fibonacci for trading in the Forex and CFD markets.

This is only the 1st edition of a full and intense library on Fibonacci. Are you looking forward?

Then grab the front seat and send us an email ([email protected]) with Fibonacci in the subject…

We will send you our eBook on Fibonacci for FREE without any obligations.

WHO AND WHAT IS FIBONACCI?

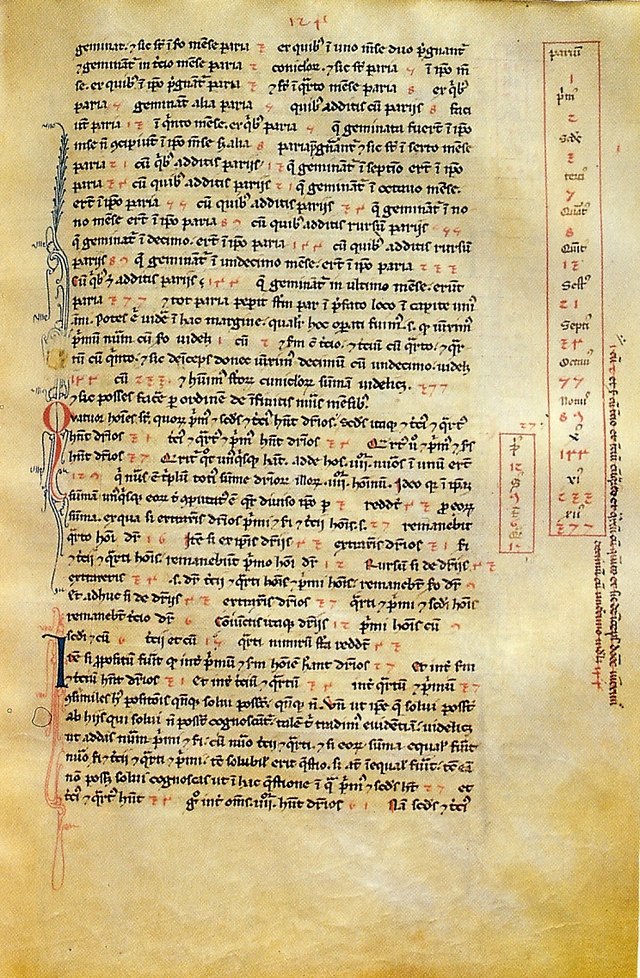

Fibonacci lived by the name of Leonardo Bonacci and was born in Pisa around 1170 as the son of a wealthy merchant. Fibonacci was an Italian mathematician, who was considered the most talented western mathematician of the Middle Ages. In 1202 he published his book Liber Abaci (Book of Calculation), where he presented the Hindu-Arabic numeral system.

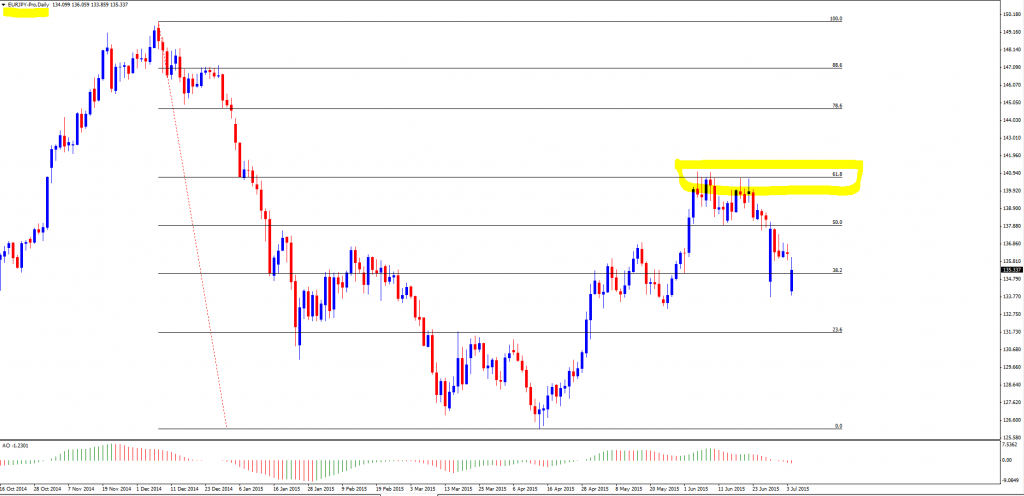

Nowadays in current times, Fibonacci levels are used in all types of trading including stocks, futures, commodities and also Forex. The Fibonacci levels, which are retracements and targets, are one of the best tools in the entire field of technical analysis. Its support and resistance levels are very precise and crystal clear. Most importantly, Fibonacci offers very defined and exact entry and exit spots.

The Fibonacci levels (or just “Fibs”) are calculated based on the Fibonacci sequence numbers, which is where this post starts.

(Liber Abbaci page; image from Wikipedia, uploaded from Otfriend Lieberknecht

FIBONACCI SEQUENCE LEVELS

The Fibonacci sequence numbers are:

0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, 144, 233, 377, 610, 987, 1597, and so on to infinity.

This line series is created simply by always adding the last two numbers together:

0 + 1 = 1

1 + 1 = 2

1 + 2 = 3

2 + 3 = 5

3 + 5 = 8 etc.

The method stays the same for higher numbers as well such as:

89+144 = 233, and then 144 + 233 = 377, etc.

You might be wondering, why on earth are these Fibonacci sequence numbers important?

There are a couple of reasons that answer this question:

1) The Fibonacci sequence numbers are in fact very well respected levels on the charts, which will be explained in a future post.

2) The Fibonacci sequence levels are used for calculating Fibonacci retracements and Fibonacci targets, which are levels frequently used in the market.

3) These numbers are not only used in trading markets by the way, but can in fact be observed all around us:

a) In crystal formations;

b) Played out in musical progressions;

c) In the growth of rabbit populations;

d) Even in the DNA spiral;

e) Whole human body itself is full of Fibonacci relationships.

(Yellow Chamomile head showing the arrangement in 21 (blue) and 13 (aqua) spiral; image from Wikipedia, uploaded from JeffyP)

Fibonacci is simply everywhere!

FIBONACCI LEVELS

The Fibonacci levels are calculated by dividing the Fibonacci sequence numbers. Here are a few examples:

34/21 = 1.618 (bigger number is divided by smaller next but one number)

8/13 = 0.618 (smaller number is divided by bigger number next to it)

34/89 = 0.382 (smaller number is divided by bigger number 2 next to it)

When dividing a smaller Fibonacci sequence number by a bigger number, then a result lower than 1 is visible: 144/233 = 0.618.

When dividing a bigger Fibonacci sequence number by a smaller number, then a result higher than 1 is visible: 233/144 = 1.618.

Fibonacci retracements are levels below 1 / whereas Fibonacci targets are levels above 1 (or below 0 – more in next post).

Many ratios can be calculated by dividing the Fibonacci sequence numbers in various ways:

– If we divided 13 by 21 for example, we get 0.619

– While 21 divided by 13 = 1.615.

– If we divide 8 by 21 we get .381.

– Conversely, 21 divided by 8 is 2.625.

The higher the numbers, the closer the ratios will reflect the standard ratios of 0.618 and 0.382. For instance 144 divided by 233 is 0.61802 and 144 divided 377 is 0.38196.

One interesting aspect is that it doesn’t matter where we start. We can take any two numbers, like 5 and 100. Soon we’re dealing with the same series – we are getting the same ratios: 5, 100, 105, 205, 310, 515, 825, 1340, 2165.

1340 divided by 2165 = 0.6189

2165 divided by 1340 = 1.616

Why these levels are important and how are they used in Forex trading will be discussed in the next article.

Before leaving, make sure to read our entire Fibonacci series!

Talk soon, Chris

[…] in both cases the Forex market tends to make price movement in pip size that corresponds to the Fibonacci sequence levels. Or in other words, price tends to move 13, 21, 34, 55, 89, 144, 233 etc pip movements when […]